Black Sea and French Wheat: Why Quality Matters

Reading time: 5 minutes

Black Sea and French Wheat are essential products for the Mediterranean Sea countries such as Tunisia, Algeria, or even Egypt. With France being the leading Wheat producing country in the EU, Russia—the world’s top Wheat exporter— and Ukraine, there is fierce competition for providing the Mediterranean Sea with Wheat. As it stands, Black Sea origins occupy the majority share of the market, except Algeria, where France has had an almost monopoly over its Wheat imports. This particular situation is primarily due to Algeria’s Wheat quality requirements over imports and particularly state tenders.

Wheat quality specifications are crucial for trades and determine the use cases, favoring a specific origin based on import policies. Comparing France, Russia, and Ukraine’s share of the market and their overall Milling Wheat quality specifications metrics in time shows how and why quality matters.

Black Sea Wheat Dominates the Mediterranean Market

France and Black Sea origins export Wheat globally, but they predominate the Mediterranean Sea market, mainly to produce semolina, pasta, and bread. Since France, Russia, and Ukraine produce different types of Milling Wheat with different qualities, they also correspond to different needs.

Figure 1: Monthly Wheat Shipment Volumes to Tunisia, Egypt, and Turkey by Origin Country Between Jul 2019 and Jul 2021

[/dica_divi_carouselitem][dica_divi_carouselitem _builder_version=”4.14.5″ _module_preset=”default” hover_enabled=”0″ sticky_enabled=”0″]

[/dica_divi_carouselitem][dica_divi_carouselitem _builder_version=”4.14.5″ _module_preset=”default” hover_enabled=”0″ sticky_enabled=”0″]

[/dica_divi_carouselitem][/dica_divi_carousel][dica_divi_carousel advanced_effect=”1″ _builder_version=”4.4.3″ global_colors_info=”{}”][/dica_divi_carousel]

Figure 1 displays the total monthly volumes imported from France, Ukraine, and Russia by Tunisia, Egypt, and Turkey. The three plots show that Black Sea Wheat products overly dominate the Mediterranean market while France’s exports are sporadic and usually minor in comparison to the other two origins. For Turkey, in particular, the closeness of Ukraine and Russia to the country makes it impossible for France to compete.

Figure 2: Algeria Monthly Wheat Imports by Country Between Jul 2019 and Jul 2021

However, France comes out on top and is undisputed as a Wheat provider for Algeria, as showcased in Figure 2. However, starting in October 2020, monthly imports decreased year-on-year.

This change is due to changes in policies for Milling Wheat imports and tenders by Algeria. Indeed, before October 2020, the limit on Bug damage was 0.1%. This was then raised to 0.5% after this date, thus opening the market to more origins, and particularly Romania in the Black Sea region.

Track Wheat Cargo From France and Black Sea Region to 118 Countries

Free & Unlimited Access In Time

Read also: Russian Wheat Crop Outlook Worsens on Hot Weather

Quality Makes the Difference

The change in policies in Algeria had a dramatic effect on French Wheat exports, showing how much quality specifications requirements can favor one origin over another or instead, and in this case, break the monopoly France had. Nonetheless, Ukrainian and Russian Wheat did not see their Wheat products imports —which was already null for Russia—increase, showing that the intrinsic quality of their Wheat products did not fit the needs required by Algeria.

Figure 3: Average Moisture Content, Protein Level, and Wet Gluten content in Percentage by Country Between Jul 2018 and May 2021

The quality metrics displayed in Figure 3 show that each origin has different types of Milling Wheat. Indeed French Wheat has the least protein content of all three origins, ranging between 11.5 and 12% on average. On the other hand, Black Sea Wheat is closer to 13% protein level, with Russia being on the higher side.

This difference is not random as in many other parameters, like crop season, weather, and Nitrogen content control the protein levels. Thus, the French market aims at bread quality Wheat with higher moisture content and a protein level close to 12, while the higher protein content of Black Sea Wheat is better for Semolina and pasta-making.

Moreover, France shows more consistency throughout time than Ukraine and Russia for all three metrics, showing that French Wheat is a more reliable product than Black Sea Wheat year on year.

Read also: Russian Wheat Getting Cheaper On Record-High On-Farm Stocks. Will This Convert Into Aggressive Exports In 21/22?

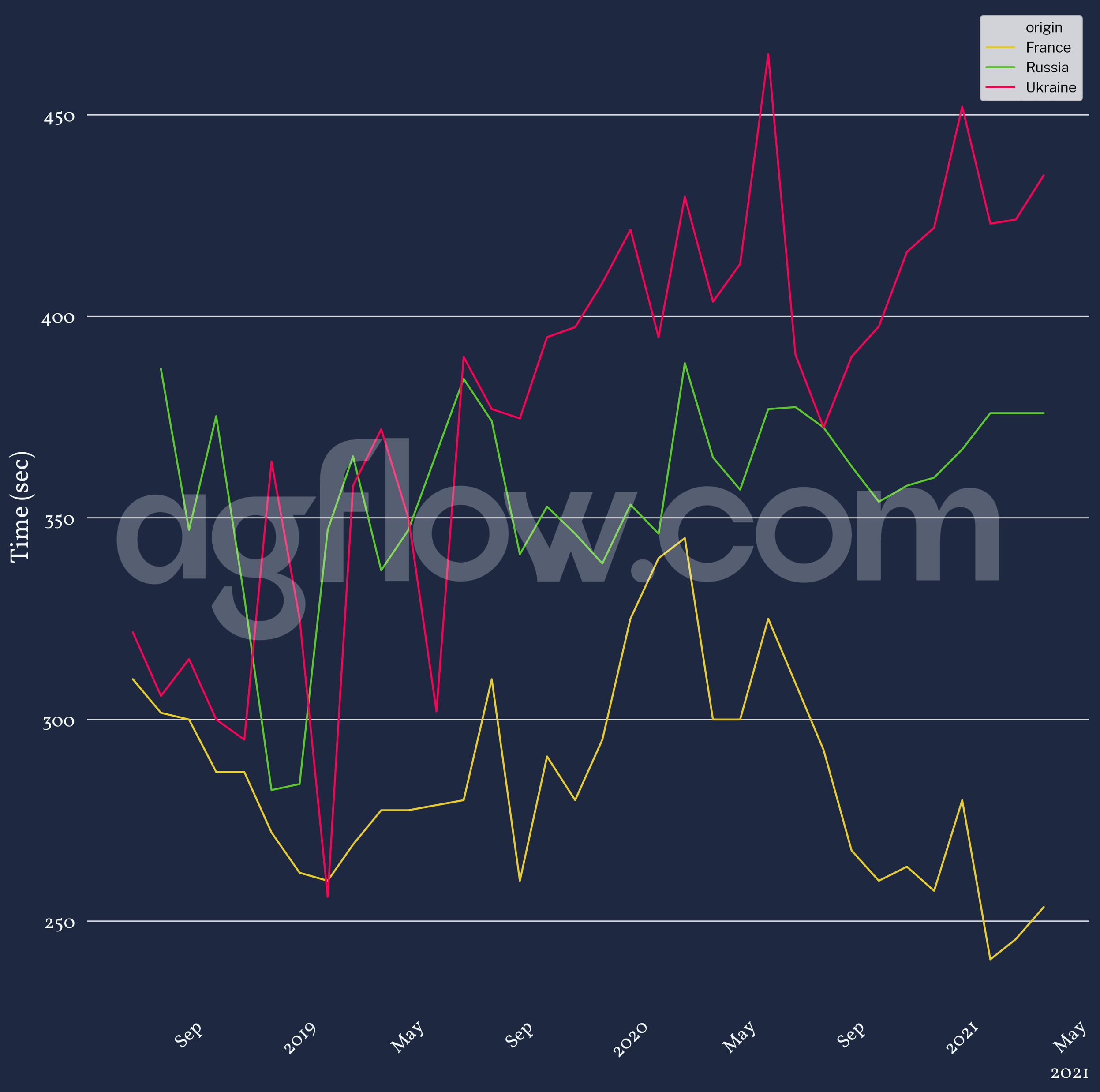

Figure 4: Average Hagberg Falling Number by Country Between Jul 2018 and May 2021

The Hagberg number, displayed in Figure 4, is also a great indicator of the Wheat quality. For bread-making purposes, a good Hagberg number is a falling time of between 250 and 280 seconds. Therefore, with Russian Wheat being around 350 seconds and rising as high as 450 seconds for Ukraine, Black Sea Wheat is not suitable for bread making.

Algeria’s Wheat import shows that it is interested in Wheat to make bread. Moreover, the limitations set on bug damage—even after the relaxation of the rule— prevents most shipments from either Russia and Ukraine. However, more minor players from Black Sea, like Romania, threaten the French monopoly.

Read also: A Guideline to the Top Wheat Specifications

Analyze 5 Years of Milling and Feed Wheat Quality Metrics Data for 20 Countries

Free & Unlimited Access In Time

In a Nutshell

Black Sea and French Wheat are the two most important sources of Wheat for Mediterranean Sea importing countries. Black Sea Wheat from either Ukraine or Russia dominates this market and represents the highest portion of Wheat shipments. However, French Wheat did have a monopoly over Algeria, securing an important share of their exports and place in the Mediterranean Wheat market.

The quality specifications of Wheat for Black Sea and France showed that the Wheat products had two different usages: While French Wheat protein level, and Hagberg number are ideal for bread-making, the higher protein level and lower moisture content are better for Semolina and pasta-making. This difference, in addition to the limitations on bug damage percentage, also contributed to the French monopoly over Algeria.

Nonetheless, a change in the bug damage limitations in October 2020 hampered the French monopoly. This move on policies opened up the market to other Black Sea origins, and particularly Romania.

Finally, Importers are looking for specific uses of Wheat and thus quality metrics are crucial for Wheat contracts. They determine which origins importers will source their Wheat from, and which destinations exporters will ship Wheat to. In the marketing year 2021-22, the Black Sea region will have a strong Wheat output, but the extreme weather conditions in Q2 & Q3 2021 could be affecting the quality of the crops. As such, this could change the balance of power in the Mediterranean market, and so tracking quality throughout the marketing year will be key to meet tenders and Importers’ demand.

Read also: Evolution of French Wheat Prices, a Breakdown by Protein Level