Chile’s Soybean Exports Gradually Progress in the EU

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

In a world where the trade and dynamics of commodities have become pivotal for the sustenance of nations, understanding the nuances of such trades becomes essential. When we speak of Chile, a nation known for its diversified exports and imports, the soybean trade has evolved as a cornerstone of agricultural commerce. But what precisely are the driving factors behind Chile’s soybean trade in 2023, and what challenges do professionals in the agricultural commodity industry face in understanding this market?

Soybeans: Why are they so Crucial?

To the untrained eye, a soybean is just a bean. But dig a little deeper and realize its monumental significance in the global agricultural landscape. Soybeans are a vital protein source for both humans and animals, but they also hold immense importance in producing soy-based products, from tofu to soy milk, from oil to biodiesel. So, why is Chile, nestled on the Pacific coast of South America, increasingly looking towards this legume?

The Factors Impacting the 2023 Chilean Soybean Market

The first half of 2023 has already revealed certain distinct patterns in the Chilean soybean trade:

- Global Market Dynamics: Soybean prices in the global market have witnessed volatility, largely due to geopolitical tensions and climatic anomalies. The ripple effects of these fluctuations have been felt in Chile, a nation deeply interconnected with global trade.

- Climatic Changes: Has anyone else noticed the growing unpredictability of weather patterns? Chile, too, grapples with this uncertainty, influencing its agricultural outputs and, thereby, the need to import to balance the deficit.

- Regional Partnerships: With Brazil and Argentina, two of the world’s largest soybean producers, as its neighbors, Chile finds itself in an advantageous position. Yet, is proximity alone enough, or are there intricate trade dynamics at play?

- Domestic Consumption Patterns: An increasing trend towards plant-based diets and the use of biodiesel in Chile is spurring the demand for soybeans. But with this increased demand, can supply keep pace?

The Trade-offs and Challenges

With every strategic decision, trade-offs are inevitable. Balancing its agricultural production with imports is a delicate act for Chile. On one hand, boosting domestic production could lead to self-reliance, but at what environmental cost? On the other, leaning heavily on imports poses risks of dependency on other nations.

Professionals in the agricultural commodity industry need to grapple with a myriad of challenges:

- How do we maintain a consistent supply amidst global market volatility?

- Given the vast array of sources, how to ensure the quality of soybeans?

- With the impending threats of climate change, how can sustainable practices be integrated into the soybean trade?

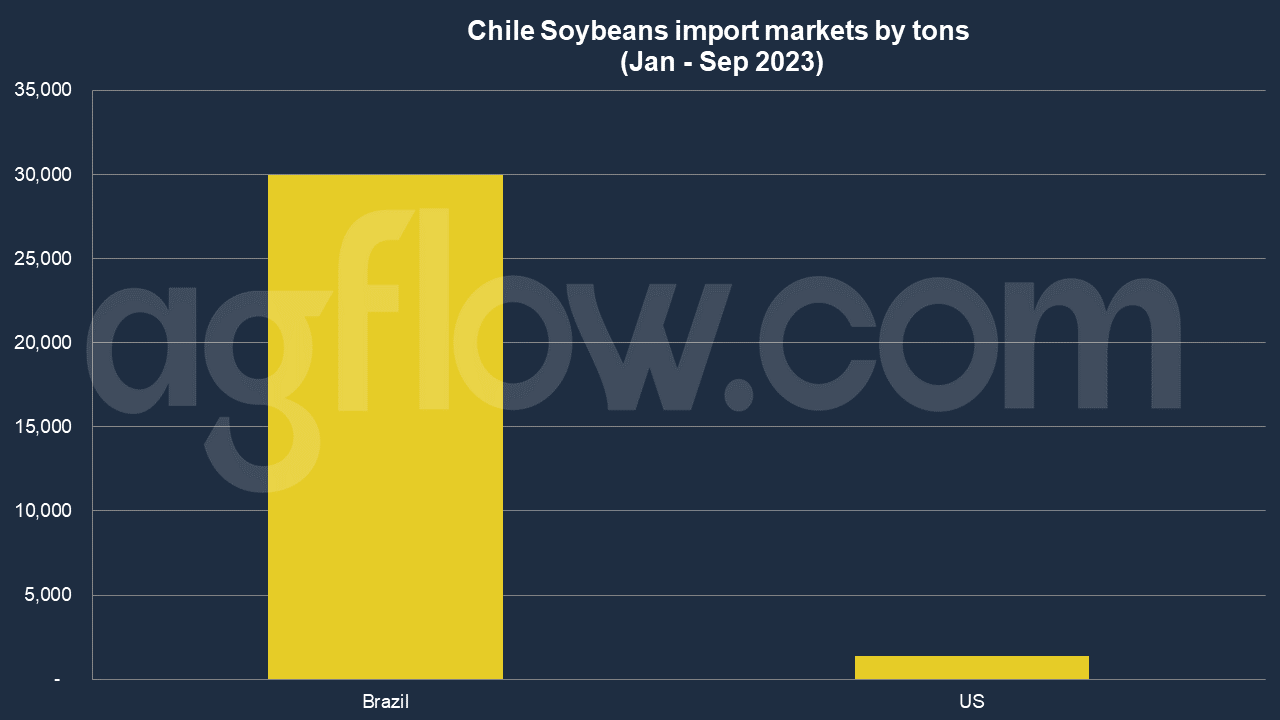

According to AgFlow data, Chile imported 29,950 tons of Soybeans from Brazil in Jan – Sep 2023, followed by the United States (1,395 tons). In 2021, Chile imported Soybeans worth $47 million, becoming the 46th largest importer of Soybeans in the world. At the same year, Soybeans was the 304th most imported product in Chile. Chile imports Soybeans primarily from: Argentina ($36.5 million), the United States ($5.88 million), Uruguay ($4.47 million), Dominican Republic ($58.4k), and Canada ($42.2k).

In 2021, Chile exported Soybeans worth $15.3 million, making it the 39th largest exporter of Soybeans in the world. The main destination of Soybeans exports from Chile was the United States ($14.5million), the Netherlands ($418k), Canada ($220k), France ($80.2k), and Spain ($22.8k).

Rhetorical Questions for Thought

Is the key to unlocking Chile’s soybean potential hidden in its regional and global partnerships? Or does the answer lie in innovative agricultural practices and policy interventions?

Concluding Thoughts

As the world continues its inexorable march toward globalization, the soybean trade, like many other commodities, will remain at the forefront of national discussions. Chile’s stance in this dance of supply, demand, and partnerships is a testament to its agility and adaptability in a constantly shifting landscape.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time