Argentina Corn Exports: Algeria Upsurges, China on Radar

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Argentinian Corn production is forecast down at 53 million tons in MY 2023/24. The persistent dry weather did not allow many farmers in the Corn belt and west of Buenos Aires province to plant all the early Corn they planned.

Early Corn, which is mainly planted in the high-yielding Corn belt, is normally planted in September through mid-October and harvested in March. About 40 percent of the Corn area was expected to be planted early, but it was forecast to drop to 30 percent because of dry conditions. Early Corn yields typically somewhat higher than late planted Corn, but the latter has proved to provide more production stability.

Late Corn is significantly inconvenient as it is normally harvested between June and August, competing with Brazil’s large safrinha harvest. Since the USDA’s first projection in April 2023, MY 2023/24 Corn economic returns have dropped 30 percent, while soybeans only dropped 10 percent. Therefore, it is currently more profitable to plant first soybeans than Corn, with the addition of having to invest half the money to produce a hectare of soybeans than one of Corn. This helps farmers reduce the total investment drastically, especially after an abysmal summer crop season (MY 2022/23), which finds many local producers with more outstanding debt or less financially sound.

Considering the average tons operated in final Corn contracts of the last five campaigns, 47% of the tons of Corn sold in the local market. Their delivery destination is Rosario Grain Exchange. Of this total, 49% of the Corn marketed comes from the province of Santa Fe, followed by a contribution of 28% from the province of Córdoba and 13% from the area of Buenos Aires. The rest is divided into 5% of the NEA region (Chaco, Corrientes, Formosa, Misiones, and Santiago del Estero).

Corn transportation in Argentina is of fundamental importance in the Up River area. The Up River ports expect to receive about 74% of the Corn exported in the country. According to a recent report from the Rosario Stock Exchange, Corn in its late harvest recovered part of what was lost with a good month of August, in which more than 3.3 million tons were shipped. However, in quantity, the 2022/2023 campaign marked a drop of 33% to 34 million tons.

Corn Export Trends

Corn exports in MY 2023/24 are projected at 38 million tons, 7 percent lower than USDA due to a smaller Corn output and higher local consumption. Sworn export certificates for MY 2023/24 are still insignificant at 430,000 tons. The fact that early Corn plantings only account for approximately 30 percent of the total area means that Argentina will not have an abundant volume of Corn to export in the March-May window when it usually has a price premium as it is one of the very few world suppliers to have Corn at that time.

Corn exports in MY 2022/23 are expected at 22 million tons. Post estimates Corn consumption in MY 2022/23 at 14.5 million tons. This is one of the main reasons for a smaller export surplus. Ending stocks for MY 2022/23 are expected to be very tight, putting pressure on prices until the new harvest begins to come in March 2024.

While the local food and energy industries consume 30% of what is harvested in the country, the remaining 70% is sold as grain in external markets. In the 2020/21 campaign, Argentina surpassed Brazil in exports and established itself as the second-largest supplier worldwide, behind the United States. With more than 40 Mt exports, Argentina supplied 22% of the world’s Corn trade (185.8 Mt).

According to AgFlow data, Argentina exported 2.2 million tons of Corn to South Korea in June – Oct 2023, followed by Vietnam (2 million tons), Algeria (1.4 million tons), Peru (1.4 million tons), Malaysia (0.95 million tons) and Chile (0.9 million tons). Also, Japan, Saudi Arabia, Colombia, Egypt, the Philippines, and Indonesia purchased significant amounts of Corn from Argentina. Total exports hit 24.9 million tons in Jan – Oct 2023.

The main markets for Argentine yellow beans will continue to be Asia, South America, and Africa. In 2020/21, Argentina supplied 22% of Asian external demand with 18.5 Mt, 42% of South American demand with 6.9 Mt, and 14% of African demand with 5.7 Mt.

In 2021, Cargill led the ranking of exporters of all the products (grains, meals, and vegetable oils) under the Export Sworn Statement obligation. On the podium, it was closely followed by COFCO and Viterra. In Corn exports, the podium was completed by ADM (8.84 Mt), Cargill (7.97 Mt), and COFCO (7.21 Mt) in 2021. Many firms use the port facilities of other companies for their shipments.

In mid-2023, Argentina and China signed a sanitary protocol that allows Argentine Corn to be exported to China. Shipments must be free of live insects and a long list of weeds, many of which are not present in Argentina. This will give China market access to import from the top four world exporters. Local brokers believe Argentina will begin exporting Corn to China in 2024.

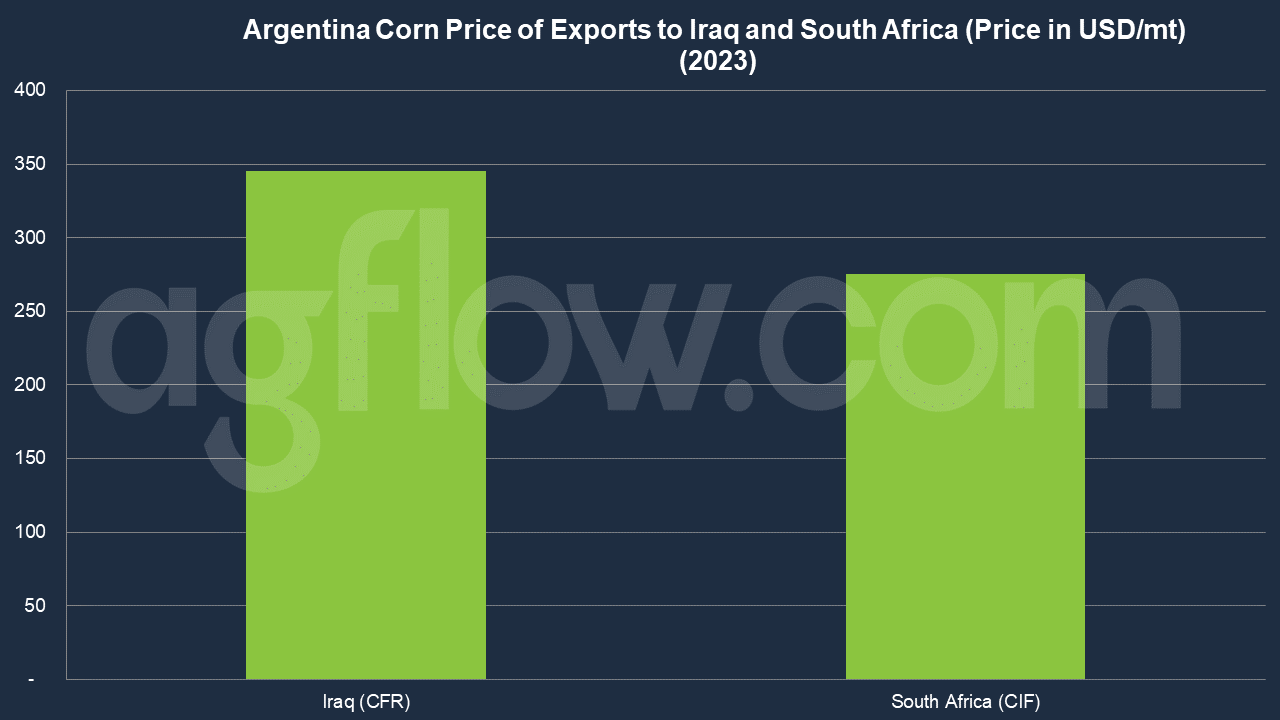

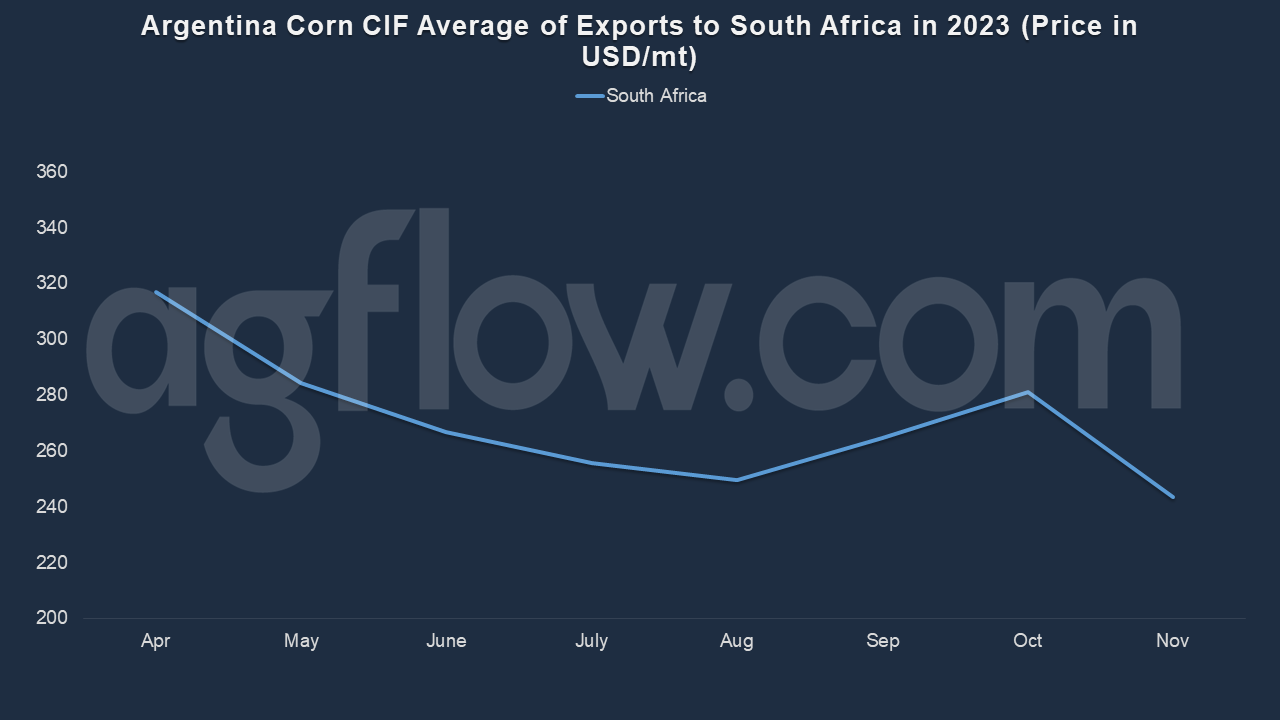

The official Corn FOB price published by the Ministry of Agriculture was $213 per ton as of 21 November 2023. Argentina quoted a CFR of $345 per ton for Iraq, while its CIF Price average for South Africa was $275 per ton. Argentina’s Corn CIF average price has been falling from April till August. Then it peaked in October and started declining again this month.

Corn Export Duty

Since 2015, when export quotas for cereal were eliminated, and despite the permanent disincentive of Export Duties that tax foreign sales, cereal exports have not stopped growing. In 2021, the value of exports from the Corn chain amounted to US$9,257 million, representing 12% of Argentine exports, according to data published by INDEC. With this, in a decade, the chain doubled its participation in the total value exported by Argentina, going from 6% in 2012 to 12% during the last year.

In addition to the high internal tax burdens common to many economic activities in Argentina, the National State also heavily taxes Corn exports. Currently, the Export Duties (DEX) rate on external sales of cereal amounts to 12% of the FOB value.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time