Argentina Steps Big Into Tunisian Corn Market

Reading time: 2 minutes

Tunisia is a net importer of agricultural products. In 2021, leading agricultural imports were Wheat ($595 million), Soybeans ($278 million), Barley ($265 million), Corn ($265 million), Vegetable Oils ($207 million), and sugar ($73 million). The leading agriculture-related exports were olive oil ($564 million), dates ($236 million), fish products ($204 million), and citrus ($8 million).

In June 2022, the value of Corn imported into Tunisia amounted to around 195 million Tunisian dinars (roughly $62 million). The import trade increased compared to the previous month, when it stood at 127 million Tunisian dinars ($40 million). From March 2022, the value of Corn imports in the country grew annually. In the same month, the average import price of Corn in Tunisia amounted to around 126 Tunisian dinars per quintal (roughly $39.8 per quintal). The price decreased compared to the previous month, when it peaked at approximately 128 Tunisian dinars per quintal ($40.4 per quintal).

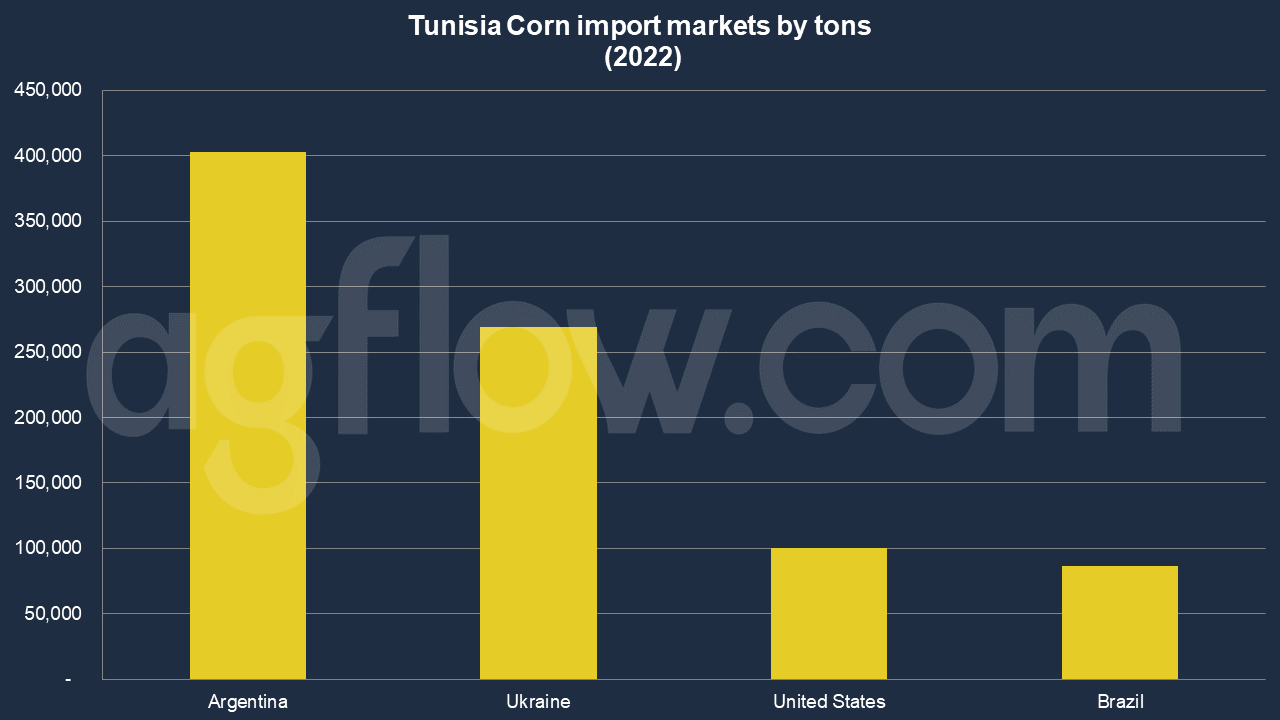

According to the AgFlow data, Argentina led its import market with 0.4 million tons of Corn in 2022, followed by Ukraine (0.27 million tons), the United States (0.1 million tons), and Brazil (86,630 tons). The import volume totaled 0.9 million tons in 2022. In 2020, Corn imports were from the Black Sea at 54%, the U.S. at 16%, Argentina at 15%, Brazil at 7%, and Romania at 5%.

Tunisia has a population of over 11.7 million. Tunisia has a well-diversified economy, although it remains dominated by only a few large sectors. Around two-thirds of Tunisia is suitable for farming, and about one-fifth of the working population is employed in agriculture. Yet, agricultural production is still insufficient to meet the needs of Tunisia’s growing population and contributes only about one-twelfth of the GDP.

Compared with other countries in North Africa, agriculture plays a relatively modest role in Tunisia’s economy, accounting for 16% of the country’s workforce and 12% of the country’s GDP while growing at around 2% per year. While larger agricultural enterprises are increasingly prominent, the sector remains politically sensitive and heavily regulated. Due to historical and geographic reasons, the European Union heavily influences Tunisia on agriculture policy. Tunisia also maintains significant market controls throughout the agriculture value chain, which, to some extent, limits growth and investment opportunities. Public land may be leased from the Government to private farmers or managed directly by the Ministry of Agriculture. Foreigners cannot own agricultural land but may obtain long-term leases.

In 2021, the food-processing sector accounted for an estimated 1,280 enterprises each employing ten or more people. Approximately 20% of these companies produce only for export. The production value of this sector is around $12 billion annually and is continuously growing due to changes in eating habits toward the consumption of processed products versus fresh ones. The food-processing sector’s demand for imported high-value ingredients is steadily increasing, with more sophisticated products licensed by multinational food companies. However, this trend has temporarily slowed down because of the COVID-19-related declines in demand, including the contraction of the tourism industry. Cereals and cereal products, oilseeds, vegetable oils, and sugar derivatives account, on average, for 90% of Tunisia’s food imports.

The US and Tunisia Grain Trade

Tunisia applies an average import duty of 32% on U.S. agricultural exports. In 2021, U.S. agricultural exports to Tunisia totaled $187 million, with Soybeans and Corn accounting for over 95%. Tunisia is a beneficiary of the Generalized System of Preferences (GSP). However, legal authorization for the GSP program expired on December 31, 2020, and U.S. Congress has yet to reauthorize it. In 2021, Tunisia’s agricultural exports to the United States totaled $259 million, 92% of which was accounted for by olive oil and dates. Tunisia supplies the United States with 13-35% of its imported dates and 4-20% of its imported olive oil.

Other sources: TRADE

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time