How the Edible Oils Market Is Currently Shaping Around Rapeseed Oil & Palm Oil In 2021

Reading time: 6 minutes

Edible Oils prices are intricately linked to one another as they are interchangeable, and thus the demand can shift between them, thereby impacting the pricing of all Edible Oils. As such, any event in one of these commodities’ markets directly affects the demand and pricing of the others’:

- Palm Oil

- Soybean Oil

- Rapeseed Oil

- Sunseed Oil

In 2021, Canada Canola production suffered from the scorching heat in North America, leading to severe droughts and thus significant production cuts. Malaysian Palm Oil also had difficulties with its workforce on the field due to the country closing borders affecting the output as fruits were rotting in place since they could not be harvested.

These isolated events are leading the Edible Oils market to restructure around Rapeseed Oil and Palm Oil in the second part of 2021.

Read also: How Is European Canola Priced at the Beginning of the 2021-22 Marketing Year?

Rapeseed Oil Supply Decreasing in 2021

Canada is one of the largest Rapeseed producers in the world. However, in 2021, the country faced extreme temperatures, leading to severe droughts and wildfires and significantly reducing crop productions (agcanada.com). Rapeseed production in 2021/22 (or Canola in Canada) lost around 5 Mmt.

Figure 1: Canada Canola FOB Spot Prices Between Jan & Sep 2021

Canada Canola prices, displayed in Figure 1, started rising rapidly in February 2021 due to already dry conditions. In Q2 2021, the Canola production is already estimated to be down from the previous year, contributing to surging prices, peaking once more in June/July 2021 with the extreme heat. The lack of Canada Canola supply impacted domestic Rapessed Edible Oil, biofuel production estimations, and the demand for other Edible Oils as the global Rapeseed supply tightened. This shift in demand also affected the pricing of the other Edible Oils.

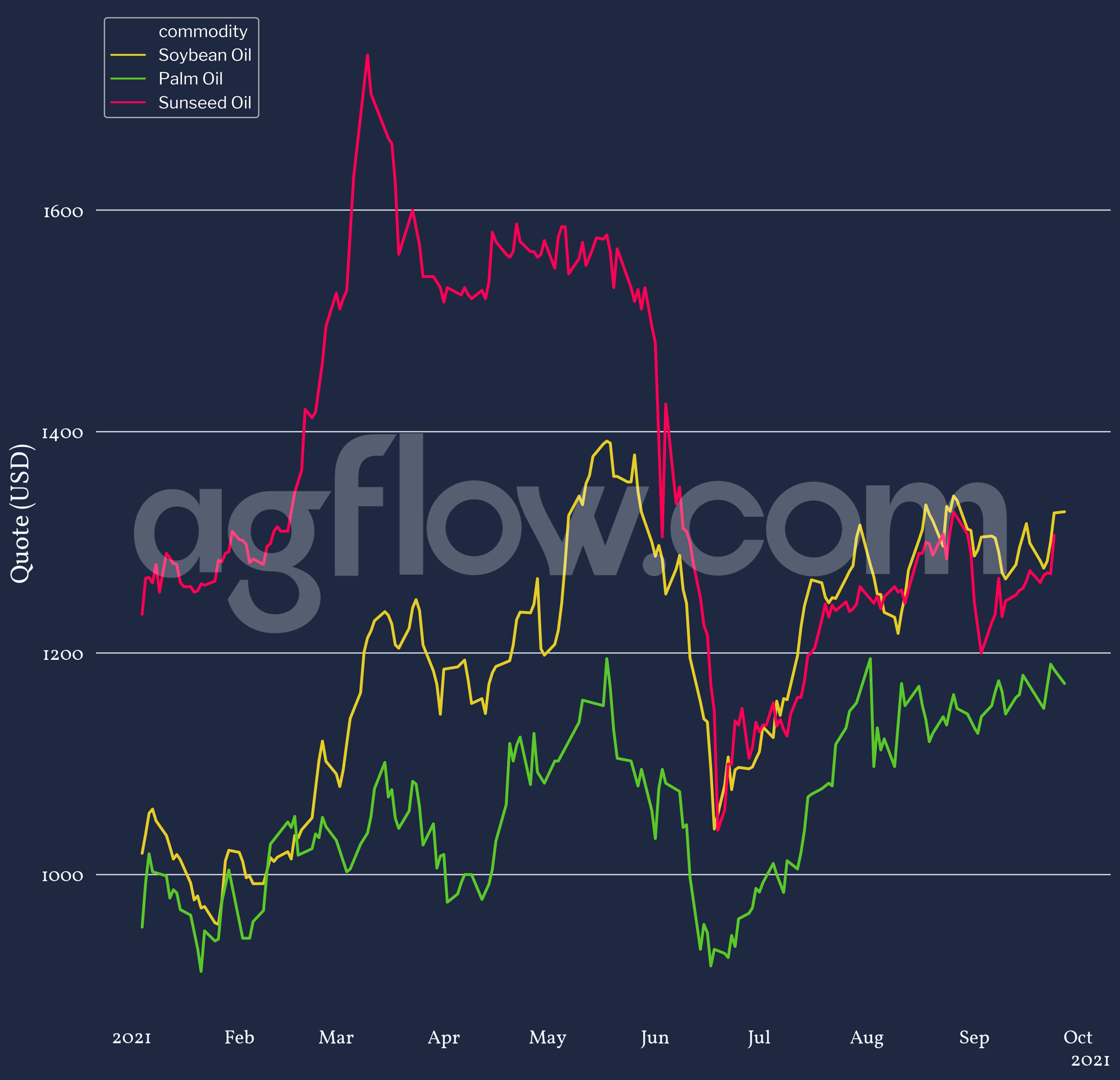

Figure 2: Soybean, Palm, And Sunseed Oil FOB Prices Between Jan & Sep 2021

Edible oils prices for Argentina Soybean Oil, Malaysia Palm Oil, and Ukraine Sunseed Oil (Figure 2) rose to record-highs in May 2021. This generalized surge across all oils is partly due to increasing demand and rapeseed supply projections, as they compete for more of the Edible Oils market share. Prices then rapidly tumbled in June 2021 under higher production estimates for Malaysian Palm Oil (nasdaq.com). Most importantly, the spread between Sunseed Oil and the rest of the other Edible Oils reduced massively at that point, to Soybean Oil levels and even below, and around 150 $/mt for Palm Oil. As such, the pricing of Palm Oil greatly dictates the shape of the Edible Oils market.

Read also: Are Argentina Soybean Crush Exports at Risk?

Access +8k Cash Quotes Monthly for Vegoils From Malaysia, Canada, and 13 other countries

Free & Unlimited Access In Time

Palm Edible Oils Production Halt Contributed to Global Vegoils Prices Increasing

Palm Oil production is mainly located in Malaysia and Indonesia, as they produce around 90% of all Palm Oil and Palm derivatives globally. The Covid-19 pandemic led Malaysia to close its borders since 2020. However, the workforce in Malaysian Palm groves is mostly Bangladeshi, representing an estimated 75 to 80% of the total workforce. Consequently, it was impossible to complete monthly harvests, and the crops rotted in place, substantially decreasing the supply.

This hole in the supply drove Palm Oil prices up, and the demand for Malaysian products turned towards Indonesia instead. Nonetheless, in August 2021, Palm Oil end-stocks in Malaysia were estimated at a year-high of 1.74 Mmt, partly due to the lack of demand (spglobal-platts).

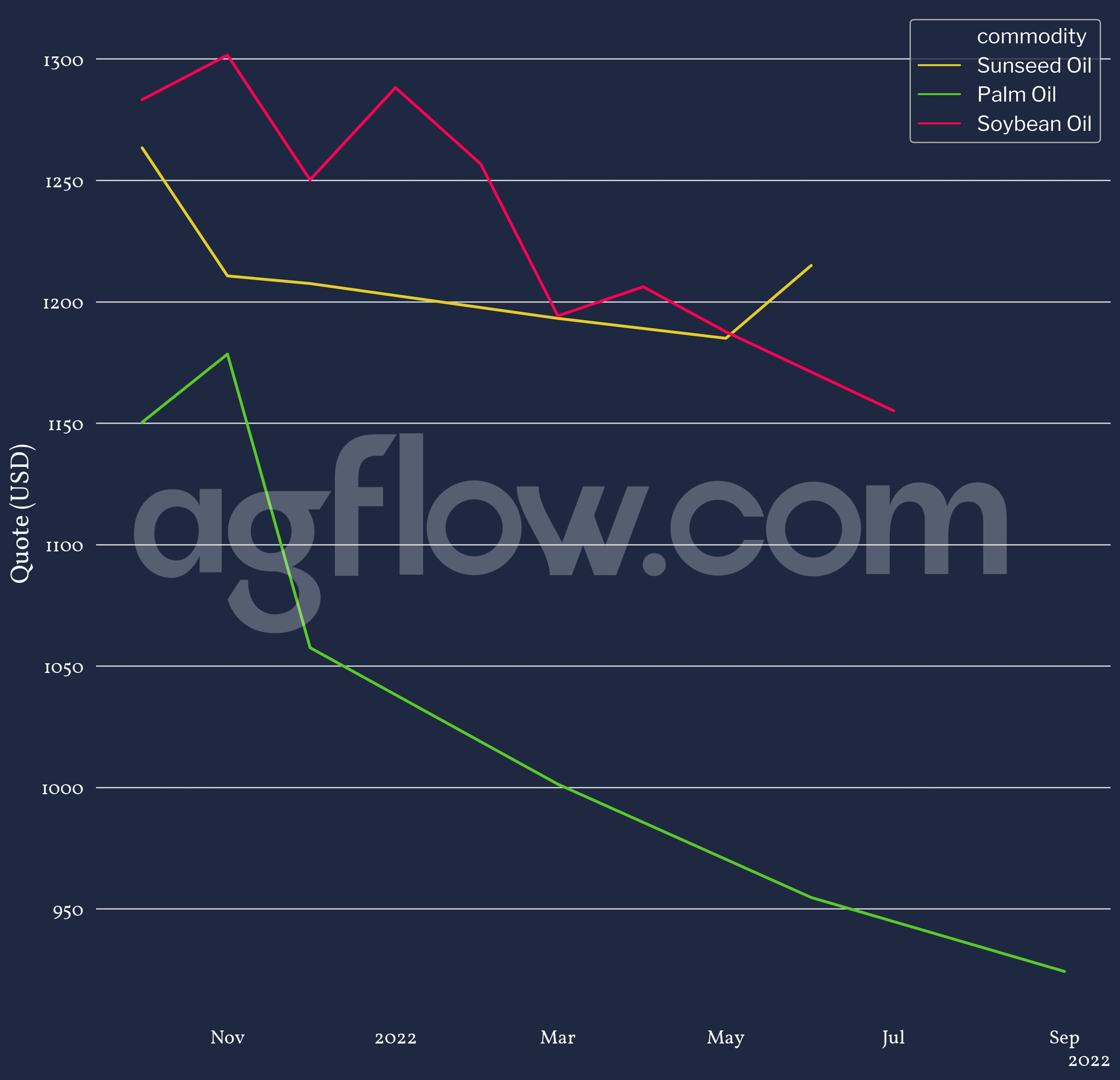

Figure 3: Sunseed, Palm, and Soybean Oil FOB Forward Prices From Nov 2021 to Sep 2022

The end-stock in August 2021 impacted the forward pricing of Edible Oils, as the larger supply available with fluid pricing due to monthly harvests supports a price decrease in the latter part of the year, as shown in Figure 3. This is also due to the Australian Canola crop coming in Q4 2021, which will re-balance the demand slightly. As a result, Sunseed Oil and Soybean Oil prices also follow how the Palm Oil and Rapeseed/Canola demand relieves some pressure on their respective markets, thereby following the forward trend.

Read also: Are Traders Shipping Cargo On Larger Vessels Given the Dry Bulk Cargo Ocean Freight Rates?

Access 2.6k Cash Quotes Over 15 Palm Commodities With Up to 12 Months

Forward Curves

Free & Unlimited Access In Time

In a Nutshell

The Edible Oils market in 2021 is greatly affected by the Canadian Canola and Malaysian Palm Oil events. The loss of supply in the Canola market created a gap filled by the rest of the leading Edible Oils. This, combined with Malaysia’s struggling to produce its staple Edible Oil, led to a surge in prices, recording historical highs in May 2021.

The high prices shifted part of the demand for Malaysian products towards its neighboring competitor Indonesia. The lower demand then contributed to Malaysian Palm Oil end-stocks in August 2021. Along with the Australian Canola crop coming in late Q4 2021, the higher stocks support the price decrease across Edible Oils.

Nonetheless, India, the largest Edible Oils importer globally, vastly increased imports in mainly Palm Oil, of which monthly imports increased by 31.5% month-on-month (economictimes-indiatimes). AgFlow datasets even record a 40.9% increase for the same period. With the current struggles in the production of Palm Oil, India’s growing demand for edible vegetable oils will impact the rest of the Edible Oils in 2021/22, pressured by the missing Canadian Canola oil.