Cuban Corn Processors Face Capacity Utilization Issues

Reading time: 2 minutes

In Cuba, more than 700,000 tons of soybeans, Corn, and other components destined for pig and poultry feed were imported annually until 2021. For 2022, some 40,000 tons of Corn of national production and some 430,000 tons of imports destined for animal consumption were planned. According to the USDA data, in MY2021/2022, Cuba’s Corn area harvested and production was 125,000 hectares and 0.25 million tons, respectively. Domestic consumption was 0.7 million tons. For MY2022/2023, the harvest area and production are estimated similarly with domestic consumption of 0.85 million tons.

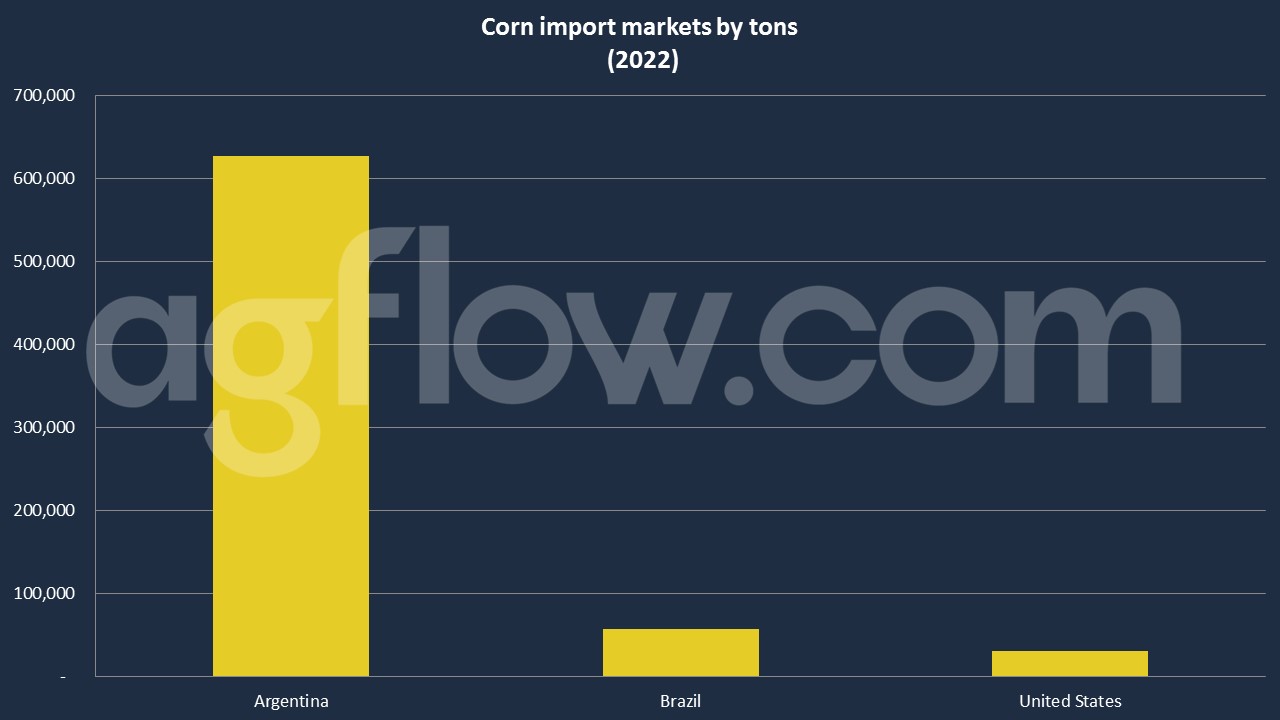

In 2020, Cuba imported Corn worth $135 million, becoming the 48th largest importer of Corn in the world. The same year, Corn was the 3rd most imported product in Cuba. Cuba imports Corn primarily from: Argentina ($105 million), Brazil ($24.5 million), the United States ($5.38 million), and Mexico ($3.47k). As per AgFlow data, Argentina led their import market with 0.6 million tons in 2022, followed by Brazil (57,920 tons) and the United States (30,433 tons).

Cuban Corn Processing Situation

A million-dollar investment was made in the country for the assembly of modern grain drying, processing, and packing plants in the provinces of Granma, Holguín, Las Tunas, and Santiago de Cuba; the latter considered the most significant industry of its kind in the country with the capacity for processing 120 tons per day.

Ángel Tamayo Yero, Director of the Base business unit (UEB) Beneficio de Granos, comments that in 2022, for example, we obtained early financing to pay the farmers. To do this, we asked the bank for an initial loan of 80 million pesos. Then we extended that amount to 100 million, which allowed us to honor the payment on time to the producers with an average term of one week or less after the Corn delivery; and. In addition, this monetary support will help us to face the bean harvest, which will begin in 2023.

Tamayo Yero also adds that one of the most positive impacts has been the increase in Corn prices; since last year, it was paid at a thousand pesos per quintal, and we bought it at 2,000 pesos, and even at certain times, we raised it to 2,200 pesos per quintal. The commercial margin was 30 pesos for each quintal if the producer took the Corn to the plant.

“We have had producers who initially did not make a contract with us, and when they began to see the positive behavior that the plant has had, they changed their minds, and in this last stage, they decided to sell us their Corn,” he notes. The support we received from the authorities of the Party and the Government was also vital because even though green Corn continued to be marketed to the population, the sale was more rigorously reinforced in 2022, highlights Tamayo Yero.

On the same date in 2021, only a little more than 800 tons of Corn had arrived at the plant, while in the first days of October 2022, close to 3,000 tons of grain were already counted. And the entry of a thousand more was planned. However, according to the manager, these figures are still far from the installed capacity in the modern and efficient industry, where some 18,000 tons can be processed annually.

To achieve that production volume, Corn would have to be planted in Cuba all year round. The largest harvest is concentrated in August to October, and smaller quantities in the cold season, but as long as a staggered planting is not carried out, it will be challenging to achieve those 18,000 tons.

Other sources: GRANMA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time