China Soybean Import: A Massive Volume

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

China’s soybean trade is a complex and multifaceted subject that has far-reaching implications for both the global economy and the agricultural commodity industry. This article will delve into the key factors that have impacted China’s soybean trade, export, and import from January to July 2023, providing an insightful and objective analysis.

The Dynamics of China’s Soybean Trade

How does a nation like China, with its vast population and ever-growing demand for soybeans, balance its needs with the global market? It’s a delicate dance, akin to a tightrope walker maintaining equilibrium on a thin wire.

On one side, the domestic demand for soybeans is driven by the country’s burgeoning livestock industry and the growing popularity of soy-based products. On the other side, the global supply chain is affected by weather conditions, international trade agreements, and geopolitical tensions.

The Chinese government’s trade policies play a pivotal role in this balancing act. Tariffs, import quotas, and bilateral agreements with major soybean producers like the United States and Brazil are tools in the toolbox, wielded with precision to maintain stability.

But what happens when one side of the scale tips too far?

The first half of 2023 has seen several challenges that have tested China’s ability to maintain this balance. Unpredictable weather patterns in key soybean-producing regions have led to fluctuations in supply. Meanwhile, global economic uncertainties and the ongoing effects of the COVID-19 pandemic have added layers of complexity to the trade landscape.

Is it possible to have too much of a good thing? In the case of China’s soybean imports, the answer might be yes. The country’s reliance on imports has led to concerns about over-dependence on foreign suppliers. What if geopolitical tensions escalate? What if supply chains are disrupted?

These are not mere hypotheticals but real questions that policymakers and industry professionals must grapple with. The tradeoff between securing a stable supply and fostering domestic production is a complex equation with no easy solutions.

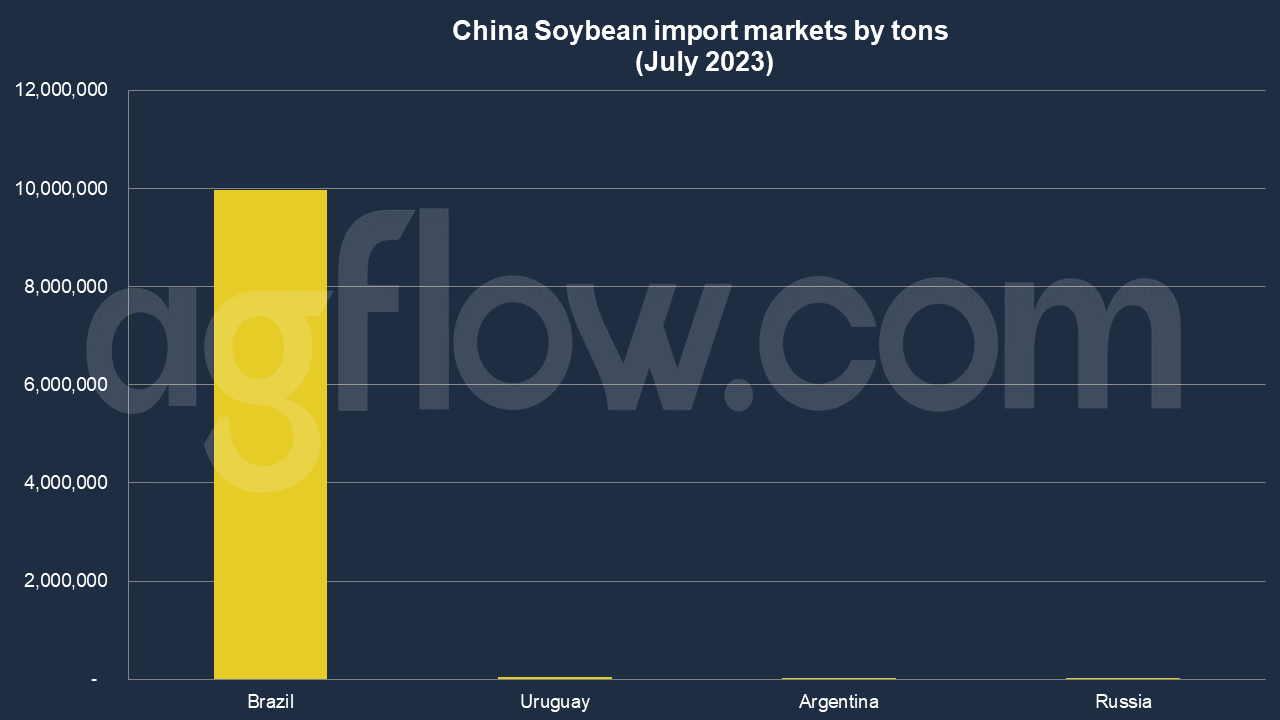

According to AgFlow data, China imported 9.9 million tons of Soybean from Brazil in July 2023, followed by Uruguay (42,000 tons) Argentina (33,000 tons), and Russia (10,000 tons). Total imports hit 62.7 million tons in Jan-July 2023. China was purchasing large amounts of Soybean from the Brazil and the United States, such as 12 million tons and 5.3 million tons, respectively.

May shipments were the largest in Jan – July of 2023, with 13 million tons. The following months were Apr (11.2 million tons), June (10.6 million tons), July (10 million tons), Feb (9 million tons), and Jan (6.7 million tons).

Looking Ahead: Opportunities and Risks

As we move into the latter half of 2023, the soybean trade in China continues to be a dynamic and evolving landscape. Opportunities abound for both domestic producers and international suppliers, but the path is fraught with risks.

Could China’s investment in domestic soybean production be the key to unlocking long-term stability? It’s a question worth pondering, like planting and watching a seed grow. But plant growth is never guaranteed, and neither is the success of a trade strategy.

The interplay between domestic policies, global market forces, and individual business decisions creates a tapestry as intricate as the Silk Road of old. Understanding this tapestry requires a nuanced and multifaceted approach that considers not just the numbers but the human stories behind them.

In the world of soybean trade, there are no easy answers, only complex questions and the relentless pursuit of balance. As China continues to navigate this challenging terrain, the lessons learned, and the strategies employed will undoubtedly shape the future of the global agricultural commodity industry.

Conclusion

In conclusion, China’s soybean trade, export, and import from January to July 2023 present a fascinating study in complexity, balance, and resilience. The interplay of demand, supply, policy, and global factors creates a dynamic and ever-changing landscape. By understanding these intricacies, we can gain valuable insights into the world of agricultural commodities and the broader economic and geopolitical context in which they operate.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time