Brazil Soybean: Weak Currency Fuels Export Boom

Reading time: 2 minutes

Brazil is a critical global oilseed producer, accounting for almost a quarter of global supply. For the 2021/22 marketing year (MY), Post estimates that the country produced about 130,200 MMT of Soybeans, cottonseed, palm kernel, peanuts, and sunflower seed. Soybeans are by far the most dominant oilseed; in the 2021/22 MY, Soybeans accounted for 96 percent of all oilseeds produced in the country. Cottonseed production is a distant second, with 3.4 percent of Brazil’s total oilseed volume, while peanuts, palm kernel, and sunflower seed account for less than one percent of production.

Brazil is the leading producer and exporter of Soybeans globally, accounting for more than one-third of the world’s Soybean production. Brazil’s contribution to global production and trade of sunflower seed and palm kernel is negligible, well below one percent. Going forward, Brazil is expected to maintain its position as the oilseed production powerhouse in 2021/22 and 2022/23 based on its dominance in the global Soybean sector.

Across all oilseed crops, a critical factor that will drive the expansion of planted areas next season and beyond is the availability of arable land and inputs, especially fertilizers. Brazilian growers are expected to continue using innovative technology (seeds and crop protection), hoping to maintain yields across the oilseed spectrum and compensate for anticipated reductions in fertilizer use. While it has strengthened recently, the domestic currency remains weak compared to the dollar, fueling the agricultural export boom.

Domestic demand for oilseeds is also expected to grow, with rising consumption of both oil and meal. However, rising costs will leave some growers will fewer resources to make future investments. Expansion may be somewhat constrained by inadequate infrastructure, though the country has made some strides on this score in recent years.

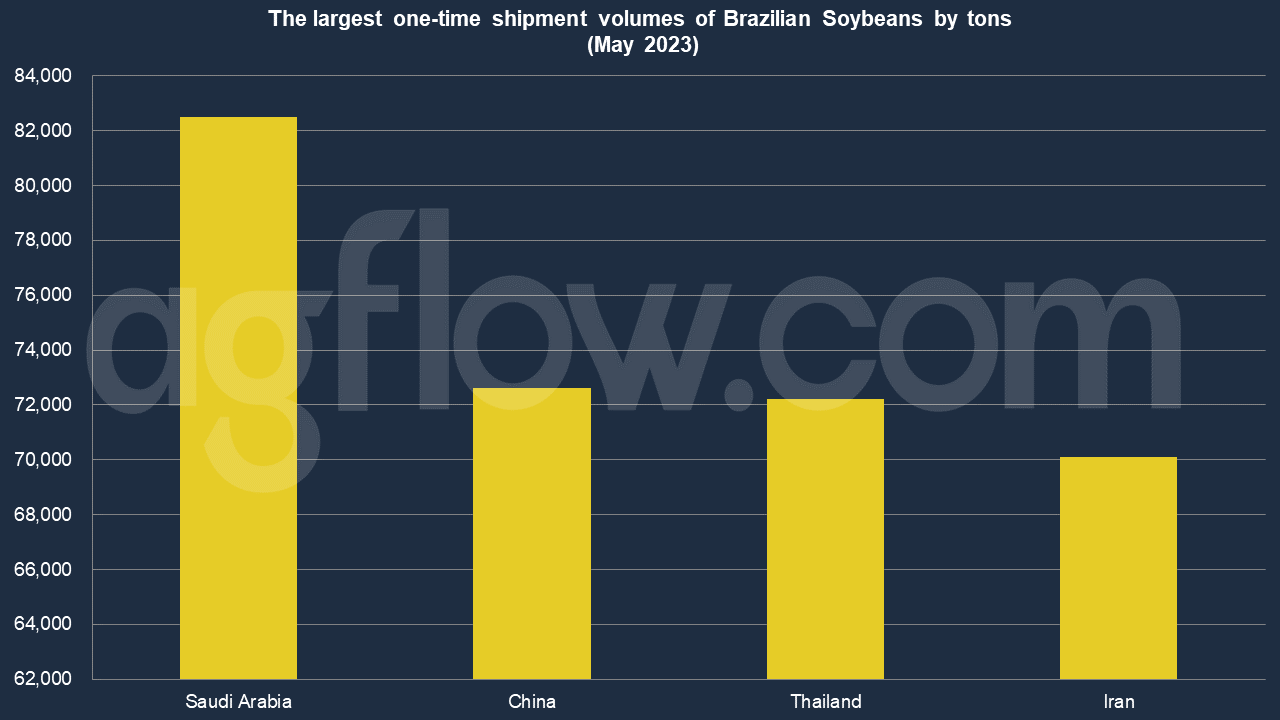

According to the AgFlow data, Brazil shipped 44.3 million tons of Soybeans in Jan-May 2023. In terms of one-time shipment volumes, Saudi Arabia led their export market with 82,500 tons in May 2023, followed by China (72,600 tons), Thailand (72,200 tons), and Iran (70,808 tons).

Soybean Planting in Brazil

Post forecasts that Brazilian producers will expand Soybean planted area to reach 42.5 million hectares (ha) in the 2022/23 season, up from the estimated 40.7 million hectares planted by farmers in the 2021/22 season. Soybeans are grown in 19 of Brazil’s 26 states and the capital Federal District. Due to concerns about fertilizer supply shortages, Post forecasts planted area to increase by 4.4 percent year-on-year, slightly above last year’s 3.8 percent annual area growth.

Brazil’s massive Center West region – encompassing the states of Mato Grosso (MT), Mato Grosso do Sul (MS), Goais (GO), and the capital Federal District (DF) – is by far the biggest producer, accounting for well over a third of the country’s planted area and production volume. Post contacts in the region’s biggest producing state of Mato Grosso have suggested that there is substantial opportunity for planted area expansion, assuming fertilizer and other input supplies revert to normal levels. The Mato Grosso Institute of Agricultural Economics (IMEA) estimates that by 2030, Soybean planted area in the state will grow by over 40 percent to 14.79 million ha, up from just over 10.3 million ha in 2021.

Meanwhile, planted area growth will continue to plateau in the South – this region encompasses the states of Paraná (PR), Rio Grande do Sul (RS), and Santa Catarina (SC). Although this is Brazil’s second-largest Soybean-producing region, in the last five years, cumulative planted area expanded by eight percent, just over half the national growth rate. In Paraná, nearly all arable land has been put into crop rotation. Thus, planted area gains will be minimal in 2022/23.

Other sources: USDA

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time