Brazil Is Losing the Italian Soybeans Market

Reading time: 2 minute

Even though Italy is not a mass producer of Soybean in the world, it is well known as one of the significant suppliers in the EU and produces over 45 percent of the EU’s Soybeans. Mediterranean climate enables the production of various crops compared with the northern part of the continent. Soybean is the most produced grain legume in Italy with significant production. Thus, Italy remains at the forefront of Soybean production in Europe, followed by Serbia and France.

Due to the suitable atmosphere, almost 96% of Soybean production is concentrated in the country’s northern area. However, the year 2022 has been harsh for Italian farmers, and Government declared a state of emergency in five regions because of a drought caused by a lack of rain and rising temperatures. Italy sent $37.5 million in relief funds distributed to the Emilia-Romagna, Friuli Venezia Giulia, Lombardy, Piedmont, and Veneto regions, which are located in the north, according to a statement by the Italian Government.

The total area of Soybean production land fluctuated from roughly 233 thousand hectares in 2014 to almost 280 thousand hectares in 2021. In 2022, a 10% increase in areas sown with Soybeans in Italy is expected compared to 2021, the year in which, according to Istat, 285,000 hectares were involved.

In Italy, Soybean is primarily used for biofuel and oil production, and 20% of the soya production ends up in the compound feed industry. Only 2% of the output is collected by the food industry, mainly for the production of soymilk.

Even though there has been drought, the 2022 Soybean harvest of the EU is likely to amount to around 3 million tons, which would be up just less than 15% year-on-year, and Italy forecasts to remain the largest producer of EU, with 1.1 million tons currently projected according to recent information published by the EU Commission. This would translate to a 29 percent rise year-on-year. In other words, Italy’s share in European Soybean production is set to rise to just less than 38 percent.

Italian Soybean Trade

Despite the high production of Soybeans, the demand in Italy still depends on imports. Over the recent years, the imports have remained higher than the production. The country imports Soybean mainly from the United States, Brazil, Canada, Paraguay, and Ukraine. Brazil was the leading supplier, according to some sources.

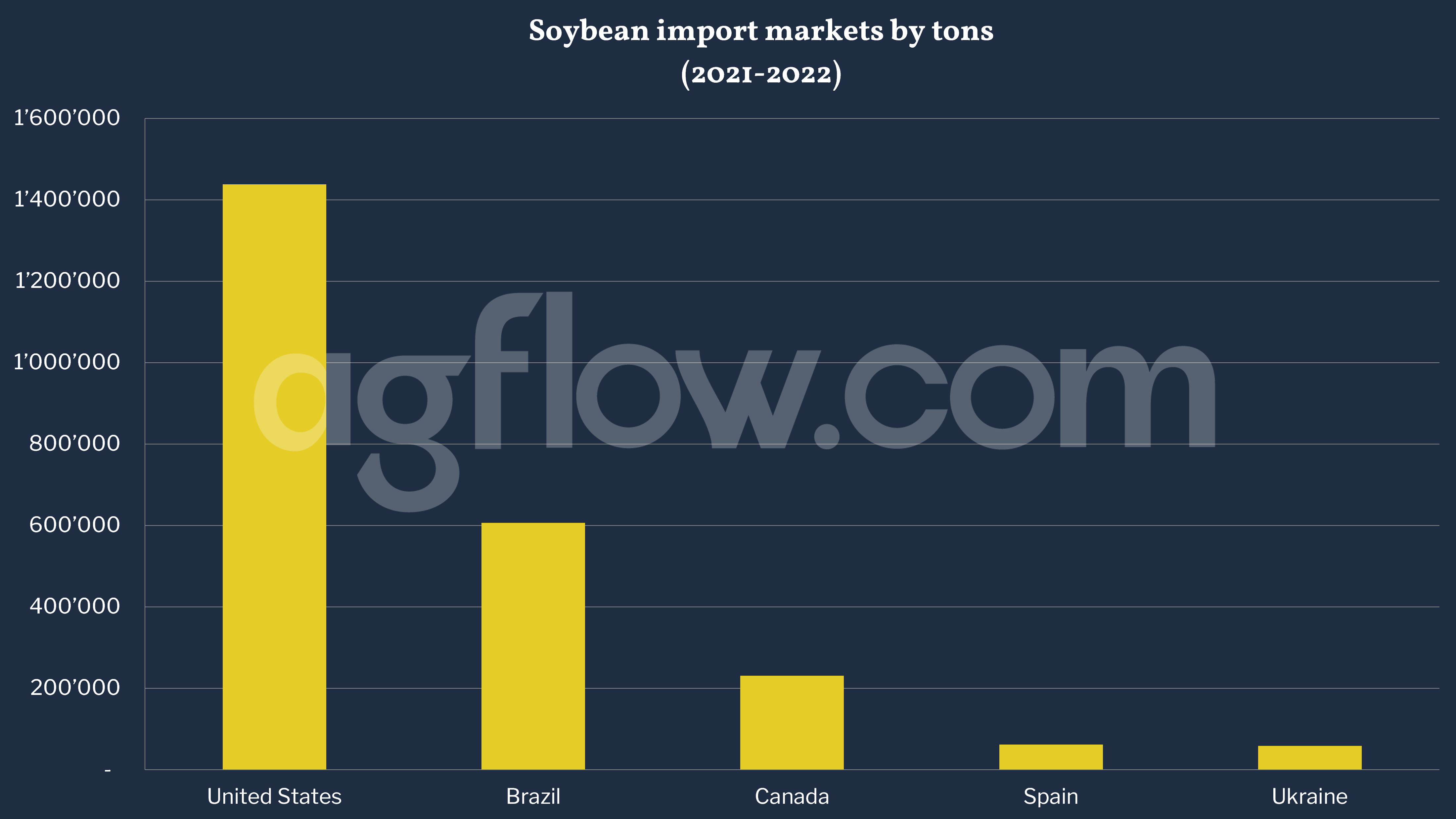

As per Agflow data, the United States is now the largest import market of Italy, with 1.4 million tons in 2021-2022, followed by Brazil (0.6 million tons), Canada (0.2 million tons), Spain (0.06 million tons), and Ukraine (0.06 million tons).

Most imported food products enter the Italian market through brokers or specialized traders. Italian importers are usually small to medium-sized companies rather than the large, market-dominating varieties in northern Europe. Consequently, these companies import on a smaller scale but often a broader range of products than their much larger counterparts do. Price is increasingly important for import purchases, although quality and novelty move some products. Imported products from North America often enter Italy indirectly from the Netherlands’ Port of Rotterdam. Italian Meat Producer Relies on Quality of the US Soybean Meal.

The export of Italy´s soybeans is less significant than their import, and only a minimal amount of soya beans is exported. The main target countries are Switzerland, Denmark, and Hungary. The best-performing markets in 2019 for Italy Soybeans for each kilo were exports to Georgia, France, Poland, and the Netherlands. The export value of Italy was USD26 million in the last year.

Other sources: x

Free & Unlimited Access In Time