Canada to Finalize an FTA With ASEAN, Barley to Benefit Much

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

StatsCan trimmed its latest 2023 Barley production estimate to 7.84 million tons. That’s 2.1 million tons smaller than last year’s crop and well below the 5-year average production of 9.29 million tons, a severe shortfall. It’s still better than the 2021 crop of 7.0 million tons, but not by much.

StatsCan also showed 2022/23 ending stocks just over 700,000 tons, a bit more than last year but still historically low. Total supplies for 2023/24 are estimated at 8.65 million tons, down nearly 2 million tons from the previous year but a bit more than 2021/22 at 7.92 million tons.

In 2022-2023, the Barley supply stands at 10.6 Mt, an increase of 33% year-on-year. Total domestic use, of which approximately 94% is intended for animal feed, amounts to 5.8 Mt, an increase of 24% year-on-year. Total exports, including exports of cereals and cereal products (in grain equivalents), amounted to 4.0 Mt.

Canadian producers sowed 2.96 Mha of Barley in 2023-2024, according to the survey. This level is 4% higher than that of 2022-2023. Approximately 52% of the area dedicated to Barley is in Alberta, 38% in Saskatchewan, 6% in Manitoba, and 4% in other provinces. The Canadian Barley yield for 2023 was projected at 2.95 tons per hectare (t/ha), down sharply compared to the previous year.

The last three years have been good for Canadian farmers. However, due to pressures from falling commodity prices, the effect of weather on crop yields, and increased operating costs, the 2023-2024 harvest year looks less promising.

A reduced acreage and lack of moisture limited 2023 Canadian Barley production. StatsCan estimates the 2023 average Barley yield at 55 bushels/acre compared to last year’s 70 bushels/acre. Some post-harvest yield reports came in better than mid-summer expectations.

The hay shortage for cattle feeding may lead to more straw-grain rations, with Barley, oats and pellets the most likely concentrate source. Barley prices have dropped, becoming more competitive with world prices, and increasing the prospects of improved Barley exports as the crop year progresses. Also, malting Barley demand remains firm.

Meanwhile, the cost of imported U.S. corn in Canada is a significant factor for feed Barley prices, considering that some feeders prefer feeding Barley, even at a premium price to corn. Traditional advice applies to Barley marketing this crop year. Know your product, consider your cash flow needs, follow the market situation, and shop widely for the best, financially secure farm gate price.

Several factors have contributed to the price moderation of feed Barley. During recent years, when Barley was in relatively short supply, and prices rose to record levels, livestock feeders sought lower-cost rations. Milling wheat was even selling as feed wheat to meet feed demand. Oats and other feed grains were also substituted for part of rations. Unit trains of imported U.S. corn became more common in the Lethbridge area as the logistic challenges of those imports were overcome. Feeding imported corn has become standard when price competitive.

Barley Exports

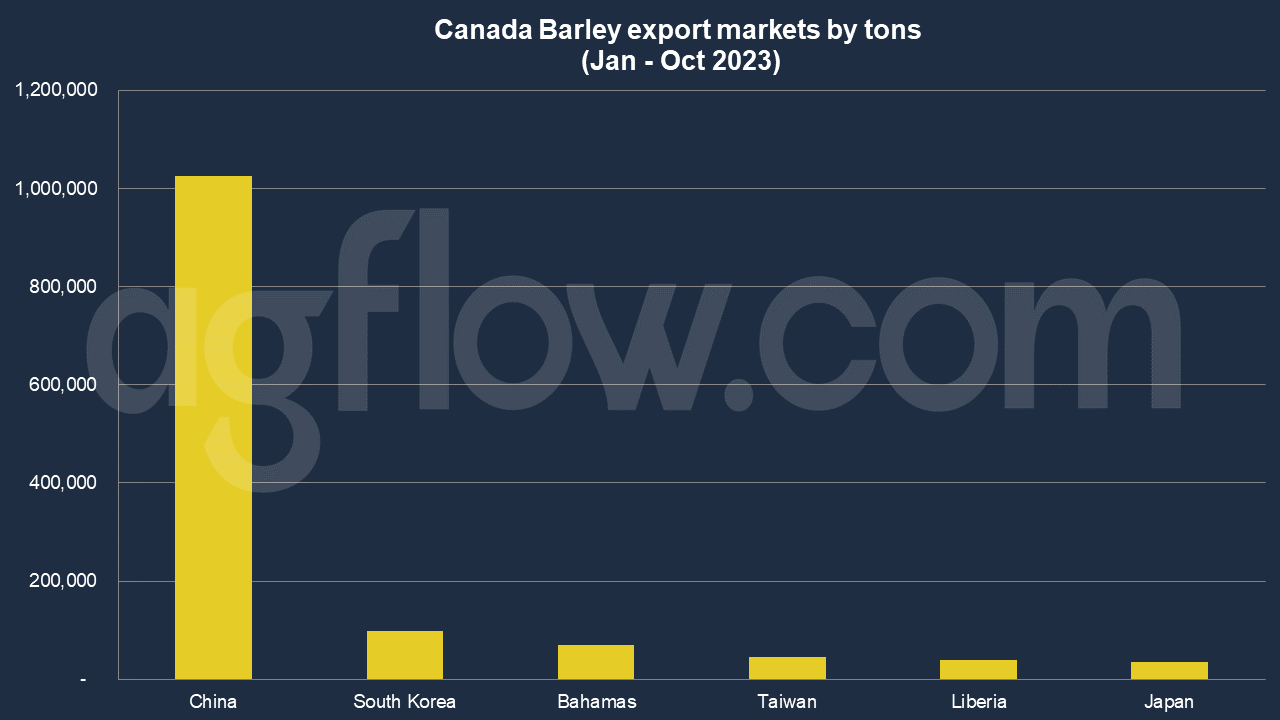

Some prominent Canadian Barley importers include the United States, China, Japan, South Korea, and Mexico. According to AgFlow data, Canada exported 1 million tons of Corn to China in Jan – Oct 2023, followed by the Bahamas (69,300 tons), Taiwan (44,500 tons), Liberia (40,000 tons), and Japan (36,000 tons). Total exports hit 1.7 million tons in Jan – Oct 2023.

As per provincial crops market analyst with the Alberta government, Canadian advantage is now gone; Canadian Barley exports to early November 2023 total just 592,000 tons, compared to 816,000 tons at this time last year and 970,000 tons in November 2021. Canadian exports will likely be lower in 2023/24, so domestic feeders won’t need to compete as much against a strong pull from the export channel.

Canada is the fourth-largest Barley producer and second-largest malt exporter globally. And every year, Canadian farmers generate $1 billion from feed Barley and malt exports. Over 50 percent of Canadian Barley is known as general-purpose Barley and is used mainly as animal feed because of its high protein and starch content.

Canada – ASEAN Ties

Canada expects to finalize a free trade agreement with ASEAN following the launch of the Canada-ASEAN strategic partnership. ASEAN is set to play a vital role in Canada’s future foreign policy, as outlined in the federal government’s Indo-Pacific Strategy (IPS), launched earlier this year. ASEAN’s role as a strategic and trading partner is at the core of the IPS, and agriculture and agri-food businesses are identified as priority sectors for development.

For more than a decade, Canada’s trade with ASEAN members in agriculture and agri-food has grown at an annual rate above 7%. As negotiations progress and are expected to conclude by 2025, this agreement holds the potential to unlock a wealth of opportunities.

Price Tendencies

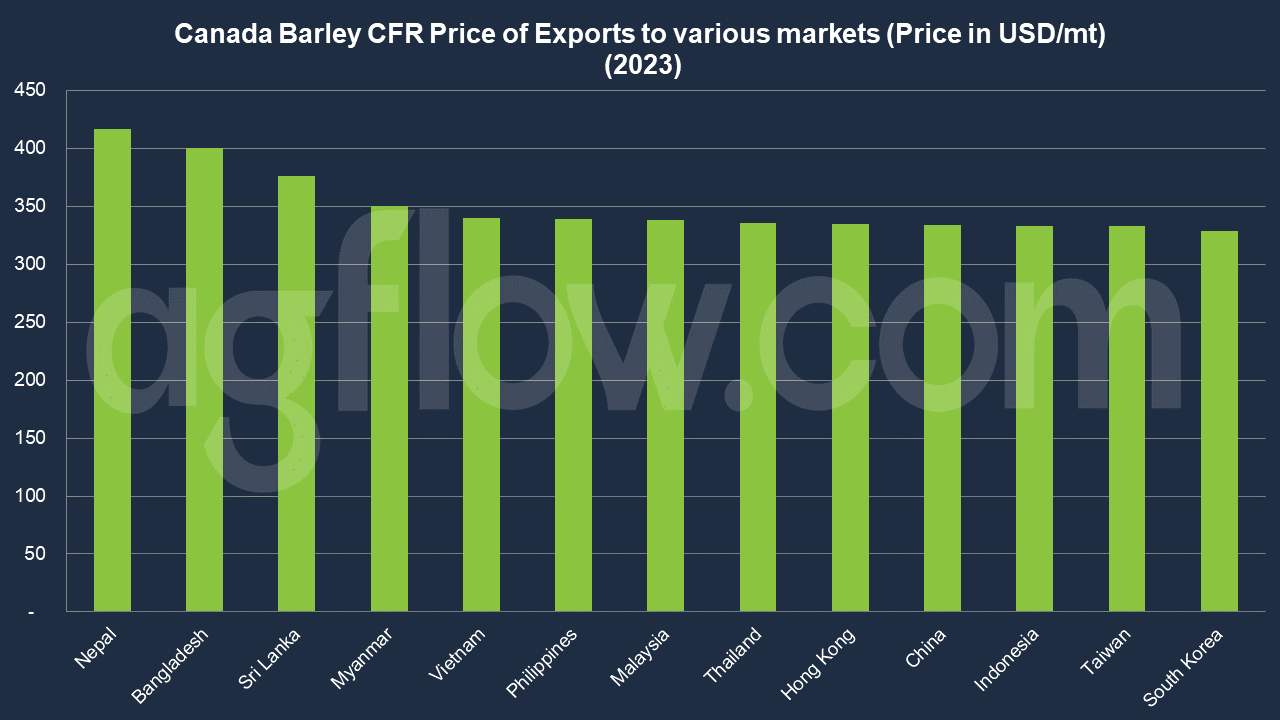

Canada quotes higher CFR price to ASEAN members but lower to Taiwan and South Korea. Myanmar was offered the highest CFR price of $351 per ton. Yet, its neighboring Bangladesh received a much higher CFR price of $400, a difference of almost $50.

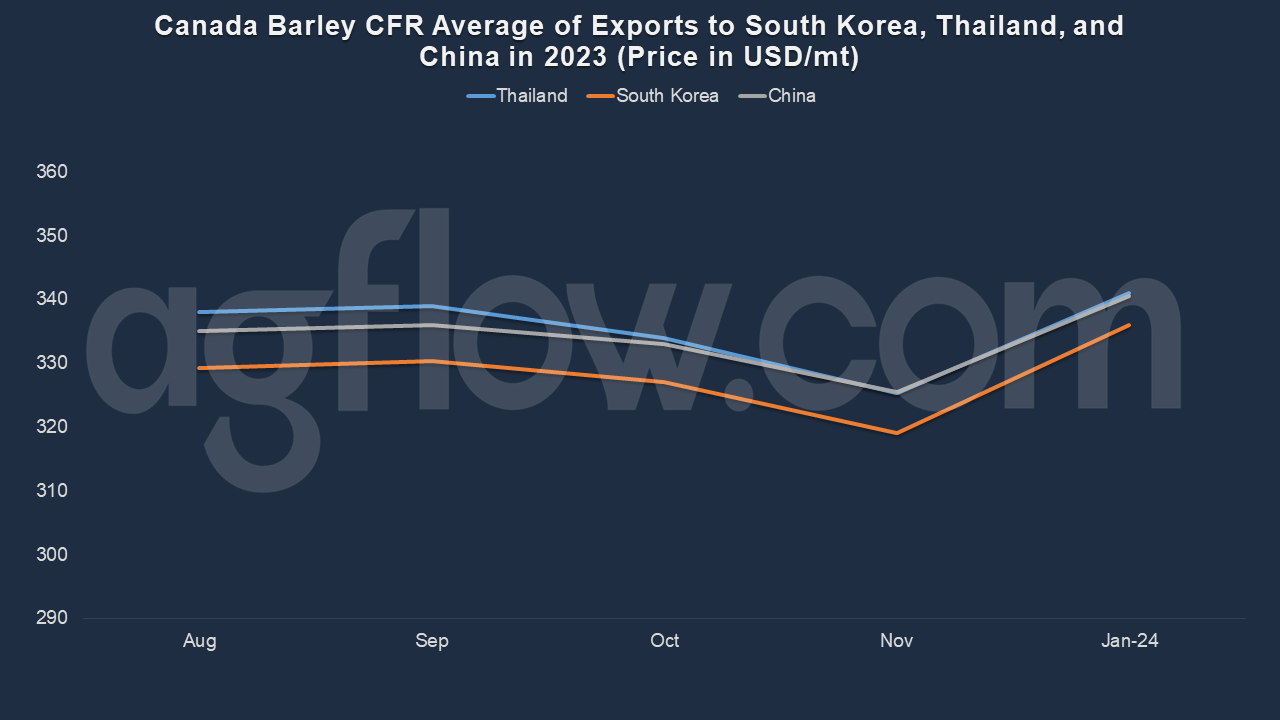

Canadian Barley CFR average exports to Thailand, South Korea, and China showed a similar situation in Aug – Nov 2023. It was falling till November and rose in the coming year.

Early in the summer of 2023, as the drought worsened and crops deteriorated, Barley prices behaved as expected, firming up as livestock feeders became more concerned about supplies. But then, in early August, as crop losses were locked in, feed Barley prices started dropping hard, which was not really what was expected.

The price of feed Barley in Lethbridge for the countryside agricultural production averaged $417/ton. Unlike 2021, Barley prices in 2023 are simply following the seasonal tendencies. In most years, Barley prices fade in early July, find a bottom in September, and then turn higher.

Besides the seasonal, a more significant underlying factor is very different for 2023. In 2023, the corn market has been dropping, especially since the end of June. Barley prices tried to avoid getting caught in that downdraft. However, as imported US corn became cheaper, especially in the southern Alberta market, feeders stopped buying Barley and started booking large volumes of corn.

As more corn started to displace Barley, there was less concern about whether there would be enough Barley to keep livestock fed. That’s when Barley prices began falling. Now, Barley has dropped to a sizable discount in key feed markets in western Canada. Because it’s now the cheaper feed, Barley demand is starting to pick up again, and should mean prices are finding a bottom (as long corn is also finding its footing).

The average price of Barley in Lethbridge in 2023-2024 should settle at $350/t, i.e., a level lower than the historic highs reached during the last two years, mainly under pressure from falling prices for American corn in 2023-2024. This level remains considerably

above the five-year average.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time