How Is the US Wheat Market Structured In 2022/23?

Reading time: 5 minutes

US Wheat Exports Continue To Fall In Yet Another Low Production Year

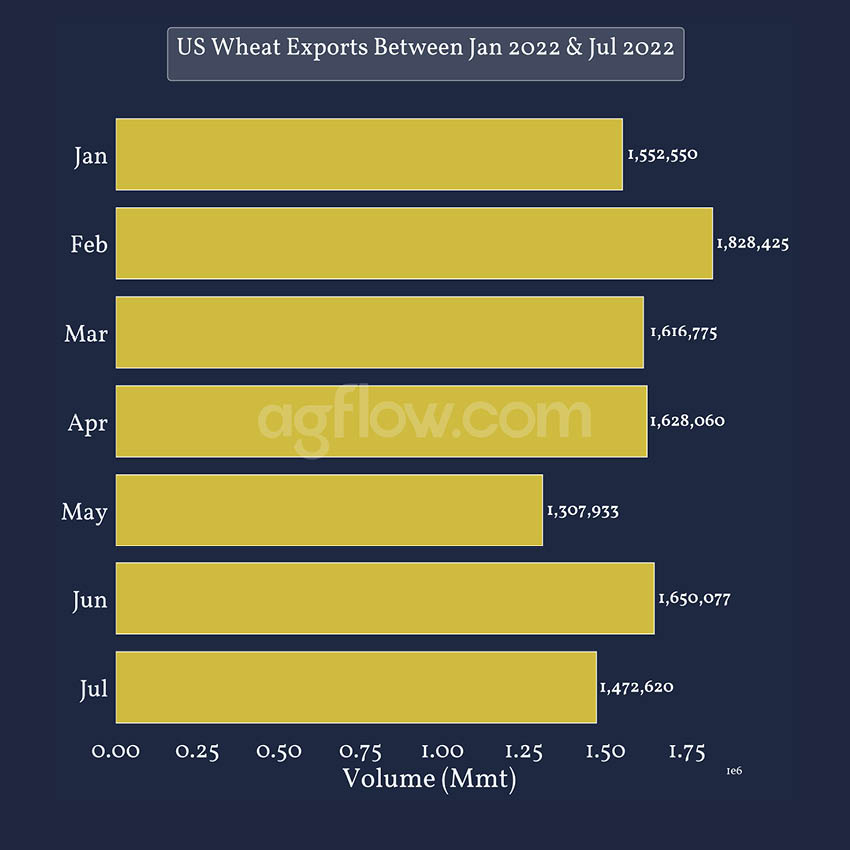

US Wheat production in 21/22 suffered from droughts and extreme heat, which led to low production and high prices. Additionally, with port infrastructure and the freight in crisis, agricultural exports decreased overall. At the end of 21/22, US Wheat exports continued to tumble, decreasing in Jan, Mar, Apr, & by up to 1.02 Mmt in May YoY. Despite increasing by 113 kmt YoY in Feb, US Wheat exports fell by ~ 2.6 Mmt between Jan & May YoY. In the first two months of 22/23 US Wheat exports continued to decrease by 130 & 800 kmtYoY in Jun & Jul, respectively, although exports were already underperforming in 21/22. Export conditions in 22/23 are similar to last year’s, with the addition of overwhelmingly non-competitive prices.

US Wheat Exports Between Jan & Jul 2022

Track Wheat Cargos From the US to Up to 16 Countries

Free & Unlimited Access In Time

US Wheat Prices Continued Rising & Losing Competitiveness in 2022

Throughout 21/22, Wheat prices globally rose due to the freight crisis and a tighter global supply. Moreover, Russia Wheat export tax contributed to the global prices rise and market volatility. Coming into 22, US Wheat prices were already lacking competitivity against exporters. In Jan 22, US Wheat prices traded 87.8 $/mt and 90.2 $/mt higher than Russia & France Milling Wheat, respectively, and on average. Despite resisting the price surge in Mar, reducing the spread with Russia to 57.6 $/mt and 25.9 $/mt with France on average, US Wheat prices continued to rise past 500$/mt on drought and decreasing production.

Meanwhile, France & Russia Milling prices remained below the 450$/mt bar. In May, US Wheat prices peaked at around 550$/mt mid-May, leading to a 137$/mt delta with Russia Milling Wheat prices. With US Wheat prices lacking competitivity, to which countries do the US export their Wheat?

US, Russia, France Weekly Milling Wheat Spot Prices Between Jan & Aug 2022

Follow +42k Wheat Quotes Monthly From Up to 33 Origins

Free & Unlimited Access In Time

Importers Lose Interest in US Wheat in 22/23

The US benefits from trade deals with many countries worldwide, such as NAFTA, USMCA, and others. Nonetheless, due to Wheat prices being too high and available supply from competitors like Russia, Argentina, or Australia, even trade partners decreased their US Wheat imports heavily. Indeed, Mexico (the largest importer of US agricultural products) decreased its Wheat imports by 3.7 Mmt YoY between Jun & Aug, so far. Similarly, imports from Japan, South Korea, and the Philippines shrank by 2.3, 1.2, & 2.6 Mmt YoY, respectively. Overall, all Top 10 US Wheat Importers’ volume decreased so far in 22/23 and by 13.7 Mmt YoY. As US Wheat exports lack pace, more of the supply may be available domestically. Therefore is the US still importing Wheat in 22/23?

Top 10 US Wheat Destinations Between Jun & Aug 2022

Track Wheat Cargos From the US to Mexico, Japan, & 35 Other Destinations

Free & Unlimited Access In Time

Where Does the US Import Wheat From?

As a net exporter of Wheat, the US only imports a small amount of Wheat from a limited number of countries depending on domestic supply availability. However, US Wheat imports have increased since 18. Indeed, in 18, the US imported 11.2 kmt of Wheat, rising by 44 & 382 kmt YoY in 19 and 20, respectively. The primary origin for US Wheat imports is Canada, representing ~ 81% of all US Wheat imports since 18, with 802 kmt. So far, on Aug 22, the US only imported ~105 kmt of Wheat. Therefore, unless the US picks up the pace in H2 22, Wheat imports should follow the downward trend set in 21, as imports decreased ~52 kmt YoY, affecting mainly Canada but with little to no consequences on its global exports.

US Wheat Import Origins By Volume By Year Since 2018

Track Wheat Cargos to the US From Canada, Australia, & Up to 4 Other Origins

Free & Unlimited Access In Time

In a Nutshell

US Wheat has suffered from lasting droughts for the last two marketing years. This has decreased planting areas, yield, and thus production for both Winter and Spring Wheat. Moreover, due to the freight crisis, port logistics still face great difficulties exporting agricultural products.

In 22, due to the war in Ukraine, Grain prices rose globally. However, with significant input prices, the already non-competitive US Wheat prices surged even higher than the rest of the market, increasing the price delta between US Wheat and the other products and decreasing the competitiveness of US Wheat even further.

With export difficulties and a lower incentive to buy US Wheat, major importers vastly reduced the volume of their imports, looking for cheaper qualitative products from competitors such as Argentina or Australia. Consequently, the US will benefit from a larger domestic supply which will reduce Wheat imports in the US in 22/23, primarily affecting Canada.

All in all, the US is struggling to produce a competitive Wheat crop as it faces structural issues with significant input costs, weather instability, and is hampered by logistics. Nonetheless, the US still has an ample supply available for exports, and due to Wheat prices decreasing, US Wheat is becoming more competitive in 22/23. Additionally, with Ukraine export capacity reduced and great global demand, the US might be able to increase the export pace and intensify & diversify its export pipelines towards MENA countries and South-East Asia.