Can The French Wheat Meet its Market in 2022?

Reading time: 6 minutes

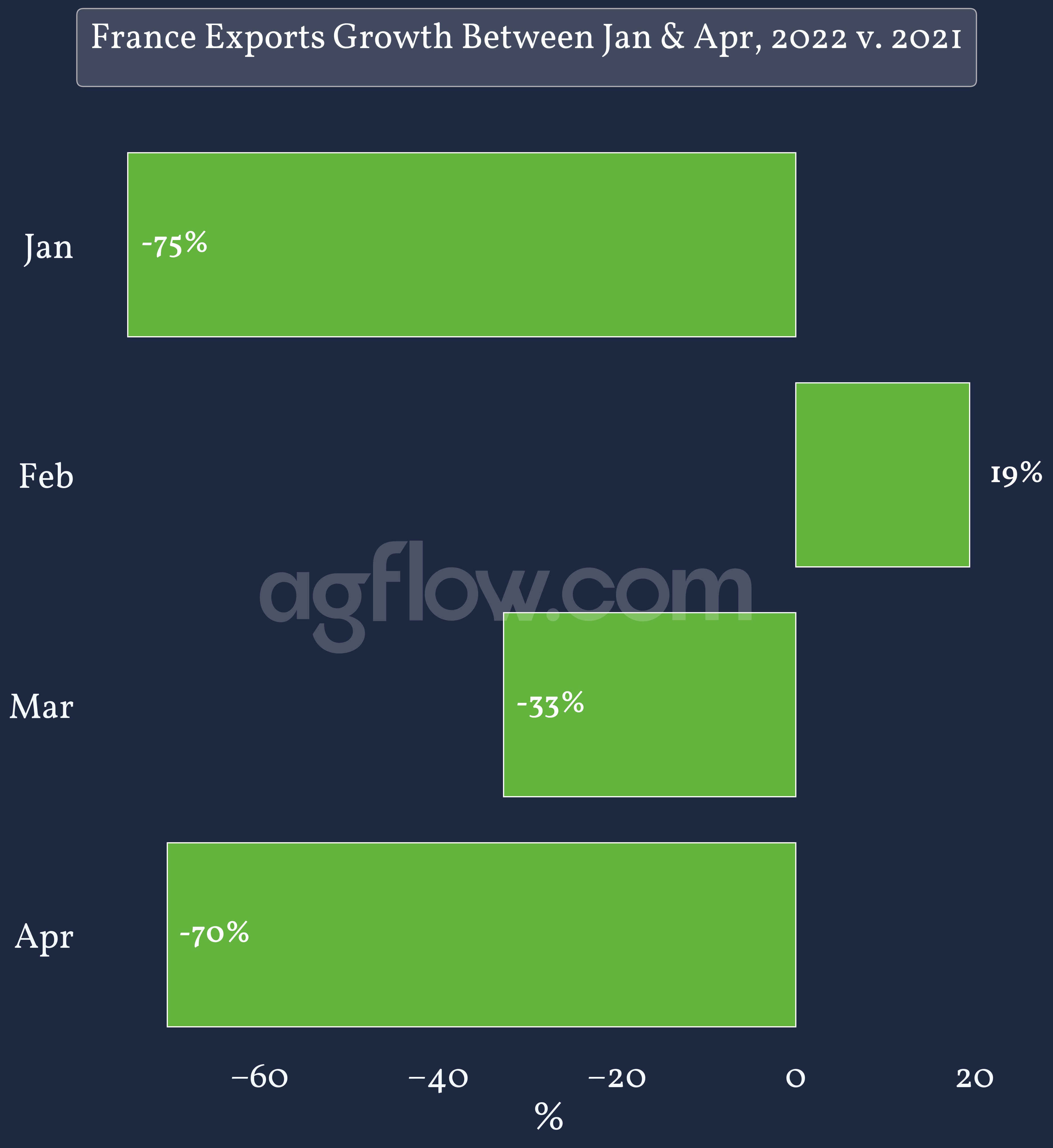

French Wheat is one of the staple export ag commodities in the EU. In 2021/22, the French crop faced hails & floods which degraded the crop. Moreover, it faced intense competition from Ukraine & Russian products. Indeed, French Wheat exports shrank heavily in Q1 22 YoY, exporting ~643 kmt less than in 2021 between Jan & Apr with less than 100 kmt Wheat exports in Jan. Since the Ukraine export cuts at the end of Feb, French Wheat exports dipped even more, reducing Apr exports by 298 kmt. This is due notably to ramping inflation and the price surge due to lack of supply. Therefore, where does French Wheat’s market lie, and what does it need to meet it with the new crop in 2022/23?

Read also: Is China Really Slowing Down Imports in 2022

Figure 1: France Wheat Exports Growth Between Jan & Apr: 2022 v. 2021

Track Wheat Cargos From France to Up to 18 Import Countries

Free & Unlimited Access In Time

Read also: Why Are LatAm Wheat Exports Booming in 2022?

French Wheat Exports in Q1 & Apr 2022 shipped primarily to China, whose market shares grew to 44.3% of French Wheat exports during the period versus 25.9% in 2021. Since Ukraine exports shut down, high prices and limited Australian Wheat availability led China to rely more heavily on France to supply Wheat, increasing imports by ~438 kmt YoY (+62.8%). Meanwhile, French Wheat staple markets shrank as Algeria & Morocco French Wheat imports fell 24.9 % & 48.8% YoY between Jan & Apr 22. As North Africa has a Grains supply crisis, which are France’s competitors in these critical markets?

Figure 2: Top 10 French Wheat Exports Destinations Between Jan & Apr 2022

Track Wheat Cargos From France to Up to 18 Import Countries

Free & Unlimited Access In Time

Read also: Can US Winter Wheat be Attractive in 2022?

France Wheat usually faces competition from Russia & Ukraine in North Africa. However, in 2022, due to surging prices, Ukraine Wheat demand increased rapidly as a cheap & high-quality product. Following the conflict in Ukraine, prices rose even more, and France became much less competitive. Therefore, Algeria, Morocco, & Egypt sought more affordable Wheat products elsewhere. Indeed, between Jan & Apr 22, Romania became even more attractive, increasing exports to Algeria by 350 kmt, and 862 kmt in Egypt. South America also became a meaningful origin, as Argentina grew exports to the region by 1.8 Mmt over the same period, 56% of which was destined to Algeria.

Figure 3: Algeria, Egypt, & Morocco Wheat Imports Growth Between Jan & Apr, 2022 v. 2021

Track Wheat Cargos to North Africa From Up to 15 Origins

Free & Unlimited Access In Time

Read also: What to Consider if You Are Trading Argentina Wheat in 2022

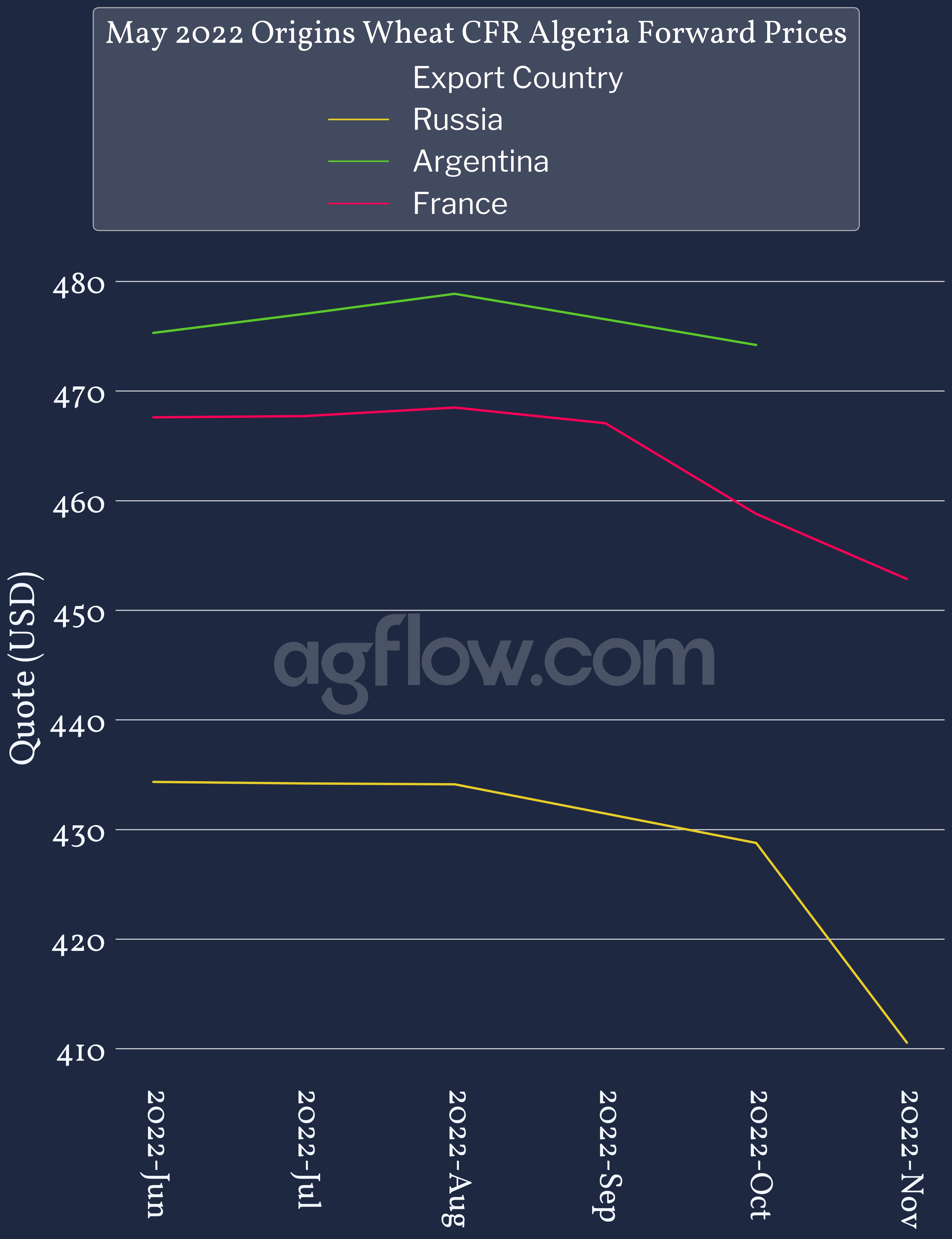

France Wheat’s lack of competitiveness resides in its current pricing. Additionally, crop estimates forecast an excellent Wheat crop for Russia. This would result in the lift of Russia export Quotas and accentuate French Wheat’s lack of competitiveness despite a potential strong crop as well. Forward CFR prices with Jun 2022 shipment to Algeria, where the competition is most intense, already show a 7.7$/mt delta in favor of France Wheat against Argentina Wheat. Meanwhile, Russia remains highly competitive as it is ~8% cheaper than France Wheat. Currently, the market is pricing the expected bumper Russian crop and the potentially excellent French one as prices decrease by around 23.8$/mt (-5.4%) and 14.8$/mt (-3.1%) for Russia & France Wheat, respectively, by Oct 2022. At this point, the 22/23 crop is fully out.

Figure 4: May 2022 Origins Wheat CFR Algeria Wheat Forward Prices

Read also: Black Sea and French Wheat: Why Quality Matters

Access Daily Argentina, France, & Russia Wheat CFR Cash Quotes to Up to 10 Destinations

Free & Unlimited Access In Time

In a Nutshell

French Wheat exports represent an important portion of the EU’s agricultural exports. At the beginning of 2022, exports for the staple commodity decreased heavily between January & April compared to the previous year.

Despite increasing exports to China – thanks to more competitive pricing than the US, the lack of availability of the extremely demanded Australian crop, and China’s loss of the Ukraine Wheat supply due to the conflict since the end of February 2022 – France Wheat exports reduced massively in North Africa, its core market.

Indeed, due to the ramping inflation and surging prices, which gained even more momentum with the conflict in Ukraine, Algeria and Morocco increased Wheat imports massively from Romania, Argentina, & Brazil, thanks to more competitive prices. Nonetheless, forward prices to Algeria, for example, are showing that France Wheat should be more competitive in the coming months, thanks to crop estimates forecasting an excellent production in 2022/23.

All in all, France Wheat exports declined early in 2022 due to a lack of competitiveness with surging prices. Moreover, even though the new crop should make the product more competitive, Russia also expects a bumper Wheat crop in 2022/23, which should make the competition in North Africa even more intense. However, China increasing its imports from France opens new potential markets in which France could also find demand.

Read also: Russian wheat export quota failed to help bulls

Read also: Rock up for the cheapest grain in the world