Ain’t No Sunseed When the Black Sea Market Is Gone

Reading time: 6 minutes

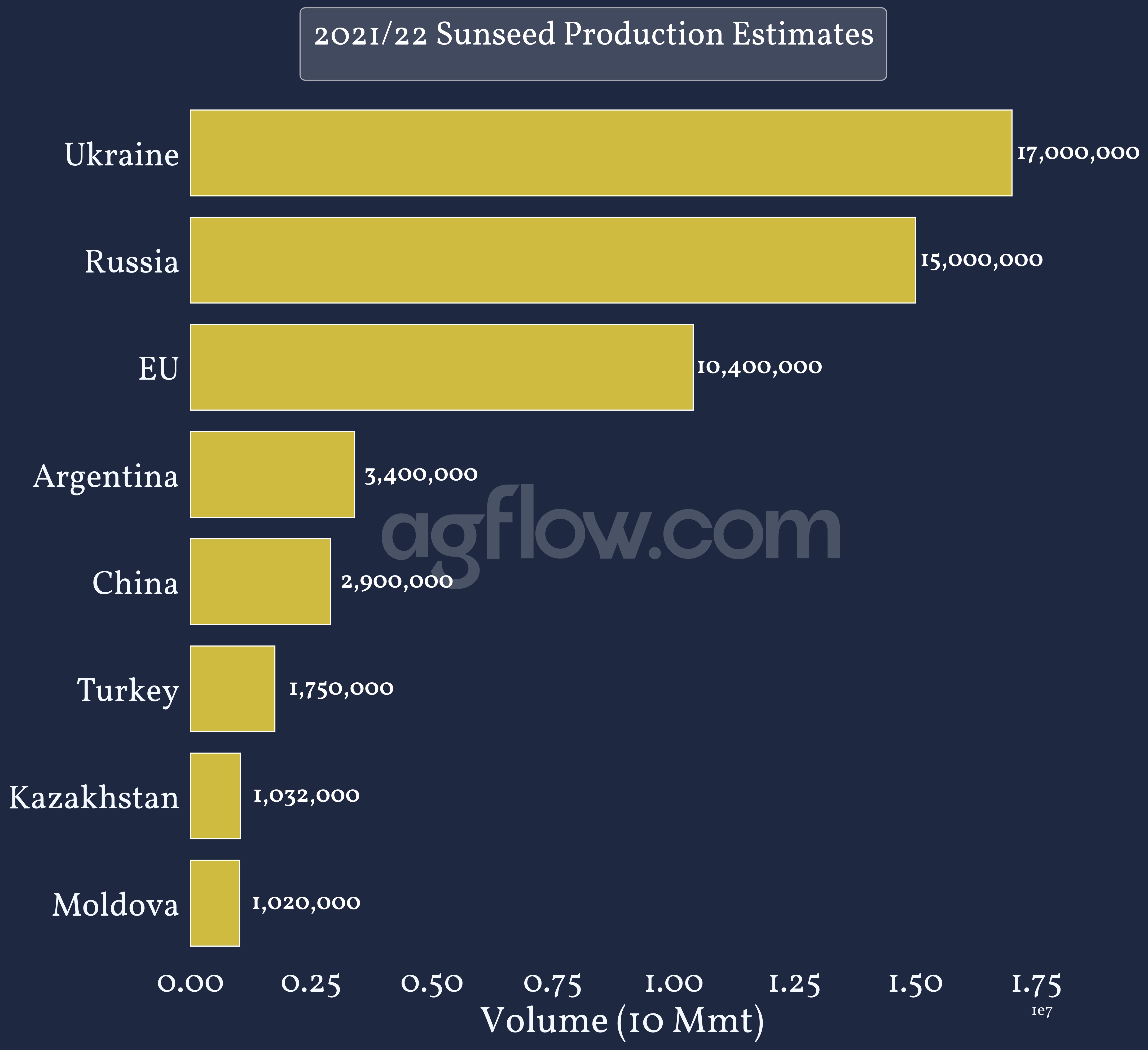

The Black Sea market is by far the largest source of Sunseed globally constituting around 58% of the total production (32 Mmt). According to USDA’s WASDE Supply & Demand data, the EU (the second-largest global producer) only represents less than a third of the Black Sea production (32.5%) with 10.4 Mmt. Cutting the Black Sea Sunseed market results in disrupting the global Sunseed market. Which importers will most suffer the blow?

Read also: How Biofuels & Weather Are Going to Impact Your Vegoils Trades In 2022

Figure 1: 2021/22 Sunseed Production Estimates Over 1 Mmt (Source: USDA)

Find out which importers are the most impacted with AgFlow’s live cargo tracking tool

Free & Unlimited Access In Time

Read also: Year of the Tiger: Is China Going to Pounce on Soybean, Corn & Barley in 2022?

The Sunseed Black Sea market supplies global demand with Turkey, China, and India as the primary importers. Turkey & India primarily import Sunseed Oil, representing 52% and around 97% of Sunseed imports in 2021, respectively. China on the other hand diversified its feed mixtures as Meal was 52% of its Sunseed imports the same year. Without this supply, Black Sea importers have to source from other origins, and this is going to pressure other Oilseeds & Vegoils with the first impact being on prices.

Figure 2: 2021 Black Sea Sunseed & Sunseed Derivatives Top 10 Importers

Track Sunseed & Derivatives Cargo to Turkey, India, & Up to 61 Other Destinations

Free & Unlimited Access In Time

Read also: What Disruptions Will the Black Sea Corn Market Cause to Your Trades?

The Vegoils crisis continues to change the market dynamics. Mar 2021, Sunseed Oil remained the most expensive Vegoils on the market. By Mar 2022, Ukraine Sunseed Oil exports are blocked by the conflict and quotes are scarce while bans on Indonesia Palm Oil and Argentina Soybean Oil exports are gathering pressure on Rapeseed Oil as prices surged 72% YoY. Since Feb, Vegoils prices increased by 18.6% on average. The challenging environment of the Vegoils Market in 2022 is requiring importers and exporters alike to find the best executions both spot and forward.

Figure 3: Vegoils Prices Between Mar 2021 & Mar 2022

Access +9.6k Monthly Vegoils Cash Prices From Indonesia, Argentina, and Up to 15 Other Origins

Free & Unlimited Access In Time

Read also: Is the New 2022 Brazil Soybean Crop Going to Affect Your Trades?

Russia increased Mar exports in 2022 with 2.63 Mmt (+2% YoY) of goods. This growth is due to exports growing in countries that depended on the Ukraine Wheat supply before the conflict (see graph). While exports decreased in Mar from Feb 2022, it was already the case in 2021 when there wasn’t a conflict with Ukraine. Export volumes in Mar decreased by 26% MoM in 2022 and by -38% in 2021. This is due also to Feb 2022 exports dropping 15% YoY. Between Feb & Mar 2022, the conflict impacted Feb the most.

Figure 4: Russia Exports Growth in March 2022 v. 2021

Track Wheat, Corn, & 47 Other Commodity Cargoes From Russia to Egypt, Turkey, & Up to 81 Other Destinations

Free & Unlimited Access In Time

In a Nutshell

Ukraine and Russia are the largest producers of Sunseed globally. With the conflict starting in March, the whole Black Sea area is disrupted and exports from Ukraine are blocked. China, India, and Turkey (the largest importers of Ukraine Sunseed, and Sunseed derivative products) are the one that suffers from this supply cut the most.

Moreover, as the Black Sea Sunseed supply is drying out, the ramping global food inflation led Indonesia (the largest producer and supplier of Palm Oil), and Argentina (the largest exporter of Soybean Oil) to ban exports in order to curtail domestic prices. Therefore, the Vegoils market is losing more and more critical providers and is pressuring Rapeseed Oil as it is the one Vegoil with accessible supply, despite Canada losing a large portion of its supply due to droughts earlier in 2021/22.

All in all, Ukraine’s Sunseed supply is crucial for the Vegoils market and while China can find other sources of feed as it imported mostly Sunseed Meal, Turkey and India will have to find other origins to source Sunseed or other edible Oils. However, while Russia continues to export and is filling some of the void left by Ukraine, its quotas & bans on the Sunseed complex will require importers to source Sunseed or Soybean Oil from other origins like the EU or Argentina.