China Reduces Rapeseed Imports

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In China, the annual output of Rapeseed was 15.5 million tons in the last year, an increase of 818,000 tons from 14.7 million tons in 2021. The total production of Rapeseed has increased for the seventh consecutive year. From the perspective of sown area, China’s Rapeseed sown area in 2021 was 6,991.6 thousand hectares, a year-on-year increase of 3.4%. This is the third consecutive year of recovery growth. In addition, the Rapeseed yield per unit area in 2021 was 2,104.5 kg/hectare, with a year-on-year growth rate of 1.3%, a slow growth rate.

In 2022, the sales of Rapeseed Oil in China were 13.08 billion yuan, accounting for 11.1% of the total sales of packaged Oil in the country. The Oil content in Rapeseed is 37.5%-46.3%, and about 600 kg of Rapeseed Meal and about 400 kg of Rapeseed Oil can be produced per ton of Rapeseed.

With the increase in Rapeseed production, while improving the self-sufficiency rate of edible vegetable Oil in China, the import quantity of Rapeseed has declined to a certain extent. In 2022, the import volume of Rapeseed was 1.961 million tons, which is 677,000 tons less than the 2.638 million tons imported in 2021, a year-on-year decrease of 25.7%.

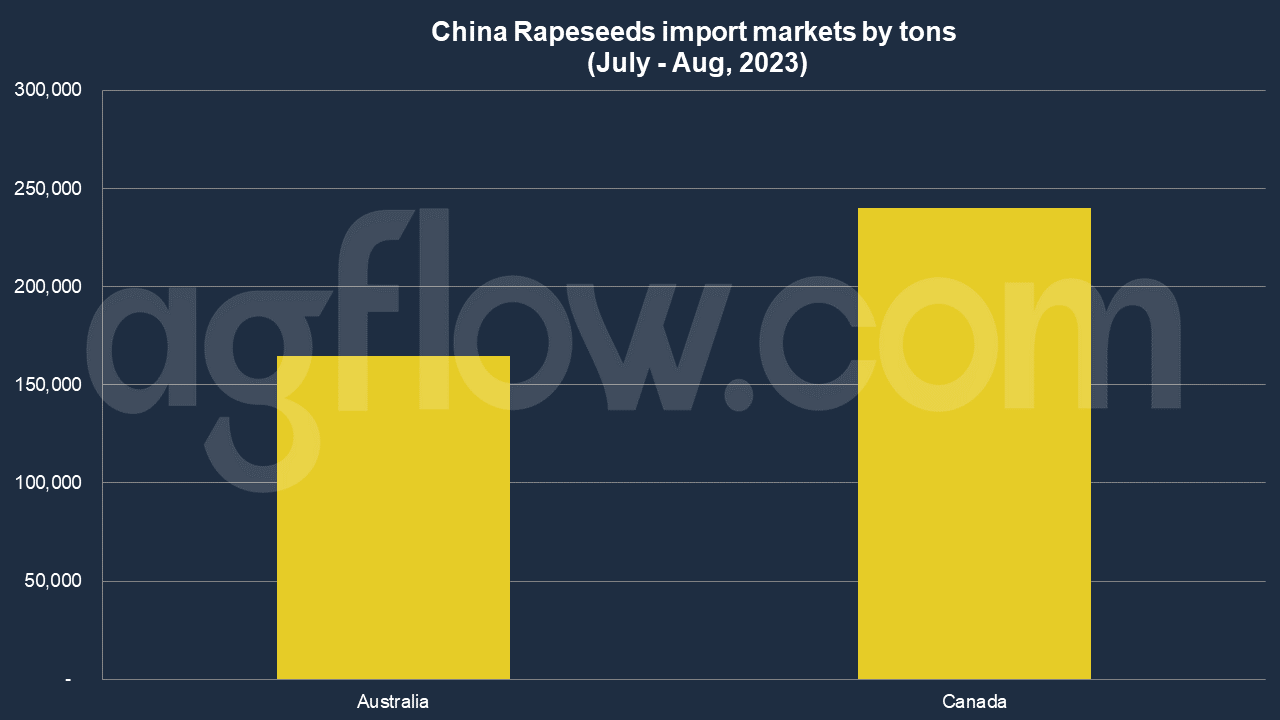

According to AgFlow data, China imported 0.24 million tons of Rapeseeds from Canada in the last two months, followed by Australia (0.16 million tons). In 2021, China imported Rapeseed worth $1.45 billion, becoming the 3rd largest importer of Rapeseed in the world. In the same year, Rapeseed was China’s 178th most imported product. China imports Rapeseed primarily from Canada ($1.39 billion), Australia ($36.8 million), Russia ($17.1 million), Mongolia ($2.32 million), and Thailand ($559).

In 2021, China exported Rapeseed worth $1.71 million, making it the world’s 45th largest exporter of Rapeseed. The leading destination of Rapeseed exports from China are Nepal ($975k), Pakistan ($578k), Japan ($101k), South Korea ($36.1k), and the Netherlands ($11.1k).

In marketing year ending in September 2022, China imported around 2.2 million metric tons of Rapeseed Meal. In the marketing year ending in September 2023, the estimated Rapeseed Meal import volume was also approximately 2.2 million metric tons.

Development Trends of Rapeseed Industry in China

In recent years, my country’s Rapeseed planting area, unit yield, and total output have shown an increasing trend. However, the Oil extraction rate of China’s Rapeseed is still lower than that of other major Rapeseed Oil-producing countries. Externally, the Government should make long-term investments in countries with Rapeseed production potential to enrich the sources of Rapeseed and Rapeseed Oil imports; internally, the Government should pay attention to the demand for Rapeseed Oil from small press mills in rural areas of the country, and growers need to strengthen breeding of high-yielding and high-Oil varieties will improve Rapeseed production efficiency.

Insufficient deep processing capabilities make Rapeseed processing simple and inefficient. China’s main Rapeseed production areas mainly follow the “local processing + local consumption” model.

The number of leading Vegetable Oil companies is small, and the brand effect is not high. In 2021, there were 370 leading Vegetable Oil companies in China, including 54 at the national level and 316 at the provincial level. Most companies’ processing technology and equipment are outdated. The Chinese Rapeseed Oil processing industry is generally small, weak, and fragmented.

The three prominent Vegetable Oil leaders, Yihai Kerry (Arowana), Fulinmen, and Luhua, adopt a multi-Oil product layout, and the market share of the leading brands in the Rapeseed Oil market is not high. At the same time, product homogeneity competition is serious, and there are few dedicated, high-end, and characteristic high-quality Rapeseed Oil products, making it challenging to meet different levels of consumer demand.

Why import when there’s domestic production? It’s a valid question. The answer lies in the growing demand, diverse consumer preferences, and the need to stabilize prices. Imports help fill the gaps, ensuring the market doesn’t run dry.

But the puzzle has its missing pieces. The tradeoffs include dependency on foreign markets, currency fluctuations, and the challenge of aligning imports with domestic policies. The recent increase in import duties, for example, has been a double-edged sword, protecting domestic producers but also raising prices.

Other sources: HUAON

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time