China – Top Export Market of the EU Sunflower Meal

Reading time: 2 minutes

The EU is estimated to produce a lower volume of Sunflower Meal, about 5 percent less than last season, due to reduced crush. Lower production is reported by Hungary, Romania, Spain, Italy, the Netherlands, and Portugal, followed by Austria and Poland, offsetting small growth in France, Bulgaria, Germany, and Croatia. Crushers in most EU countries will likely opt for rapeseed use due to improving margins compared to Sunflower seeds and likely for soybeans in select MS in the second half of the MY.

Estimated reduction in consumption of Sunflower Meal in the current year is likely to lead to lower imports compared to MY 2021/22, especially in the second half of the season when the competitiveness of rival Meals is likely to improve. The current conservative estimate is for imports of 2.4 MMT, a seven percent decline compared to MY 2021/22. In the first quarter of the MY Sunflower Meal, imports registered a sharp increase.

As of March 21, EU Customs data shows imports exceeding last year’s levels. However, the difference has declined since the beginning of CY2023. The main origins to date have been Ukraine (47 percent), Russia (22 percent), and Argentina (21 percent). It is expected that shipments from the Black Sea region will be more challenging in the second half of the current year due to logistical and trade regime issues (export duty in Russia), along with anticipated lower exportable supplies in Argentina due to its shorter crop and crush. Most EU countries, such as the Netherlands, Spain, Italy, Belgium, Latvia, Lithuania, and Bulgaria, expect lower imports offsetting projected marginal increases in Poland, France, Germany, Romania, Hungary, Denmark, and Slovenia.

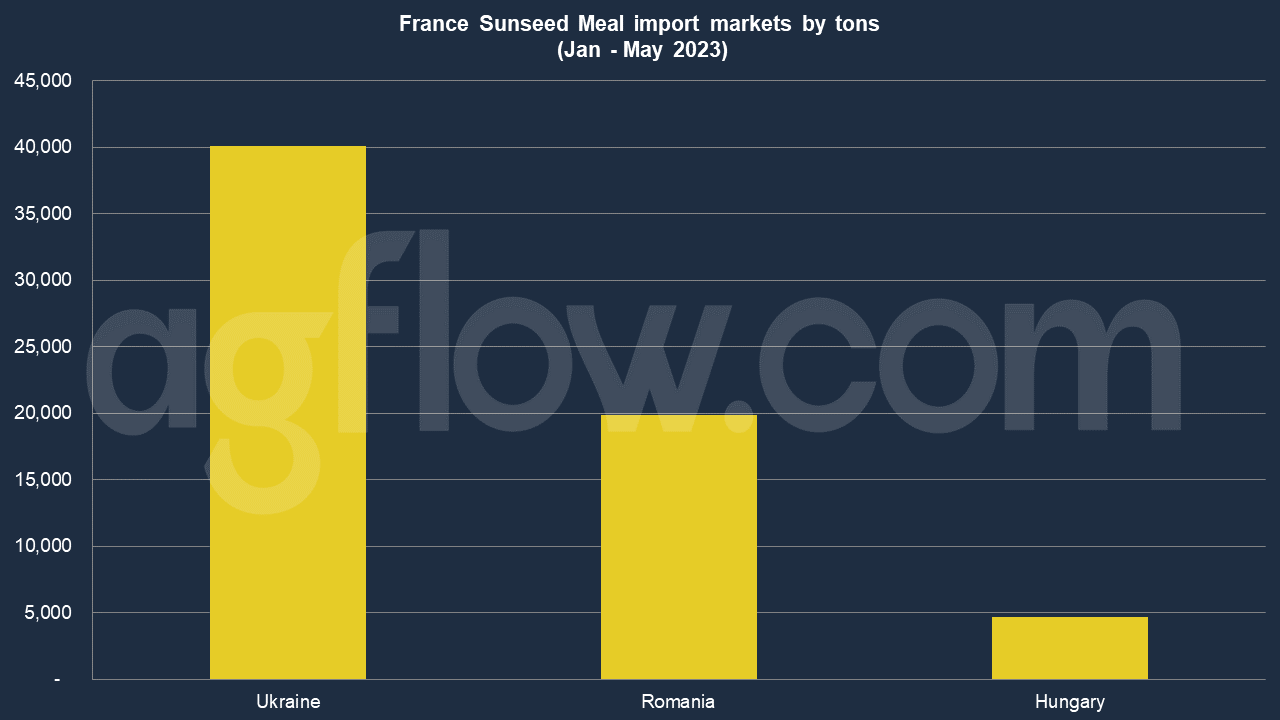

The current estimate for imports is subject to adjustment depending on the development of the Black Sea region situation. The EU’s use of Sunflower Meals is projected to decrease by about six percent compared to MY 2021/22. Use in most EU MS is suppressed due to challenges in the poultry and livestock industry related to increasing prices of inputs and shrinking profitability. Romania, Hungary, Italy, the Netherlands, Poland, and Greece report lower Sunflower Meal use, while flat or higher use is seen in France, Germany, Denmark, Belgium, and Bulgaria. As per the AgFlow data, France imported 40,050 tons of Sunflower Meal from Ukraine in Jan-May 2023, followed by Romania (19,890 tons) and Hungary (4,686 tons).

Despite a shorter total supply in the current MY, Sunflower Meal exports are estimated to be steady or higher than the previous season due to weaker domestic demand. Early in the season, Sunflower Meal also enjoyed good export demand due to less available Sunflower Meal from the Black Sea region. In the first quarter of the MY, exports were six percent more than a year ago. As of March 21, the growth rate in EU exports accelerated, and exports were 23 percent higher than a year ago. The top export destinations were China (53 percent), the United Kingdom (13 percent), and Morocco (12 percent). Bulgaria (64 percent of total EU exports) and Romania (12 percent) are leading EU exporters.

Sunflower Oil Production in the EU

Sunflower Oil production is forecast to increase by 2.4 percent due to higher crush. Most MS expect steady or increased production. The highest growth is seen in Hungary, France, Romania, Bulgaria, and Austria, compensating for slight declines in Spain, Belgium, Greece, the Netherlands, and Portugal. Despite better domestic production, Sunflower Oil imports are estimated to grow by about 5 percent to 2.2 MMT due to projected favorable and stable demand for food and industrial use. This will likely result in a higher total supply in the EU, predetermining a recovery in consumption and regular exports.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time