Global Soybean Production to Hit a Record High

Reading time: 2 minutes

Venezuela is entirely dependent on imported Wheat for domestic consumption. Wheat consumption estimates for marketing year (MY) 2022/23 will increase by 5 percent from the previous marketing year to 1.2 million tons, based on rising Wheat imports due to an expected recovery of the Venezuelan economy.

The national milling industry is expected to rebound in the production of pasta and Wheat flour due to the regime’s priority of increasing local processing capacity. The Venezuelan milling industry will likely translate rising prices of Wheat into higher consumer prices if commodities become less available in the market due to current global uncertainty and supply disruptions.

In MY 2021/22, the Wheat consumption estimate was 1.15 million tons. Driven by a regime policy, the domestic industry tried to increase production, but local pasta was not satisfactorily sold in the market, given the competitive prices of pasta from Turkey. In calendar year (CY) 2021, the domestic Wheat industry and the regime agreed to progressively increase demand for domestically produced pasta. The objective was to achieve a supply balance of 50 percent domestic pasta and 50 percent imported pasta through price reductions and product availability.

The annual per capita consumption of Wheat, based on a population of 28 million, remains at approximately 37 kg (82 pounds). The purchasing power of Venezuelan consumers is slowly strengthening, supported by the augmented salaries paid by the private sector and a rebound in the reception of remittances in MY 2021/22.

The milling industry is currently working at an average capacity of 24 percent. The nominal installed milling capacity is 2.54 million tons per year. Now, the milling industry produces 65 percent of total consumption. The monthly needs of the Venezuelan Wheat milling industry to supply the current domestic market and maintain reasonable inventory levels are 115,000 tons per month (50,000 tons of Hard Red Winter (HRW) Wheat, 40,000 tons of durum Wheat, 20,000 tons of Wheat blend, and 5,000 tons of soft Wheat for cookies and crackers).

Global Soybean Export

It is also a significant export good: nearly 44% of all Soybeans produced in 2017 were exported, accounting for 150.1 million tons at a value of USD 58 billion. The overall sector had a total (retail) market value of around USD 146.23 billion in 2017. The Soybean sector is also highly concentrated, with cultivation mainly focused in the United States, Brazil, and Argentina, with India ranking a distant fourth. The top three countries together accounted for 80% of total production in 2017 and dominated world exports. Global Soybean exports are predicted at 169 million metric tons for 2022/23.

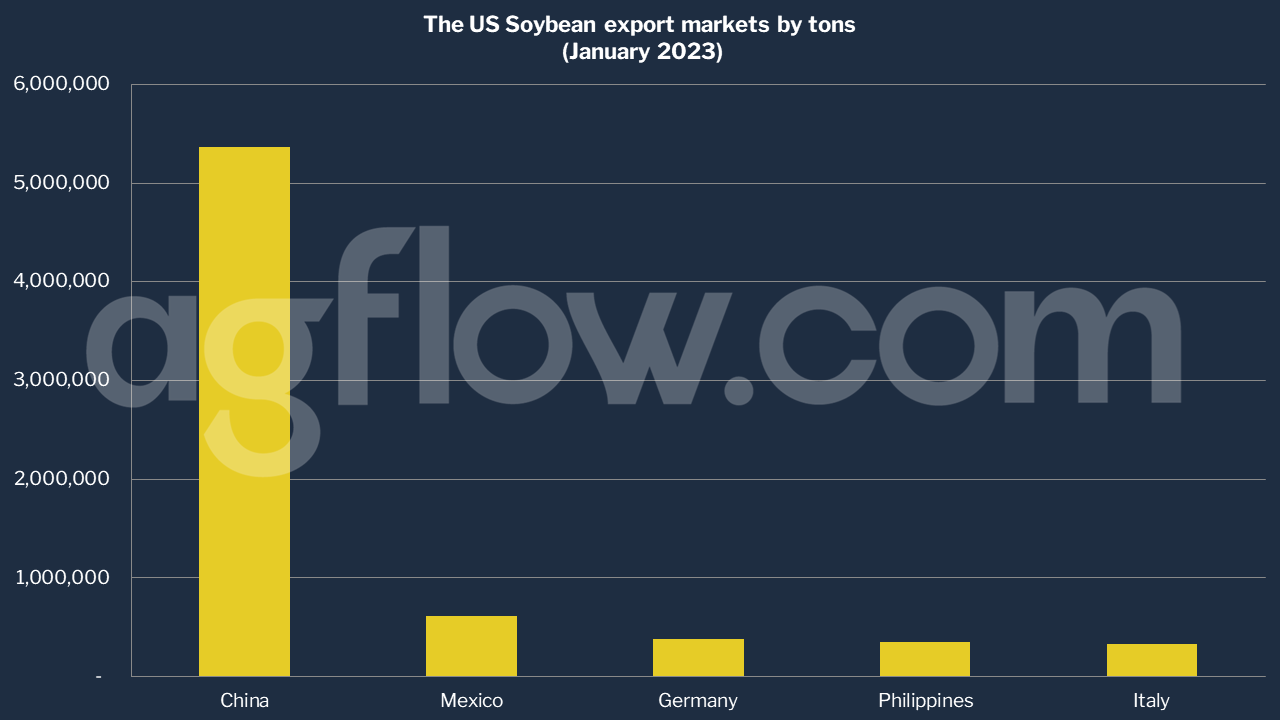

According to AgFlow data, the US exported 5.4 million tons of Soybeans to China in January 2022, followed by Mexico (0.6 million tons), Germany (0.4 million tons), the Philippines (0.35 million tons), and Italy (0.33 million tons). In 2020, the top exporters of Soybeans were Brazil ($28.6 billion), the United States ($25.6 billion), Argentina ($2.31 billion), Paraguay ($2.15 billion), and Canada ($1.95 billion).

The largest Soybean-exporting countries in 2017, by value, were Brazil (USD 26.1 billion), the United States (USD 22.8 billion), and Argentina (USD 3 billion), and the largest importing countries were China (USD 38.1 billion), Mexico (USD 1.7 billion), and the Netherlands (USD 1.6 billion). Soybean-producing countries ended up with year-end stocks ranging from 34 million to 52 million tons from 2014 to 2019.

Other sources: IISD

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time