Australia Wheat: Taiwan Becomes a Rising Star

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

According to the Australian Government, the gross value of Australian Wheat production is forecast to fall by 39% to $9.5 billion in 2023–24. Despite a significant fall from the estimated 2022–23 record of $15.7 billion, this is still well above average and would be the fourth-highest value.

The forecast fall in value is driven by easing world prices and lower Australian production. World Wheat prices are forecast to remain below the previous year’s highs because of easing supply uncertainty but remain elevated. Australian Wheat production is expected to decrease following three consecutive record production years:

- Dry conditions in northern cropping regions will likely see Australian Wheat production fall in 2023–24, with yields forecast to be below average.

- This is likely to be partially offset by more favorable winter crop prospects in southern cropping regions where stored soil moisture and early winter rainfall benefit winter crops.

- While El Niño is expected to develop and reduce production prospects, the extent to which it influences Australian rainfall and temperatures presents a critical downside risk to the outlook. If conditions are even drier and hotter than expected, this is likely to see crop prospects deteriorate further in regions where winter crops have little soil moisture.

Relatively high export values are expected because of high exportable supply supported by record 2022–23 production and relatively high prices forecast for 2023–24. Major Asian markets remain the most prominent export destinations for Australian Wheat by value and volume. In 2022–23, Australia’s top five Wheat export destinations – China, Indonesia, Vietnam, the Philippines, and the Republic of Korea – accounted for 65% of total Wheat export values.

As per AgFlow data, Australia exported 3.8 million tons of Wheat to Taiwan in Jan – Aug 2023. The following markets were Indonesia (3 million tons), China (2.6 million tons), the Philippines (2.6 million tons), South Korea (2.1 million tons), Vietnam (2.1 million tons), Thailand (1.4 million tons) and Japan (0.9 million tons). Yemen was behind these far eastern markets, with 0.7 million tons.

Wheat Export Prices

The Australian Wheat export price (Australian Premium White) is forecast to decline by 6% in 2023–24, averaging AUD 490 per ton. This reflects falling world prices because of easing supply uncertainty outside of Ukraine across major Wheat-producing countries following the northern hemisphere harvest. Nonetheless, Wheat prices are forecast to remain relatively elevated in 2023–24. The Russian Federation’s withdrawal from the Black Sea Grain Initiative and uncertainty surrounding Black Sea exports will likely add volatility to world grain markets in 2023–24 and keep international prices elevated.

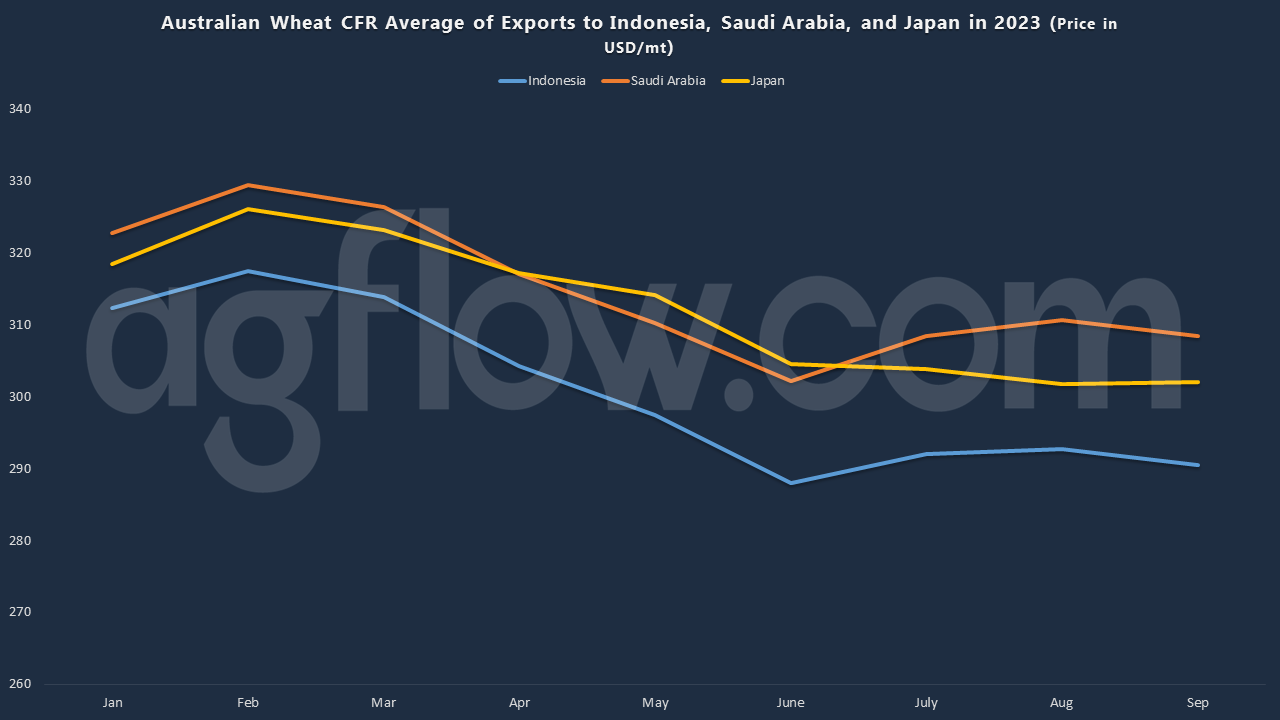

Australia quoted Kenya the highest CFR price, USD 316 on average, in Jan – Sep 2023. The country also offered higher CFR prices for North African and Middle Eastern countries (Saudi Arabia: USD 315, Jordan: USD 315, and Egypt: USD 314). In terms of Australia’s key Asian markets, Japan was offered the highest CFR price of USD 312, followed by the Philippines (USD 307), South Korea (USD 305), and China (USD 305). Indonesia’s was the lowest with USD 301.

For selected countries, trends of CFR price showed a similar situation for Saudi Arabia and Indonesia in Jan – Sep 2023. The price started falling since the last March. The lowest point was in June, and after that, it increased gradually. It was the same for Japan until June, and then the price was relatively stable for the following months.

Western Australian Wheat Industry

Wheat is the primary grain crop produced in Western Australia, making up 65% of annual grain production and generating A$2-5 billion for the State economy each year. Wheat production occurs across the WA Wheatbelt on 2,900 mostly family-run farms ranging in size from 1,000-20,000 hectares. WA generates about 40% of Australia’s total Wheat production, with more than 95% exported predominantly to Asia and the Middle East. WA produces white-grained Wheat varieties that generate a high flour milling yield and a bright white flour suitable for various products.

The area sown to Wheat in WA over the past 20 years has remained relatively stable at between 4-5 million hectares, but over this same period, production has increased enormously with improved yields. As a result, production reached 8-10 million tons per annum.

Grown under rain-fed conditions, WA Wheat production can fluctuate from season to season. Seasonal variability, particularly since 2000, combined with increased competition from producers with lower production costs, has pressured Wheat profitability. Despite this, a recent study of WA Wheat producers found almost two-thirds of WA farms can be classed as ‘growing’ or ‘strong’ due to their use of technology to create economies of scale and their managerial and social characteristics.

China and Indonesia are WA’s largest Wheat export markets. Increased competition from low-cost producers, such as the Black Sea, has recently pressured these markets. To counter this, the Department of Primary Industries and Regional Development (DPIRD) (through AEGIC) is actively engaged with Indonesian milling companies to understand better their grain quality requirements and the performance of WA Wheat varieties in the milling and baking process.

WA is the world’s major supplier of Wheat for Japanese white salted udon noodles – a one million-ton market supported by a long collaboration between DPIRD, AEGIC, GIWA, and Japanese flour millers. The department has hosted visiting Japanese noodle manufacturers and flour millers since 1990 – a program that has enabled WA to be in tune with Japanese quality expectations of WA noodle Wheat varieties.

WA produces white-grained Wheat varieties that generate a bright white flour and high flour milling yield. WA Wheat typically has a low moisture content, low discoloration, and high bulk density and is suitable for a range of products, including different breads. WA’s dry harvesting environment results in low moisture content and low risk of weather-damaged grain.

Major Wheat milling grades in WA are:

- Australian Hard (AH): used for bread; about 12% protein.

- Australian Premium White (APW): used in blends for bread, including European and flatbread, some noodles, and steamed bread; about 10.5% protein.

- Australian Standard White (ASW): used for flatbread, steamed (Asian) bread, and noodles; 9-10.5% protein.

- Australian Standard Noodle Wheat (ANW): specifically for Japanese udon noodles; 9.5-11.5% protein.

- Australian Premium White Noodle (APWN): WA only. Used for blending: 10.5-11.5% protein.

- Australian Soft (ASFT): used for biscuits, cakes, and steamed buns; less than 9.5 % protein.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time