Algeria’s Corn Imports: Stiff Competition Among Brazil And Argentina

Talk to our team about AgFlow's offering →

Reading time: 2 minutes

Corn, a staple grain that has been cultivated for thousands of years, has become a significant import for many countries, including Algeria. But what drives Algeria’s corn imports, especially in the first seven months of 2023? Let’s delve deep into the intricacies of this trade, exploring the key factors, trade-offs, and challenges that have shaped the Algerian corn market this year.

At first glance, Algeria, with its vast stretches of desert and Mediterranean coastline, might not seem like a prime candidate for corn consumption. However, the nation’s growing population and changing dietary habits have increased the demand for diverse food sources. Corn, versatile and nutrient-rich, fits the bill. But why import instead of cultivating it domestically?

Climate and Agriculture

Algeria’s predominantly arid climate poses a significant challenge for large-scale corn cultivation. While certain regions can support corn farming, the overall yield is insufficient to meet the nation’s demands. This imbalance between supply and demand has naturally led to increased imports.

Trade-offs in Balancing Different Factors

Importing corn, however, is not without its challenges. On the one hand, Algeria needs to ensure food security for its citizens. On the other, it must manage the economic implications of importing large quantities of staple grain. How does one balance national food security with economic stability?

The answer lies in diversifying sources of imports, negotiating favorable trade agreements, and investing in domestic agricultural innovations. By sourcing corn from multiple countries, Algeria can mitigate risks associated with geopolitical tensions or crop failures in a particular region.

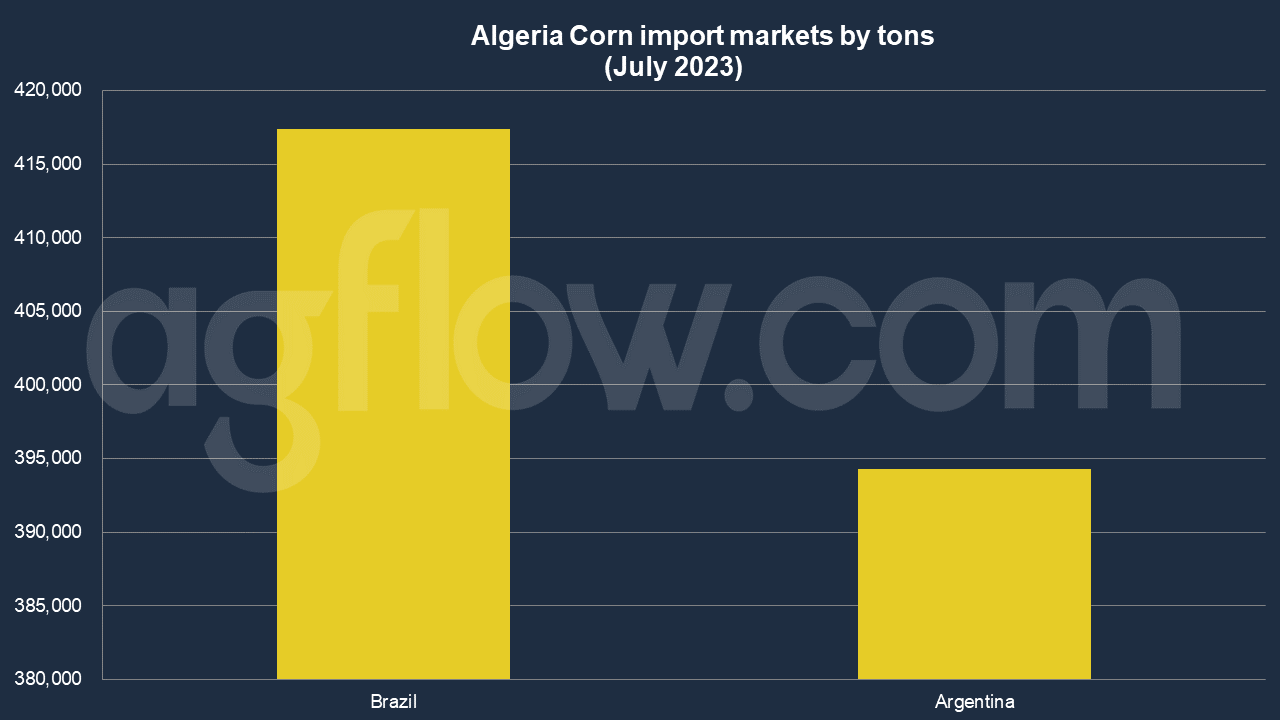

According to AgFlow data, Algeria imported 0.41 million tons of Corn from Brazi in July 2023, followed by Argentina (0.39 million tons). Total imports hit 2.1 million tons in Jan-July 2023. Algeria was purchasing large amounts of Corn from Brazil, Argentina, and Romania, such as 49,000 tons, 47,000 tons, and 24,000 tons, respectively.

Brazil ships Corn to Algeria from its Santarem port mostly while Argentina exports from its San Lorenza port. Romania ships from Constanta port as usual. July shipments were 0.8 million tons, while June and May’s were 0.2 million tons and 0.55 million tons, respectively.

Challenges in the 2023 Corn Market

The first seven months of 2023 have been particularly interesting for Algeria’s corn imports. Global climate anomalies have affected corn yields in traditional exporting countries. This has led to a spike in global corn prices, posing a challenge for countries like Algeria.

Moreover, the global shipping industry has faced disruptions, further complicating the import process. How does a nation ensure a steady supply of a vital commodity amidst such challenges?

Innovative Approaches and Looking Ahead

The Algerian government and private sector have been exploring innovative solutions. Investments in agricultural research aim to develop corn varieties suited to Algeria’s unique climate. Additionally, strengthening regional trade partnerships can provide a buffer against global market volatility.

The story of Algeria’s corn imports in 2023 is not just about a grain; it’s a tale of a nation navigating the complex interplay of climate, economy, and global trade. As we look ahead, the lessons from this year serve as a testament to the importance of adaptability, foresight, and collaboration. Whether you’re a casual reader or a professional in the agricultural commodity industry, understanding these dynamics offers valuable insights into the future of global food security and trade.

Try AgFlow Free

Access Free On Updates for Corn, Wheat, Soybean,

Barley, and Sunflower Oil.

No Credit Card Required & Unlimited Access In Time