Australia’s Wheat Production and Exports Are Largely Dependent on Weather.

Reading time: 6 minutes

![]() Free Report

Free Report

Read also: Germany, a Major European Wheat Producer

How Did Wheather Affect Australia’s Wheat Production Over the Past Four Years?

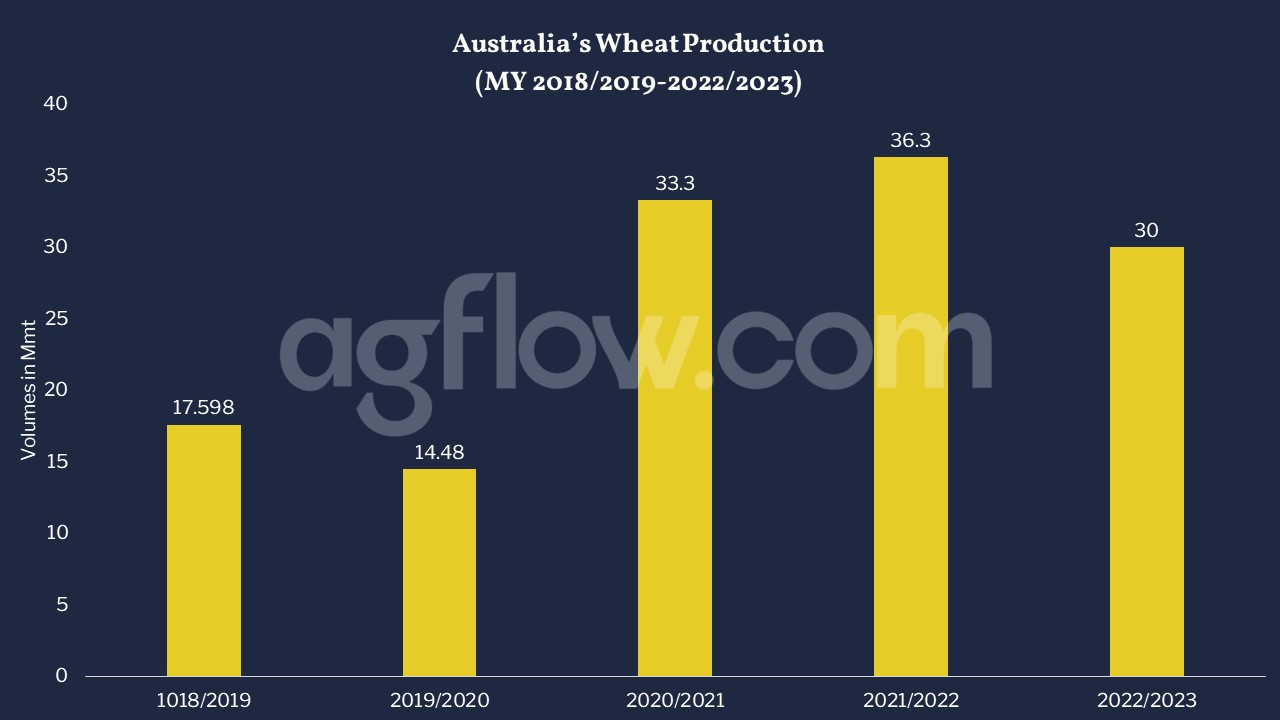

In MY 2019/2020, Australia’s Wheat production in the Northwest suffered from droughts, less rainfall and warmer weather, leading production to decrease to 14.48Mmt. However, In MY2020/2021, Wheat production increased to 33.3 Mmt, and increased again by 3 Mmt YoY in MY 2021/2022, making Australia the sixth-world Wheat producer. Australia managed to bring its Wheat production up thanks to the weather condition turning in favour of soil moisture and rainfall abundance in the last two years. However, for MY 2022/2023, the USDA estimates Australia’s Wheat production to decrease by 6.3 Mmt YoY as the weather will likely be warmer in the northwest and due to the extreme floodings in the South Wales region, one of the major Australia Wheat producing area.

Figure 1: Australia’s Wheat Production (MY 2018/2019 – 2022/2023)

Track Wheat Production from Australia and Up to 109 Other Origins

Free & Unlimited Access In Time

Australia’s Exports Will Decrease in MY 2022/2023

Australia’s Wheat exports decreased to their lowest in MY 2019/2020 because of unfavourable weather affecting yields. However, Australia increased its exports by 13 Mmt in the following MY, due to better weather conditions and increased harvested area. Similarly, in MY 2021/2022, exports increased by 5 Mmt YoY. For MY 2022/2023, USDA estimates exports will decrease by 5 Mmt, as yields will decrease by 0.53 mt /ha. Australia’s Wheat production decreasing in the current situation- where the war in Ukraine and the floods in Pakistan perturbed the world grain supply- represents a big challenge for dependent import markets. Thus, Which markets will be the most affected by Australia’s decreasing production?

Figure 2: Australia’s Wheat Exports (MY 2019/2020 – 2022/2023)

Track Australia’s Wheat Production and Exports Since 2017

Free & Unlimited Access In Time

Read also: China Wheat import hits record high

Read also: Germany, a Major European Wheat Producer

Southern Asia Is the Main Destination for Australian Wheat

Australia’s Major Wheat destination is Southern Asia, led by China with 5.5 Mmt in MY 2021/2022, Singapore, Indonesia (with 2.6 Mmt), the Philippines, Vietnam, South Korea, Japan and Malaysia reaching 14.1 Mmt altogether. Australia’s exports to South Asia are more dominant due partially to the cheaper freight costs. In addition, China is a significant consumption market attracting the largest producers, and despite the sanctions applied in 2020, Australia’s exports are still heading to China, increasing by 1.4 Mmt YoY in MY 2021/2022. In October 2022, Australia’s Wheat exports increased by 1.2 Mmt YoY; of which 1.04 Mmt headed to South Asia, despite the USDA estimating exports will decrease in MY 2022/2023. Australia Wheat exports benefitted from being the most price competitive product available. However, with the reduced crop, how are Australian Wheat prices changing compared to the past three years?

Figure 3: Australia’s Wheat Top Destinations (MY 2021/2022)

Track Australia’s Wheat Exports to Up to 64 Destinations

Free & Unlimited Access In Time

Read also: Germany, a Major European Wheat Producer

How Have Australian Wheat FOB Prices Change Over the Past Three Years?

Australian Wheat FOB prices ranged from USD 229 /mt to USD 375 /mt between Nov 2020 and Oct 2022. In MY 2021/2022, prices reached their lowest level since Oct 2021 ( USD 262 /mt) in Jan 2022, where the average price was only USD 2/mt higher YoY. Later, prices gradually increased to peak at USD 375/mt in May 2022 in the wake of the Ukraine war, with the average price was USD 78/mt higher YoY. In October 2022, FOB prices decreased to USD 260 /mt, where the average was only USD 5/mt higher YoY. However, with the arrival of the new crop in Oct, prices are gradually increasing, with an increase of USD 75/mt from the beginning to the end of Oct, which raises the question of how prices will evolve for the rest of MY 2022/2023, especially since the USDA estimates that production will decrease by 6.3 Mmt YoY.

Figure 4: Australia’s Wheat FOB Prices (Nov 2020-Oct 2022)

Access 3.7k+ Monthly Wheat FOB Prices From Up to 24 Origins

Free & Unlimited Access In Time

Read also: China Wheat import hits record high

Read also: Germany, a Major European Wheat Producer

In a Nutshell

Australia’s Wheat production is heavily impacted by weather conditions. In MY 2019/2020, production declined to 14 Mmt due to severe drought. Thereafter, Favourable weather conditions led production to reach 36 Mmt in MY 2021/2022, an all-time record for Australia Wheat production and increasing exports to 29 Mmt.

With South-East Asia being a major market for Wheat consumption and lower freight costs, Australian Wheat is primarily destined for this region, led primarily by China. Australian Wheat FOB prices have ranged from USD 229/mt to USD 375/mt over the past three years, peaking in May 2022. These prices are relatively low compared to European countries affected by the war in Ukraine, such as Germany , France and Romania, where prices surged over USD 500 / mt.

Finally, even though Australia offers cheaper Wheat, weather conditions will not be favourable for MY 2022/2023, and the USDA estimates that Wheat production will decrease by 6.3 Mmt YoY. Thus, prices will increase, and South Asian supply will be lower. As such, where will South-East Asian importers source the rest of the supply needed in 2022/2023?