France to Decrease Barley Exports to Minor Importers?

Reading time: 2 minutes

Barley is a rich source of vitamins, proteins, carbohydrates, and fatty oils. French Barley is known as the best in the world. The global Barley market is segmented into the food industry, alcoholic & nonalcoholic beverages, personal care, animal feed, and pharmaceuticals. The market is also propelled by the heightened demand for different convenience food products, emerging applications in the food and beverage industry, clean-label trends, and the escalating demand for natural ingredients. Thus, these factors have led to increased Barley exports across the globe from countries such as France, Russia, Australia, and Argentina.

Barley consumption is anticipated to grow at a CAGR of 3.1% in 2022-2027. Europe accounts for the majority of share the global Barley consumption. The United States Department of Agriculture (USDA) estimated that the “World Barley Production 2022/2023 would be 145.53 million metric tons, around 1.73 million tons less than the previous month’s projection in June. Barley’s production was 145.08 million tons last year. This year’s estimated 145.5 million tons could represent an increase of 0.45 million tons or 0.31% in Barley production around the globe.

Due to the surface areas increasing by 69,000 hectares over one year, the French Ministry of Agriculture estimated winter Barley production in 2022 at 8.25 million tons, up slightly by 0.4% over one year. The average yield in France is expected to drop to 65 quintals per hectare (compared to 68.5 quintals per hectare in 2021).

In the Center region, the leading winter Barley-producing region, the Ministry of Agriculture forecasts a sharp drop in yield, which would drop on average from 73 quintals per hectare in 2021 to 64 quintals per hectare in 2022. In this region, the increased surface area would not compensate for the drop in yield, with production expected to fall by 7.9% over one year.

The winter Barley harvest is completed in most districts across the country. Winter and spring Barley production is forecast at 11.2Mt collectively, down 2.4pc on 2021-22. The lost output will put a severe dent in the country’s exportable surplus of cereals, just as global consumers search for reliable substitutes for stranded Ukrainian grains.

French Barley Export Forecast

Russia’s invasion of Ukraine has stalled sea exports of its grain and complicated trade with Russia due to the Western sanctions. Therefore, it focused more on supplies from the European Union, particularly France, as importing nations scrambled to find alternatives. Globally, France ranked second for Barley exports, with a sales value of USD1.7 billion (16% market share) in 2021, after Australia (USD2 billion).

In July, FranceAgrimer revised French grain export forecasts to a downwards trend. In soft Wheat, the estimate for third countries is lowered by 150,000 tons, for a total exported outside Europe of 9.1 Mt. In Barley, the forecast for third countries is reduced by 50,000 tons, for a total of 3.35 Mt. For these two kinds of cereal, intra-European shipments are on the other hand revised upwards: + 24 000 t for Wheat and + 15 000 t for Barley. Soft Wheat stocks were projected to fall by nearly 30% in 2022/23 to 2.3 million tons.

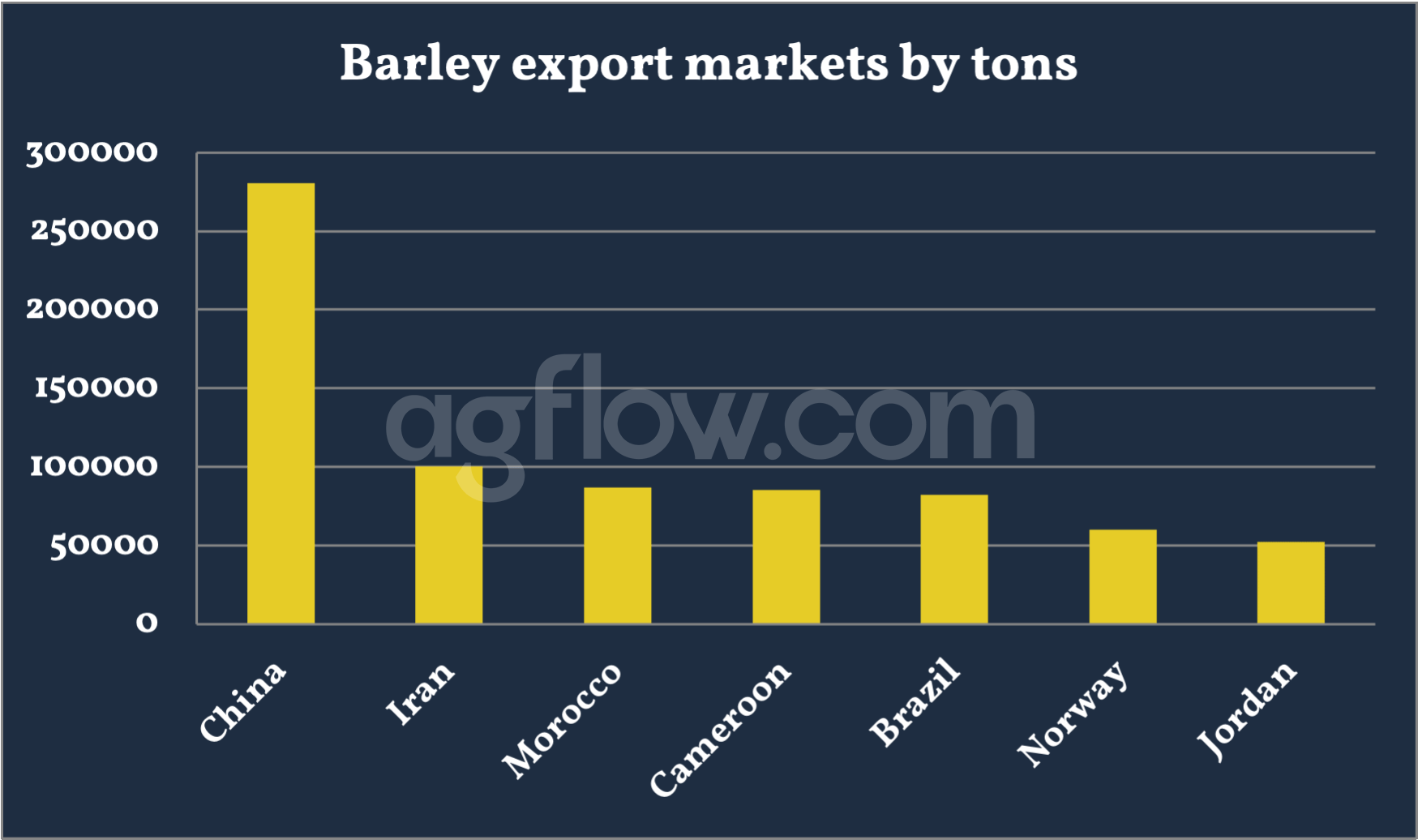

As per AgFlow data, the top 5 destinations of French Barley are China, Iran, Morocco, Cameroon, and Brazil. Mid-level importers include Germany, Saudi Arabia, Algeria, and Tunisia. Minor volume importing countries are Ireland, Finland, Spain, and Poland.

France comes amid significant market uncertainty and volatility because of increased demand. It could affect in country’s utilization. Also, traders are trying to set false rumors regarding Ukraine’s potential to return as a major grain exporter to reduce the Barley price.

Free & Unlimited Access In Time