Does Less Corn Mean Less Demand in 2022?

Reading time: 6 minutes

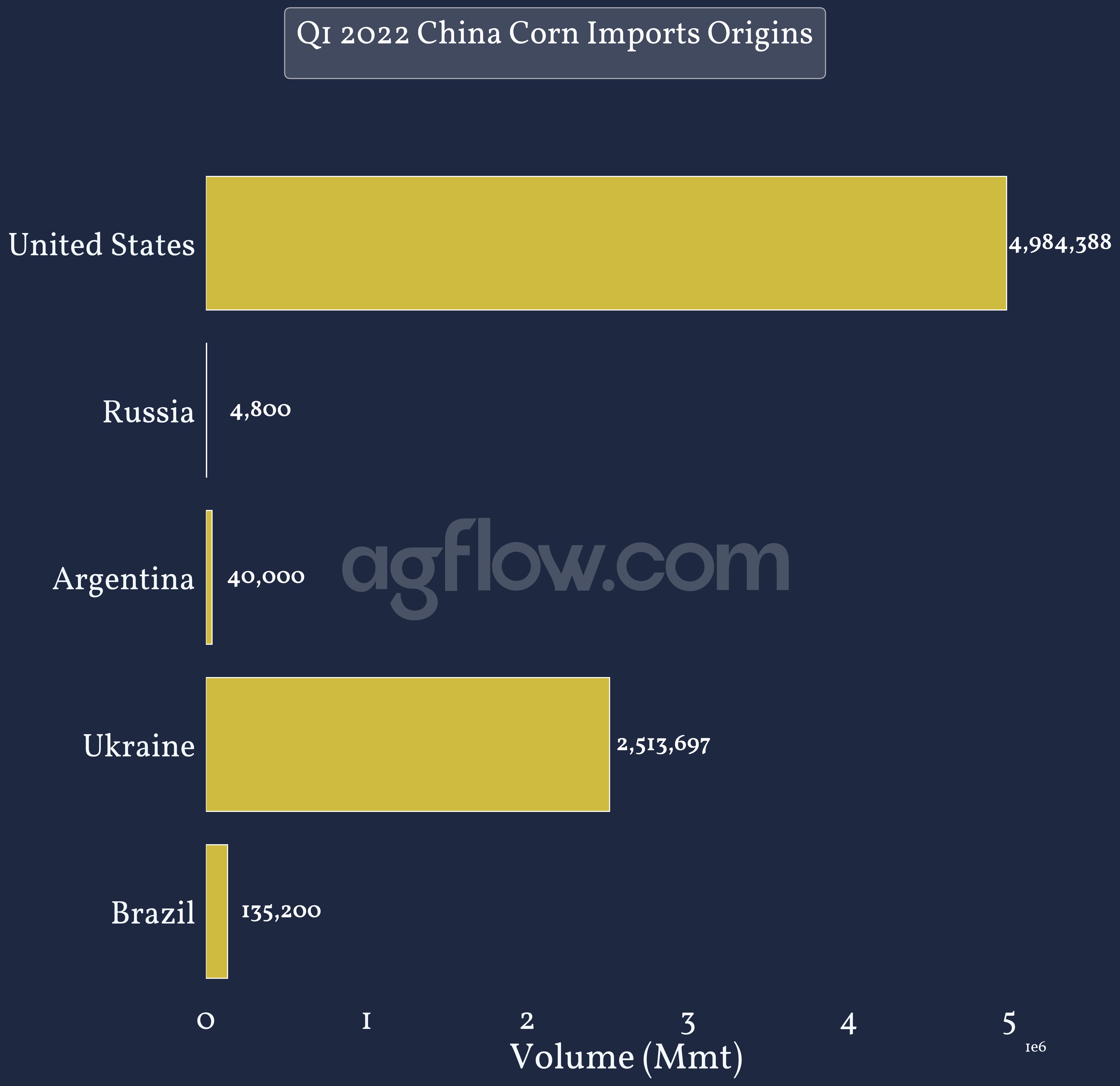

In 2022, both LatAm & the US are suffering from droughts due to La Niña. USDA reduced the US planting areas, and Brazil Corn conditions are improving. Meanwhile, China forecasts 20 Mmt Corn imports in 22/23 (-4 Mmt YoY). In Q1 2022, China increased its US Corn imports by 31% YoY, but decreased its Brazil & Ukraine Corn imports by 49% & 2% YoY despite only exporting until the end of Feb. China was counting on Ukraine supply until recently and fell back on the US instead. With China’s demand slowing, will this be the same trend for the rest of the world?

Read also: What Disruptions Will the Black Sea Corn Market Cause to Your Trades?

Figure 1: Q1 2022 China Corn Imports Origins

Track Corn Cargoes From the US, Brazil, & Up to 4 Other Origins to China

Free & Unlimited Access In Time

Read also: Current update on the importation of maize into Turkey in the Fourth Quarter of 2021

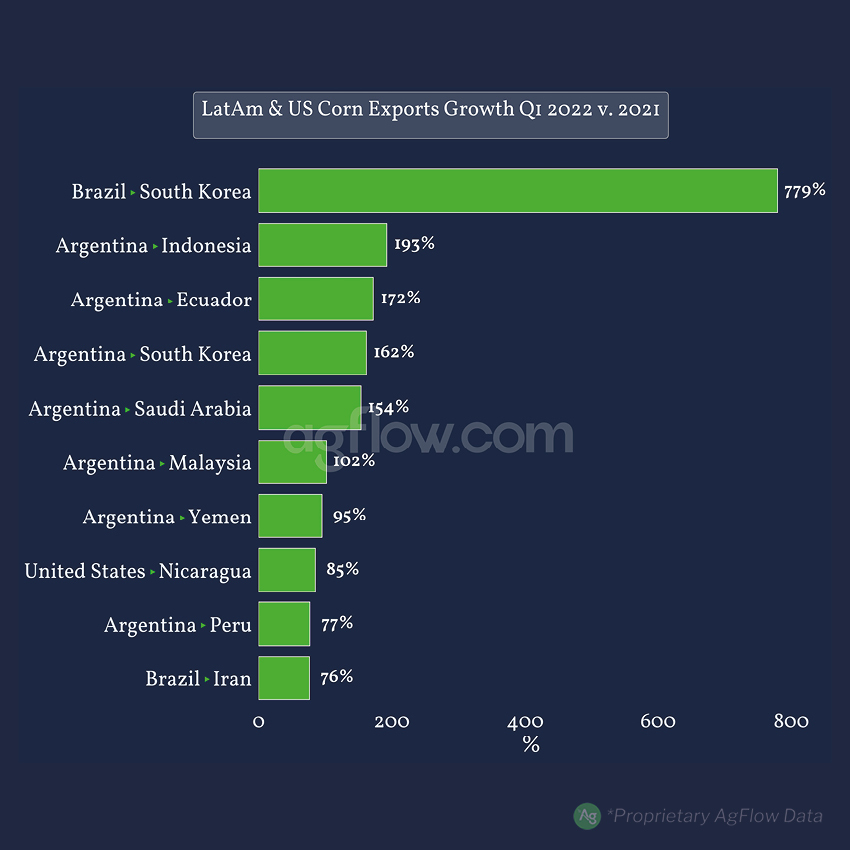

Global Corn demand in Q1 2022 did not slow down. LatAm & the US saw increasing demand. Argentina Corn exports increased in all regions, with Malaysia imports reaching up to ~1.1 Mmt. Thanks in part to South Korea imports growth, Brazil Corn exports managed to compensate for the loss from China (-49% YoY), and keep the same level as 2021, decreasing only 0.8% YoY. Due to large feed demand, LatAm & US Corn exports gained strength in early 2022. With Ukraine exports at a stop, have the Americas started filling the gap yet?

Figure 2: LatAm & US Corn Exports Growth in Q1 2022 v. 2021

Track Corn Cargoes From the Argentina, Brazil, & the US to Up to 110 Destinations

Free & Unlimited Access In Time

Read also: Ukrainian 2022 grain crop to decline substantially

During the 2021/22 Campaign, Ukraine exported Corn to 30 countries with the EU, South Korea, Turkey, Egypt, Tunisia, & Iran as top importers. Since it stopped exporting in Feb 2022, Brazil increased Corn exports to Iran although only by a volume of 24 kmt. Despite the loss in Ukraine Corn supply, US Corn exports decreased in SK by 886 kmt since Feb as China channeled its supply in Q1 2022; Argentina exports replaced 51% of this loss. Thus far LatAm, & the US filled some of the void left by Ukraine in MENA & SK. Yet Europe, the second-largest Ukraine Corn destination, decreased imports from Argentina YoY. Where does Europe’s demand lie?

Figure 3: LatAm & US Corn Exports to Top Ukraine Corn Destinations Since End of Feb 2022

Track Corn Trade Flows to Ukrainian Corn Importers From Up to 31 Origins

Free & Unlimited Access In Time

Read also: What Should You Be Expecting if You Are Selling From the EU Or US Corn Market in 2021/22?

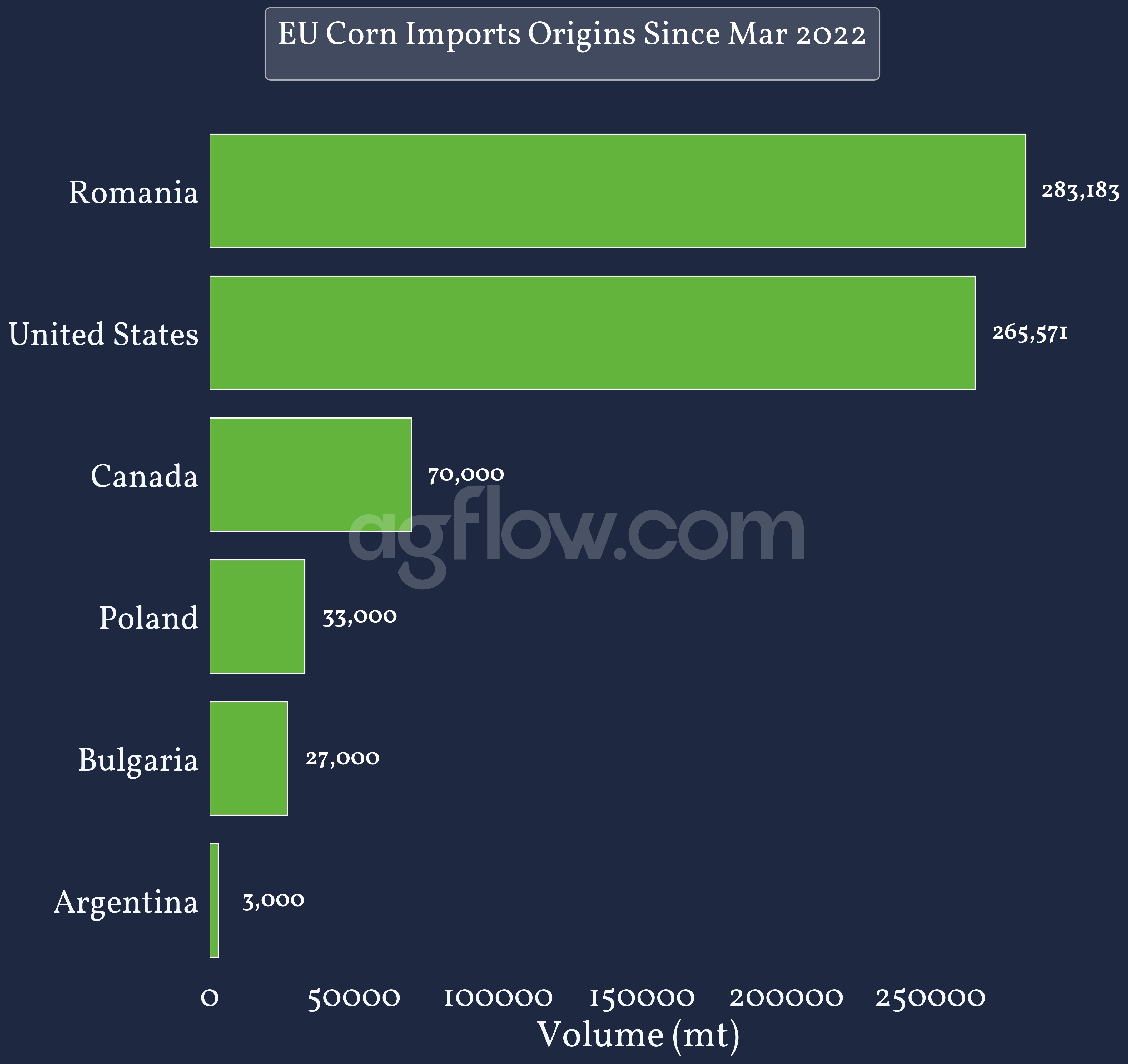

After Ukraine exports shut down at the end of Feb 2022, EU imports from Romania decreased 18% YoY despite remaining the largest Corn origin over the period. However, the EU imported Corn from the US & Canada, which it did not in 2021 during the same time period. Despite diversifying its pipelines in Mar/Apr 2022 to compensate for the loss of Ukraine Corn supply, EU Corn imports decreased by 228 kmt during this time (-24% YoY).

Figure 4: EU Corn Imports Origins Since Mar 2022

Live Track Corn Cargos to the EU with AIS data

Free & Unlimited Access In Time

Read also: Here is Why Turkey and Iran Grain Imports Surged in August 2021

In a Nutshell

In 2022, droughts from La Niña are affecting Corn supply in LatAm, with Argentina suffering the most from it. In the US, the latest planting area estimates show that the Corn crop will have a smaller surface than Soybean for the third time in 60 years. In 2022/23 Corn supply is seemingly shrinking, particularly due to Ukraine exports still being shut down in April with limited production for the new crop. Therefore, China decreased its Corn demand and will be importing less than in 2021/22, whose volumes already failed to meet expectations.

Nonetheless, the world in Q1 2022 still has a strong demand for Corn, as Argentina exports grew globally, and South Korea channeled the leftover Brazil supply in addition to increasing Argentina Corn imports. Despite growing imports, LatAm & the US only partially filled the void left by the loss of Ukraine Corn exports. The EU, which usually favors the Black Sea with Ukraine, Romania, and Bulgaria, started diversifying its pipeline toward North America and the US specifically.

All in all, the demand for Corn is not slowing down and the global disruptions caused by the sudden Ukraine Corn exports cut are shaking up the demand. LatAm & the US are trying to balance importers diversifying their pipelines and the expected cut in Ukraine Corn supply in 2022/23. However, despite the US planting area shrinking and with Argentina Corn crop in the rough, timely rains in Brazil increased the domestic supply forecast – which could overcome expectations – and led to prices decreasing and stabilizing after surging in Q1 2022. Therefore, Corn demand might not faint in 2022 as it should remain the cheapest feed product on the market, and is gaining more and more traction for Ethanol and Biofuels.