Here is Why Turkey and Iran Grain Imports Surged in August 2021

Reading time: 6 minutes

Turkey and Iran Grain imports increased hugely year-on-year in August 2021, while large exporters such as the US or Brazil, and major importers like China or Spain, were receding. As Turkey and Iran are very arid countries, they necessarily rely on Grain imports to add to their Grain production. Domestic production in these countries is crucial to maintaining a sustainable trade balance, meeting domestic consumption, serving feed purposes, and more. In 2021, however, Turkey and Iran—like the rest of the Middle East—faced severe droughts which impacted Wheat and Barley domestic crops, two of the most strategic agricultural products for these countries. Consequently, Grain imports rose amid a global market facing supply issues, relaunching the temporarily calm bull market.

Turkey’s Tactical Grain Imports Move

Grain imports are essential to Turkey since domestic production is insufficient to ensure its status as one of the world’s largest Wheat Flour producers and exporters. This is why Wheat is a key crop in the country. However, the production of Grains in 2021 suffered vastly from droughts. Consequently, production estimates were lowered for both Barley and Wheat due to the lack of rain, particularly during critical growth periods (latifundist.com).

Figure 1: Turkey Precipitations Between Jan & Sep 2021

Between April and June 2021, precipitation in Turkey only exceeded 50mm twice, most often moving around the 25mm line. The insufficient amount of rain directly impacts the volume and quality of the Wheat produced, thus leading to more Grain imports required.

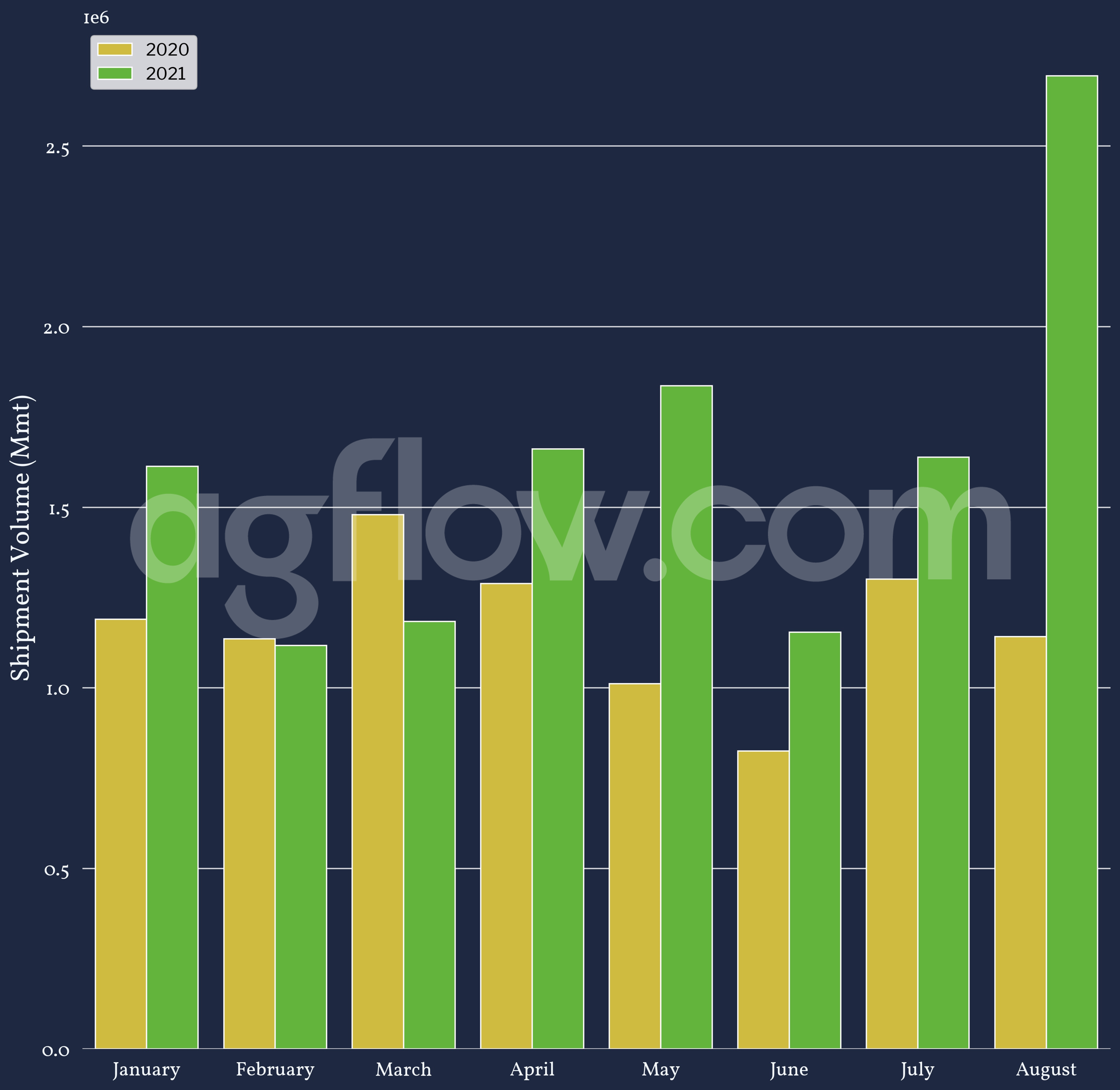

Figure 2: Turkey Monthly Import Volumes Between Jan & Aug 2020 v. 2021

Indeed, Turkish imports between January and April 2021 remained below or at the same level as the 2020 import volumes. However, concerns started to arise around the domestic production in May 2021, likely explaining the 6.5% increase in May 2021 imports compared to 2020. Grain imports surged in July 2021, increasing by more than 80% YoY, continuing into August 2021 with a 186% increase YoY.

Russia is the primary origin for Turkish Wheat Imports. However, by the end of June 2021, Russian Wheat production estimates started indicating a significantly reduced supply in 2021/22. This was only confirmed later in July 2021 with a further decrease in August of the same year, leading Russia Wheat FOB prices to surge as a result. Additionally, although Ukraine has a large crop in 2021/22, making the product more price-competitive against Russian Wheat, Turkey is limited by protein level. Indeed, the Russian product has higher protein content, which Turkish Wheat millers require.

Figure 3: Turkey Monthly Wheat Import Volumes Between Jan & Aug 2021

Monthly Wheat import volumes, shown in Figure 3, echo those in Figure 2, with July and August 2021 being the most significant monthly volumes of Wheat imported in 2021. Assuming that not all Russian Wheat buyings are executed in spot windows (as it takes four days to ship from Russia to Turkey), Turkish actors had already seen Wheat prices and export tax rising in July 2021 (world-grain.com). Therefore, they bought Wheat in July 2021 for August shipments to curb costs and the high tax variability.

Live Track Cargoes to Turkey From 35 Ports Incl. AIS Data

Free & Unlimited Access In Time

Read also: Here’s Why US Agricultural Exports Have Decreased in August 2021 v. August 2020

Iran’s All-In Grain Imports Move

Grain imports in Iran serve another purpose entirely. Iran produces Wheat, Barley, and Corn in quantities that are not large enough to meet domestic consumption and feed demand. In 2021, precipitations were even smaller than in Turkey and significantly reduced domestic crop production (financialtribune.com).

Figure 4: Iran Precipitations Between Jan & Aug 2021

The lack of rain in Iran led all crops to drop in production and quality, and particularly for Wheat. Consequently, government domestic Wheat buyings for strategic reserves decreased by 37% YoY (financialtribune.com), therefore, leading to the surge in Grain imports.

Read also: Black Sea and French Wheat: Why Quality Matters

Figure 5: Iran Monthly Imports Between Jan & Aug 2020 v. 2021

Unlike Turkey, Iran’s monthly imports in Figure 5 already increased YoY in January 2021, with May and August 2021 having the largest increase (84% and 136% respectively). One of the reasons behind the import increase relies on Iran’s trade deficit improving (Iran Chamber of Commerce). But Iran’s Grain imports requirement is more diverse than that of Turkey and, as such, lower crop production imports increased mostly for Grains.

Figure 6: Iran Monthly Imports for their Top 5 Commodities Between Jan & Aug 2021

The top five commodities that Iran imports, as displayed in Figure 6, put Corn in the first place. Nonetheless, Wheat imports are the most impressive Month-over-Month increase. This sudden surge in Wheat imports in August 2021 is linked to the results of the domestic crop. Therefore, contrary to Turkey players—which just tried to increase margins and limit costs— Iran Wheat imports responded to a need to replenish strategic stocks, as well as domestic consumption. In contrast with Wheat, Barley demand in Iran is mostly for feed. As such, imports did not increase as dramatically as Corn or Wheat.

Corn imports also contribute greatly to the Iranian feeding industry, and while the livestock production is increasing, in August 2021 Corn imports (from Brazil) also took advantage of Brazil Corn prices decreasing due to a lowered demand induced by competitive US Corn prices, particularly from the Gulf area.

Read also: Russian wheat prices push higher again supported by export tax

View all Shipments in the last 12 Months to Iran for Oilseeds and Grains from 15 Origins

Free & Unlimited Access In Time

In a Nutshell

Severe droughts in the Middle-East in 2021 impacted Grain crops production, notably for Turkey and Iran. As a result, Grain import volumes required for both countries increased in 2021-22. Nonetheless, Turkey and Iran have different profiles:

- as a top Wheat Flour exporter, Turkey relies on Wheat imports to fuel its industry

- while Iran requires large Corn, Wheat, and Barley imports to meet domestic consumption and feed demand, as well as replenishing strategic stocks

As such, Turkey Wheat imports ramped up in July and August 2021, observing the Russian Wheat pricing surge and the tax-induced volatility, in order to manage costs and hopefully profit from spread margins. The Iran Grain imports increase, on the other hand, mostly relied on Corn for the feeding industry until August 2021, where Wheat imports reached Corn levels, in light of the challenging domestic crop.

All in all, the increase in both countries’ Grain imports was drought-driven. In September 2021, Turkey lifted import duties on Wheat and other Grains (argusmedia.com), like in 2020. This is both an incentive for Turkish Wheat millers to buy Russian Wheat, and an attempt to limit the current price surge on Black Sea Grains. Nonetheless, due to a short supply, trying to restrain the bull market has proved ineffective so far and is unlikely to be successful. Additionally, Turkish imports fuel the Milling industry, and Wheat Flour prices increase in relation to Wheat prices. Therefore, it is unlikely that Turkish imports will decrease, unless Wheat flour demand tanks, and margins thin down.