Black Sea Barley – Battle for Spain, a Ban on Durum Wheat

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

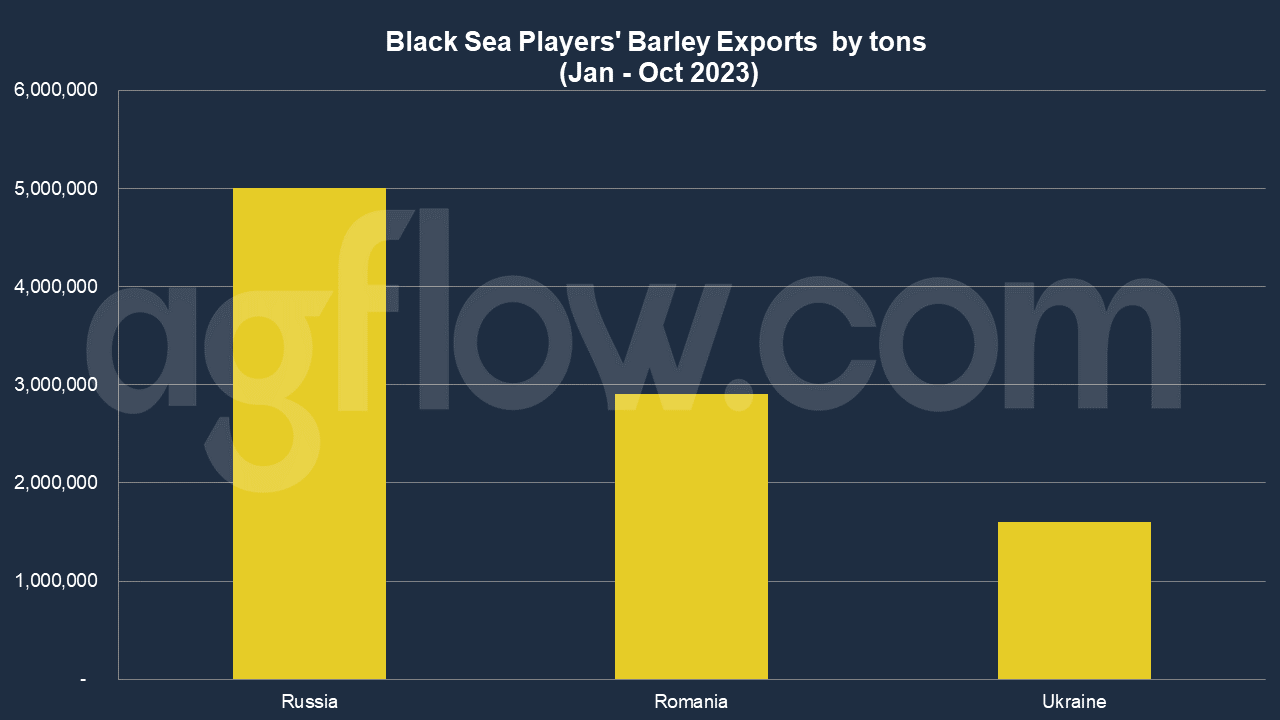

Russia, Ukraine, and Romania are significant Barley players in the Black Sea Basin. Russia dominates in Barley exports with 5 million tons in Jan – Oct 2023, followed by Romania (2.9 million tons) and Ukraine (1.6 million tons).

Romania

For autumn Barley, the harvested production from 371.7 thousand hectares (342.7 thousand hectares last year) amounted to more than 1.8 million tons in Romania, 22% above the level of the previous year, while the Barley production of spring increased by 40%, up to 209.7 thousand tons, against the background of the increase of the harvested area by 8.9 thousand hectares. The yield was good. For instance, farmers in Olteanu closed the Barley harvest with an average of 8 tons/hectare. The three farms had productions of 8.3 tons/hectare, 8.1 tons/hectare, and 7.7 tons/hectare.

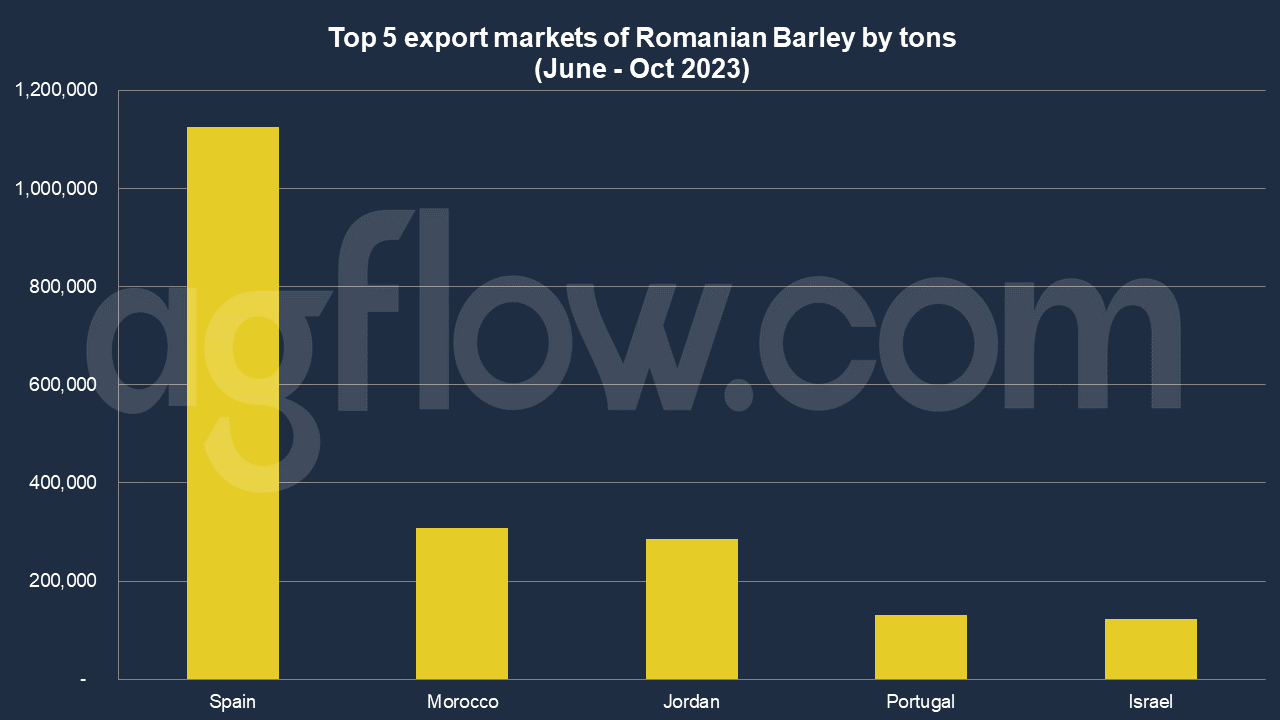

According to AgFlow data, Romania exported 1.1 million tons of Barley to Spain in June – Oct 2023, followed by Morocco (0.3 million tons), Jordan (0.29 million tons), Portugal (0.13 million tons), and Israel (0.12 million tons).

Ukraine

Ukrainian Agriculture Ministry reports that the country’s Grain exports are down 30% to 8.3 million metric tons so far in the 2023/24 July-June season. By Oct. 24 last year, the ministry said traders had exported 12 million tons. 1.6 million tons of Grain were shipped in the first 22 days of October. Ukraine exported 3.2 million tons from Oct. 1 to 23 a year ago. The exported volume included 4.16 million tons of Wheat, 3.4 million tons of corn, and 663,000 tons of Barley.

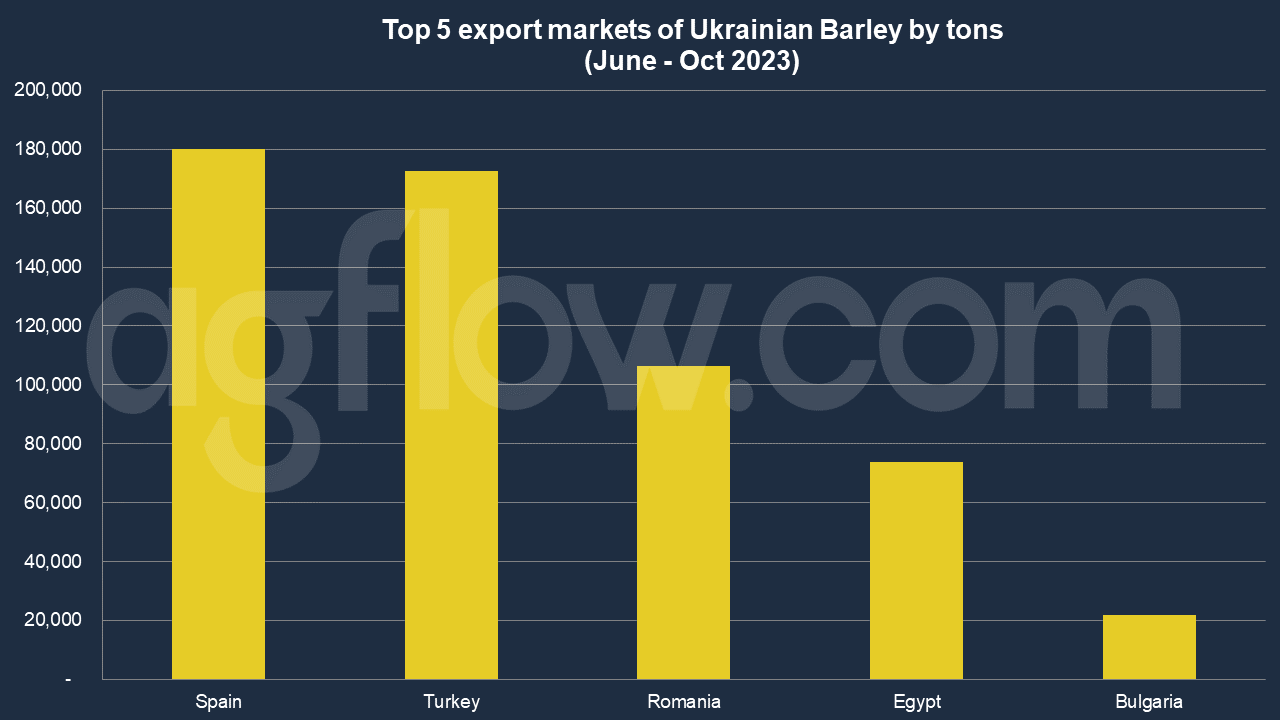

As per AgFlow data, Ukraine shipped 0.18 million tons of Barley to Spain in June – Oct 2023, followed by Turkey (0.17 million tons), Romania (0.1 million tons), Egypt (73,950 tons), and Bulgaria (21,900 tons).

The European Commission proposes the following option: those who export Grain from Ukraine through Baltic, Polish, and German ports must be given support from 20 to 40 euros per ton to ensure that Ukrainian Grain does not end up in Poland or other EU countries. This issue has only just begun to be resolved.

The big problem is that Grain is very cheap in Ukraine. You can buy Grain there for about half the price and then bring it to the European market. And for those European Grain growers who sell their produce on the domestic market, this is a huge problem. People are losing a lot of income, and governments must do something. Now, it is expected that the Ukrainian entities that will bring, for example, Grain to Klaipėda and ship it to Africa will be assisted. European support is needed for this because getting Grain from Ukraine to Klaipėda costs quite a lot.

Russia

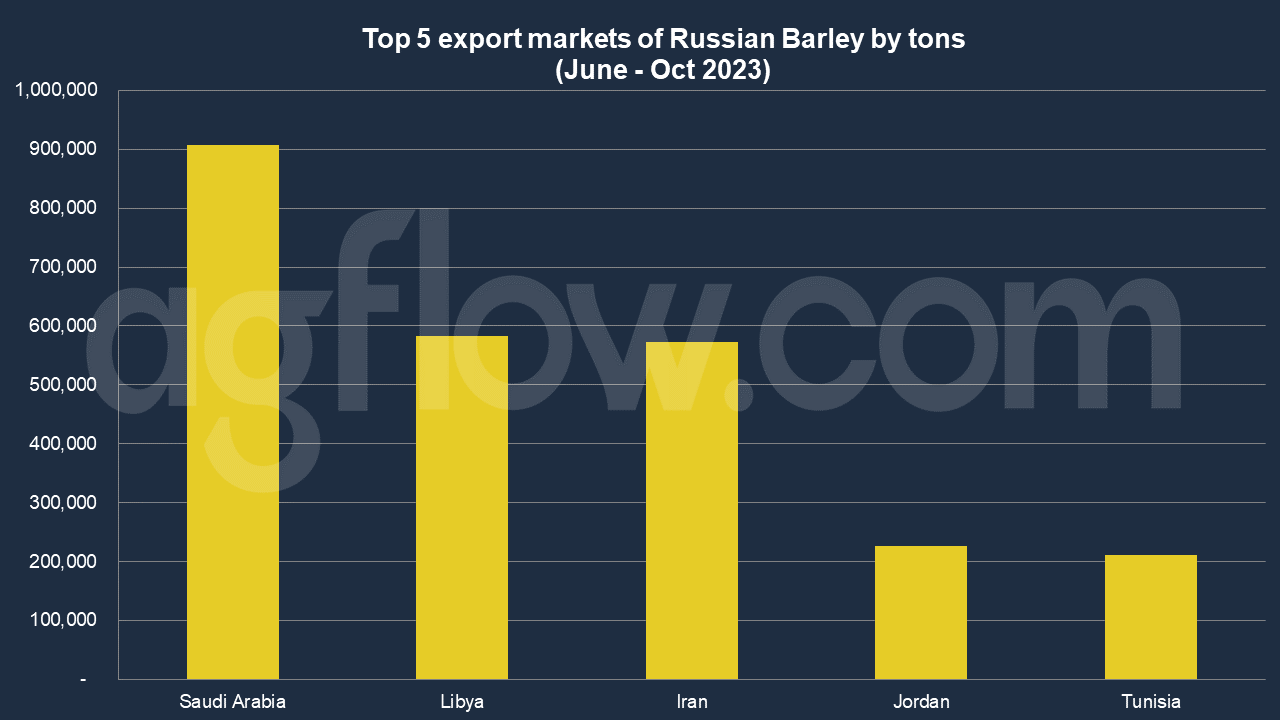

Barley production is estimated to reach 21 million tons this year – slightly less than in 2022. Russia sold 0.9 million tons of Barley to Saudi Arabia in June – Oct 2023, followed by Libya (0.58 million tons), Iran (0.57 million tons), Jordan (0.22 million tons), and Tunisia (0.21 million tons), according to AgFlow data.

Russian Subcommittee on Customs and Tariff Regulation adopted several decisions to protect the domestic market and expand product supply. The proposal of the Ministry of Agriculture and the Ministry of Economic Development to establish a tariff quota for the export of basic Grains – Wheat, Barley, corn, rye in the amount of 24 million tons – was supported. It is planned that the quota will be valid from February 15 to June 30, 2024. The quota does not apply to supplies to the EAEU.

Last June, the Government adopted a resolution according to which, from 2024, the tariff quota for Grain exports will be divided into a main and an additional part. This decision aims to optimize the export quota mechanism and maximize the utilization of quota volumes. The main part of the quota will be distributed, as before, historically until the start of the quota period. The new mechanism also allows voluntary refusal of the received quota or part of it. Applications for quota waivers will be accepted from April 1 to April 20, and the final decision on quota reduction will be made before May 1.

The additional quota volume will consist of three parts: 10% of the total quota volume plus the volume “freed up” due to the application of the reduction factor and the volume formed from refusals. Exporters who have already been allocated the bulk of the quota historically can apply for an additional portion. In this case, the other part cannot exceed 45% of the volume of the main part of the quota distributed to the applicant in the current season.

Price Strategies

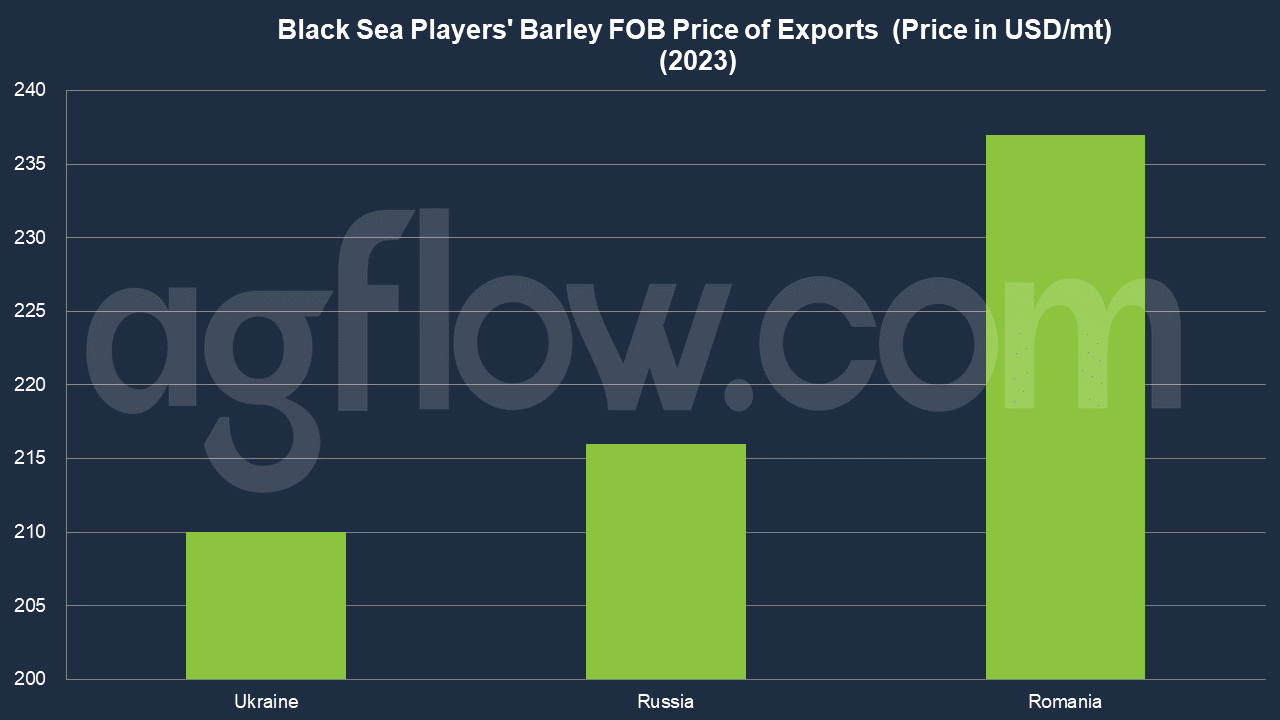

Regarding FOB average price, Ukraine quotes the lowest, $210 per ton in 2023, followed by Russia ($216) and Romania ($237). In July, Romania quoted CIF price of $223 per ton to Turkey, while Ukraine offered CIF price of $205. Ukraine’s EXW Price was $147 per ton on average in 2023. FCA and DAP prices were $150 and $157 per ton, respectively.

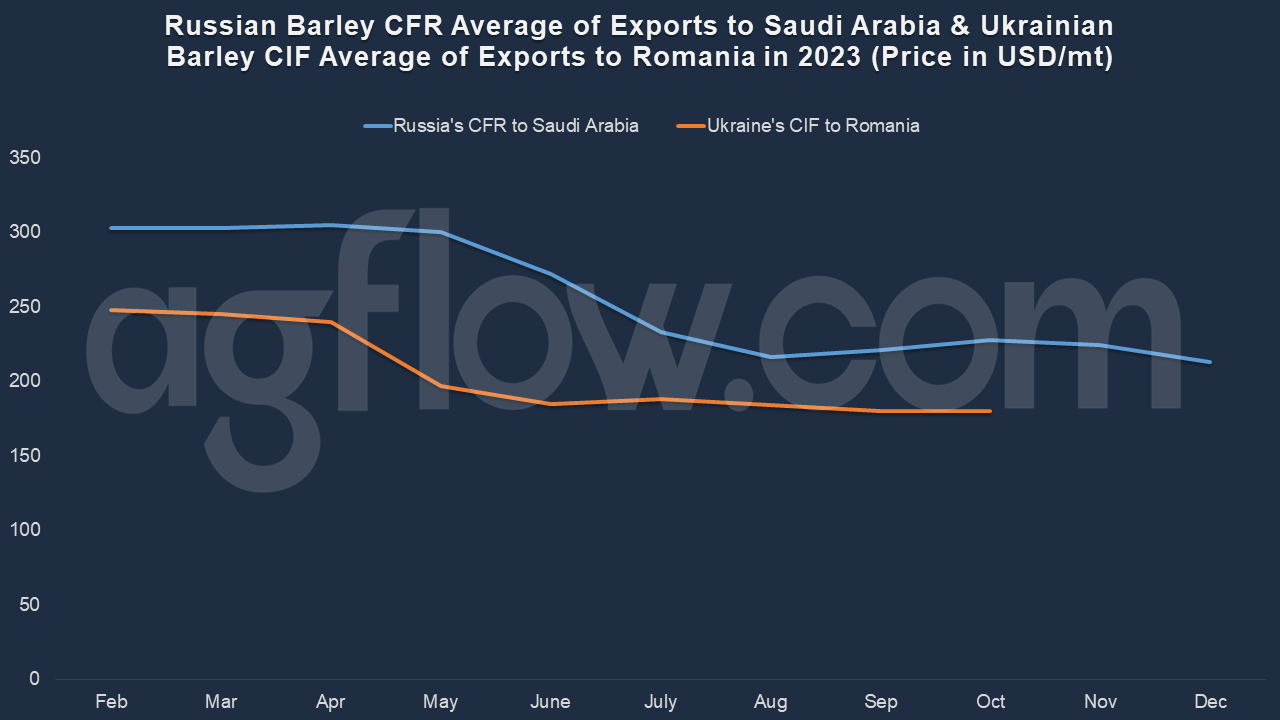

Regarding trends, the Russian Barley CFR price to Saudi Arabia has fallen from May to August. After that, the price showed a little upward trend. For Ukraine, its Barley CIF price to Romania has been declining since the beginning of the year.

Export Ban on Durum Wheat

In addition, the Ministry of Agriculture’s initiative to introduce a temporary ban on the export of Durum Wheat from the Russian Federation for six months – from December 1, 2023, to May 31, 2024 – was supported. This ban on the export of Durum Wheat, which is used in pasta production, can be explained by the sharp increase in its supplies abroad this season.

Russian Grain Union reports that, from July 1 to November 10, its shipments increased almost 13 times annually to 657 thousand tons. Export growth was facilitated by “the existing Grain damper,” according to which the export duty is calculated based on the indicative price for all Wheat. As a result, the share of responsibilities in the price of Durum Wheat is significantly less.

Durum Wheat, in particular, is purchased by Italy and Türkiye. Domestic demand for it, according to the union, is small. The Ministry of Agriculture of the Russian Federation previously explained the reasons for the ban: the decrease in the world’s Durum Wheat harvest and increased demand for it. According to estimates, its harvest this season in the vast majority of producing countries will fall to a 20-year minimum. In this regard, an increased demand for Durum Wheat has formed in the foreign market.

The Ministry of Agriculture plans to increase the Durum Wheat area and its production every season. Its leading producers are the Altai Territory (up to 80%), Orenburg, Chelyabinsk, Omsk, Saratov, Samara, and Volgograd regions. By 2025, Durum Wheat harvest in the Russian Federation, compared to 2021 (735 thousand tons), may increase almost 2.5 times and reach 1.8 million tons. The regions were supposed to develop and submit plans to the Ministry to increase the production of this Wheat for the period until 2030.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time