Chinese Wheat Market since 2019, and the acceleration of imports in 2021

Reading time: 7 minutes

Chinese Wheat is not a very sought after commodity in the physical cash market since it is exclusively domestic-based. However, the Chinese Wheat Cash Market yields opportunities for parties in foreign countries exporting Wheat products. There are two crops for Chinese Wheat with Winter and Spring, and harvest starts towards the end of May and continues through August. Therefore, the period between the end of June and the beginning of May is critical for this market. Adding to this, the current trade war with Australia, notably discussed in a previous AgFlow article on the Australian Barley Export Market, could offer exciting opportunities in this market. In contrast to the earlier studies on German and French Wheat, this study will have a broader focus and look at the Trade Flows in addition to the Domestic Wheat and Import Wheat Cash Prices.

Chinese Wheat Domestic Market Prices

The first approach to the Chinese Wheat market is with the Domestic Wheat Prices. As always, this gives a general overview of the events for this specific market and the market trends. This then lays the groundwork for an extensive analysis of the Market.

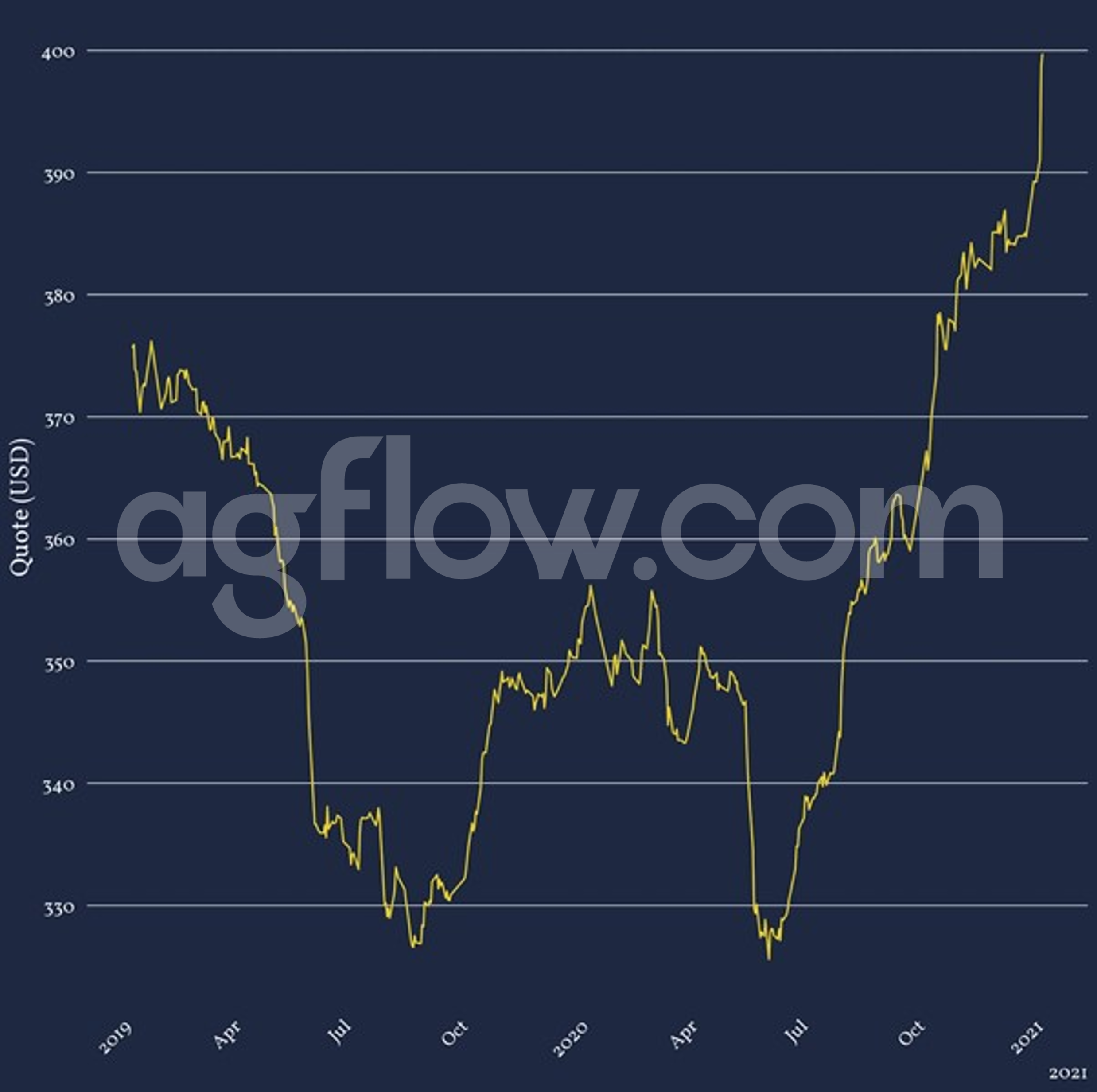

Figure1: Chinese Wheat Prices between Jan 2019 Jan 2021

The curve in Figure 1 displays the prices for China Wheat EXW China from various ports and with no specified specs. The domestic Wheat prices show noteworthy characteristics:

- From January 2019 until around October 2019, the market is bear

- There is a bulge between October 2019 until June 2020. During this period, the price is relatively stable, around the $350 mark

- From June 2020 onwards, the market is bull going from $330 on average to breaking $400

The market underwent a remarkable event as the market data shows that the bear market stabilized and even went from its lowest point in 7 months back to June levels. This is undoubtedly due to the new quality crops gathered during the campaign that was rated higher than in previous years; however, the market settled by the end of the Spring harvest in late June and went back down to its June 2019 level.

Since then, market prices are ever-increasing, recording the highest quotations for domestic prices since the beginning of the timeframe and breaking the $400 point in 2021, representing an increase of over 25% since July 2020. However, this bull market is not due to crop qualities but perhaps related to China’s import policy.

Hence, looking at the Wheat import prices and parities will provide a better understanding of the dynamics of the Chinese Wheat market even further.

Chinese Wheat Import Products

Chinese Wheat Imports only represent a small portion of the total Chinese Wheat stocks. Nonetheless, they are crucial to China due to a growing population and economy.

Figure 2: Average Chinese Wheat Import price per Origin

The bar chart from Figure 2 displays the average Wheat quotation from the AgFlow dataset. This data shows average prices way lower than the domestic Cash Wheat Prices and corresponds to quotes from May 2020 for Ukraine, October 2020 for Serbia, and November 2020 for the United States.

Additionally, the dataset for these prices showed that origins had specific specs associated with them. The U.S. prices are indeed exclusively Red/Soft/Winter Wheat prices. In contrast, the other two origins are only Feed and Milling Wheat. This implies that origins are also important for their different parity, and therefore import origins must vary due to seasonality.

Nonetheless, this dataset is lackluster as there are only one Serbian and two Ukrainian prices. Moreover, the average price does not show the actual price variation. Due to the dataset size, this variation is visible only for the United States Wheat prices.

Track Chinese Wheat Prices

Figure 3: Chinese Wheat Imports of U.S. Red/Soft/Winter Wheat price variation in USD

The chart in Figure 3 represents a box plot of the U.S. Wheat prices. The wideness of the boxes scales exponentially with the number of data points fitting into it. Hence, most of the data is located within the largest box. Practically this graph shows a considerable variation in U.S. prices, due primarily to the import destination.

All in all, the dataset shows that Chinese Wheat import prices are very competitive with domestic Wheat products’. Moreover, the shipment periods for products correspond to the off-season for Chinese crops for Wheat. Trade flows will then show how these prices’ competitive advantages influence the volumes imported.

Wheat Imports Trade Flows

Chinese Wheat Imports have several origins corresponding to different shipment periods, specs, and prices. Thus, not all export countries represent the same share of import volumes.

Figure 4: Share of Chinese Wheat Imports

per Origin Based on Total Volume from Jan 2019 to Jan 2021

The pie chart in Figure 4 shows the distribution of Wheat import origins according to the AgFlow dataset. It clearly shows that Canada and Australia are the two largest Wheat import origin countries for China overall. The U.S. and France, respectively third and fourth, also represent a significant portion of the Chinese Wheat imports. Lithuania is surprising to find in the top 5 origin countries for a player like China. Moreover, the Others share is the sum of origins representing less than 1% each, namely Brazil, Ukraine, and Argentina.

This chart does not, however, show the raw volumes imported each month. Consequently, it overlooks events like the Chinese trade war on Australia or the rise of small individual origins.

Figure 5: Monthly Chinese Wheat Imports per Origin Country Between Jan 2019 and Jan 2021

Plot 1: Monthly Chinese Wheat Imports from the Top5 origins

Plot 2: Monthly Chinese Wheat Imports from the bottom origins ( < 1% share)

The bar charts from Figure 5 provides the needed granularity for observing these trends and events. The first plot in Figure 5 highlights that Lithuania being a major source of Wheat for China, was only relevant between Sep 2019 and Mar 2020. Moreover, contrary to its Barley exports, the Chinese Wheat Imports data show that Australian Wheat exports resisted the ban very well, thus showing the importance of this specific parity.

For the bottom origins, plot 2 highlights that they are not frequent imports. Indeed, there is only one shipment recorded on the dataset for Argentina and Ukraine. For Brazil, China imported Brazilian Wheat for the last two consecutive months. Additionally, January will potentially overcome the volumes for December since the month is not over yet. These two shipments are the most important volumes from the bottom pool. Although the data size is small, this probably shows the beginning of a new important origin for Chinese Wheat Imports.

Finally, Both plots highlight that the overall Chinese Wheat Imports accelerate in time, both due to the increasing need for more Wheat products and the competitiveness of the foreign products.

Track Chinese Wheat Imports

Conclusion

The Chinese Wheat market showed that its dynamics revolved around the seasonality of its domestic products. Indeed Chinese Wheat prices start increasing at the end of the gathering season, around the end of June. During the off-season, the market is then bull.

This trend is then influenced by the prices of imported Wheat, which, from the AgFlow dataset, is very competitive with the domestic market. This, in turn, affects the bull cash Chinese Wheat market. Moreover, the diversity in origins also ensures the availability of different parities, also driven by seasonality.

The trade flows further show that the diversity of origins for Chinese Wheat Imports depends on seasonality. The share of origins also indicates that most of the Wheat imports originate from a limited pool. However, this data is biased, as, for example, Lithuania is no longer a relevant Wheat origin. The monthly breakdown also helped to show that the least important origins are not regular imports. But this also showed that Brazil is potentially an up and coming origin.

Finally, the data shows that the Chinese market faces impressive growth and is currently in a very bull market. Wheat imports are also a big part of the Chinese Wheat market, with competitive prices and the necessity of importing more and more Wheat products. The case of Brazil Wheat shows that there are opportunities for more origins to take advantage of the Chinese market. However, time will show whether Brazil will become a genuinely regular Wheat source or a temporary one like Lithuania.

Read also: Australia Barley Export Market in 2020

Read also: Evolution of Wheat Prices on cash markets by protein levels in Germany since 2018

Read also: Evolution of French Wheat Prices, a Breakdown by Protein Level