European States Ship Barley in Similar Volumes to Portugal

Reading time: 2 minutes

Portugal cultivates Barley on over 20,000 hectares and produces approximately 60,000 tons per year. Key Barley-producing regions are Alentejo and Ribatejo e Oeste. The price of imported forage Barley, entering the Port of Lisbon in late Feb 2022, reached 370 euros per ton, an increase of 64% compared to the same week of 2021.

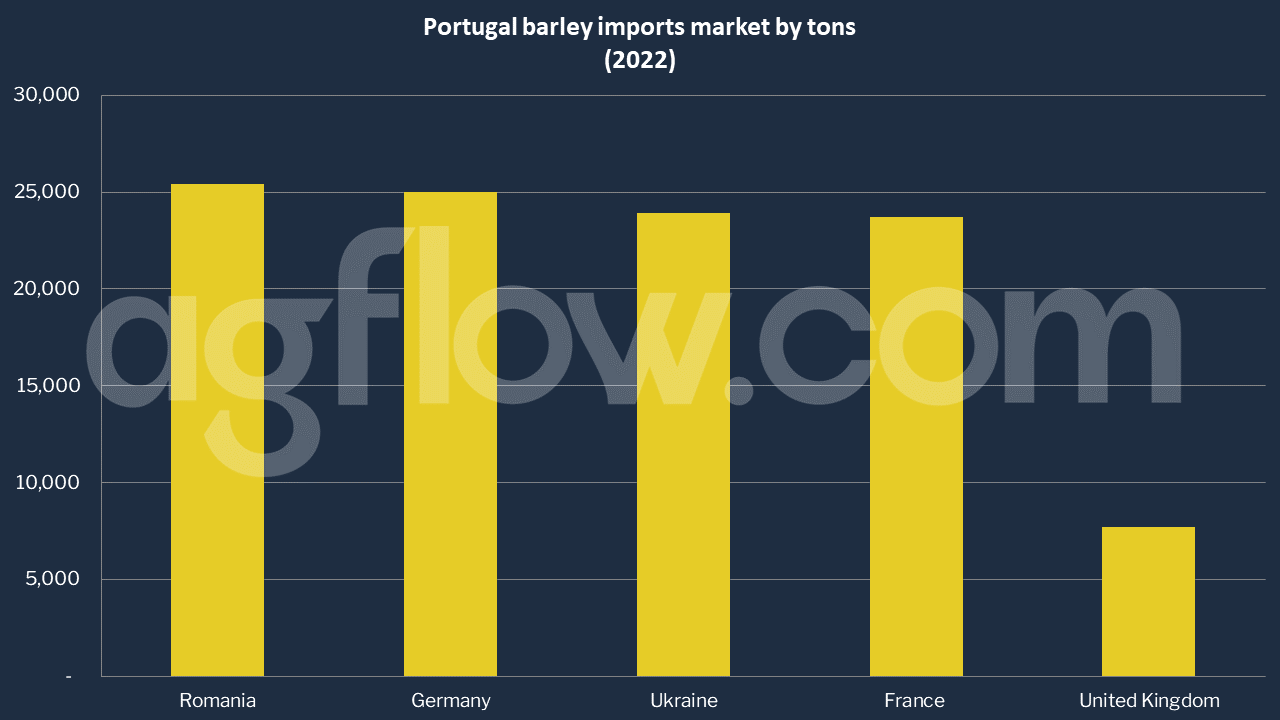

The trade balance and the balance in the volume of the Grain sector market are negative. That is, Portugal is a country that imports Grain, and the main ports of entry are Lisbon, Aveiro, and Leixões. Ukraine, France, Spain, and Brazil are the origin countries of Portugal’s most significant imports, both in quantity and monetary value. According to AgFlow data, Portugal imported 105,721 tons of Barley in 2022. The top supplier was Romania, with 25,421 tons, followed by Germany (25,000 tons), Ukraine (23,900 tons), France (23,700 tons), and the United Kingdom (7,700 tons).

In 2020, Portugal imported Barley worth $69.1 million, becoming the world’s 25th largest importer of Barley. The same year, Barley was the 242nd most imported product in Portugal. Portugal imports Barley primarily from: the United Kingdom ($44.9 million), Spain ($13.2 million), France ($9.36 million), Finland ($889k), and Germany ($690k).

The same year, Portugal exported Barley worth $1.82 million, making it the 44th largest exporter of Barley in the world. In the same year, Barley was the 786th most shipped product in Portugal. The leading destination of Barley exports from Portugal is Spain ($1.75 million), Angola ($54.5k), and the Netherlands ($8.2k).

Grain at Crossroads in Portugal

Oats production meets 67.6% of consumption; rye production meets 44.7% of consumption; corn production meets 26.8% of consumption, and wheat production meets 4% of consumption. The national brewing industry imports approximately 80% of the Barley it consumes due to a lack of domestic raw materials. It challenged farmers to produce more of this cereal, suggesting investment in irrigation to solve the problem. The head of the APCV (Cervejeiros de Portugal) indicated that “investment in irrigation” and a system of contracting with farmers would be solutions to solve the lack of national raw material.

Also, Fernando Carpinteiro Albino, President of the Portuguese Quality Cereals Club, believes that “in the medium term, the National Strategy for the Promotion of Cereal Production (Enppc) will have visible results” and says that the cultivation of Grains has all the place within the new Common Agricultural Policy (CAP), since, in Portugal, it is highly sustainable, environmentally friendly, generating much labor, direct and indirect, and promotes the circular economy, which is one of the current concerns.” The recent reform is being made “based on Grains.”

“It is inconceivable that we import 95 percent of common wheat to make bread. We’re eating açordas with bread made with cereals from Ukraine and Azerbaijan”, protests Carpinteiro Albino.

He argued that “the cultivation of Grains is not a losing battle, as long as conditions are created for this to happen, namely among the precarious, since it is a culture that needs little water. The rainfed area is much larger, and we must do what we have always done, and well, and which is environmentally friendly”.

However, there are those who do not defend the bet on wheat cultivation. Experts argue that “making wheat is a bad option” since the production achieved in countries such as, for example, Germany, Poland, or France represents twice the ones obtained here. They also say that the wheat crop “has always been subsidized” and that we should focus on crops where we are competitive, “as is the case with olive groves.”

Other sources: MILLENNIUM

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time