Colombia Blends Imported Wheat for Cost-Effectiveness

Reading time: 2 minute

Colombian Wheat production is a minor rudimentary crop, primarily grown in two high-altitude regions with more favorable climatic conditions for Wheat cultivation. The average yield might vary between 2.0 and 2.4 tons per hectare, depending on weather conditions. Over the past ten years, reductions in Wheat area planted are small but permanent as the country has noncompetitive production systems. In MY 2022/23, Wheat production is forecast at 6,000 MT with an estimated area harvested of 2,500 Ha. Domestic Wheat production is primarily destined for wet milling and human consumption.

In MY 2022/23, Wheat consumption is forecast at 2.1 million tons. Wheat consumption trends will likely parallel population growth, with demand increasing yearly (2-3 percent). However, current global uncertainty, high food inflation rates in Colombia, and the increase in international Wheat prices, might slow down consumption driven by lower imports. The Colombian Wheat milling industry is entirely supplied through imports.

Per capita Wheat consumption is estimated at 65 pounds. The bread and flour sector consumes nearly 70 percent of Wheat, followed by the pasta sector (15%) and the cookies and pastry industry (10%). Wheat feed consumption usually represents nearly 5 percent of total consumption, as the animal feed industry only imports larger amounts of Wheat when Wheat prices are competitive enough for feed formulation.

In MY 2022/23, ending stocks are forecast to decrease to 343,000 tons as imports are forecast to be low while consumption remains unchanged. Wheat importers also make purchasing decisions based on short-term necessity, given current high international prices and the strong U.S. dollar against Colombian peso. The feed and Wheat milling industries maintain limited carry-over inventories of grains, given the high storage cost. The storage capacity depends on the mill size, but most mills can store product for two-month operations.

Colombian Wheat Trade

Colombian millers primarily import Canada Western Red Spring (CWRS) Wheat due to its affordability, higher protein content, and strong trade relationships with Canadian exporters, given the Colombia-Canada Free Trade Agreement entered into force before the CTPA. In 2021, Colombian millers imported other Wheat varieties, primarily from the United States, such as soft white (SW) and hard red winter (HRW) Wheat. In Colombia, HRW Wheat is blended with Canadian Wheat to attain the required protein level needed to satisfy the requirements for bread and pasta production. The quality protein level in U.S. HRW Wheat provides an excellent, cost-effective alternative for Colombian millers.

There are no Government programs in place for Wheat. Implementing trade agreements with Canada and the United States has established favorable trade conditions with duty-free Wheat imports. Mercosur Wheat is subject to the Andean Price Band System (APBS) mechanism. Current Mercosur duties for Wheat are zero, as the reference price for the second half of March 2022 is $438/ton. Colombia currently has 15 trade agreements in force, most of which have zero duties for Wheat, including Canada and the United States.

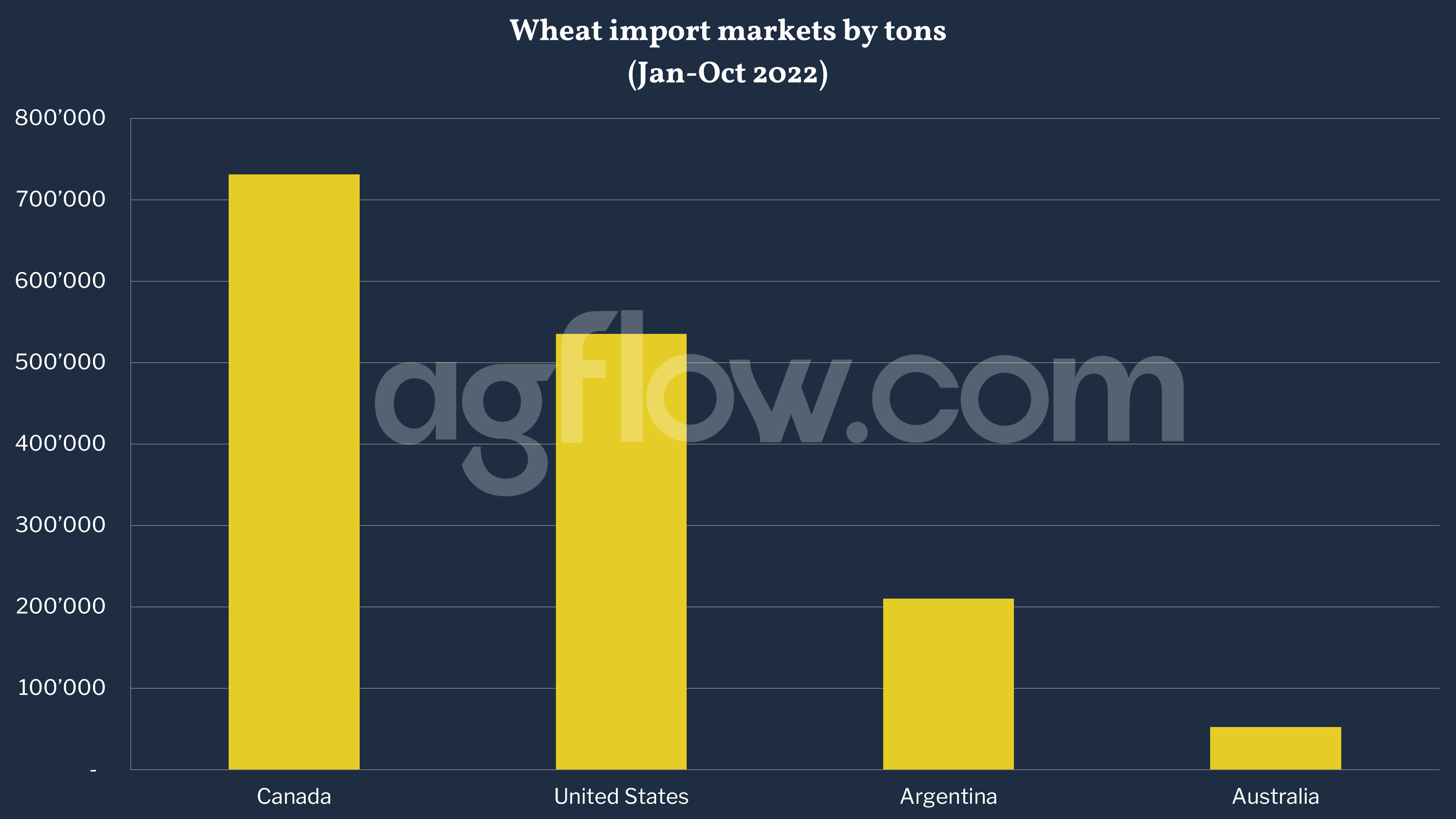

There are approximately 60 importers of Wheat. Yet, imports are concentrated (roughly 90 percent) among 25 importers. In MY 2020/21, about 98.5 percent of Colombian Wheat imports were Wheat grain, and the remaining 1.5 percent was pasta. According to AgFlow data, Canada led Colombia’s Wheat import market with 0.7 million tons in Jan – Oct 2022, followed by the US (0.5 million tons), Argentina (0.2 million tons), and Australia (0.05 million tons).

In terms of export, Colombian Wheat exports are forecast to remain stagnant at 20,000 tons in MY 2022/23, considering production constraints from the Wheat milling industry due to high Wheat international prices. The leading destination for Colombian Wheat flour is Venezuela, which accounted for 88 percent of total exports in MY 2020/21.

Other sources: https://www.usda.gov

Free & Unlimited Access In Time