Agricultural Market Coverage – Week 23

Reading time: 5 minutes

Australia Wheat Exports On a Record Pace

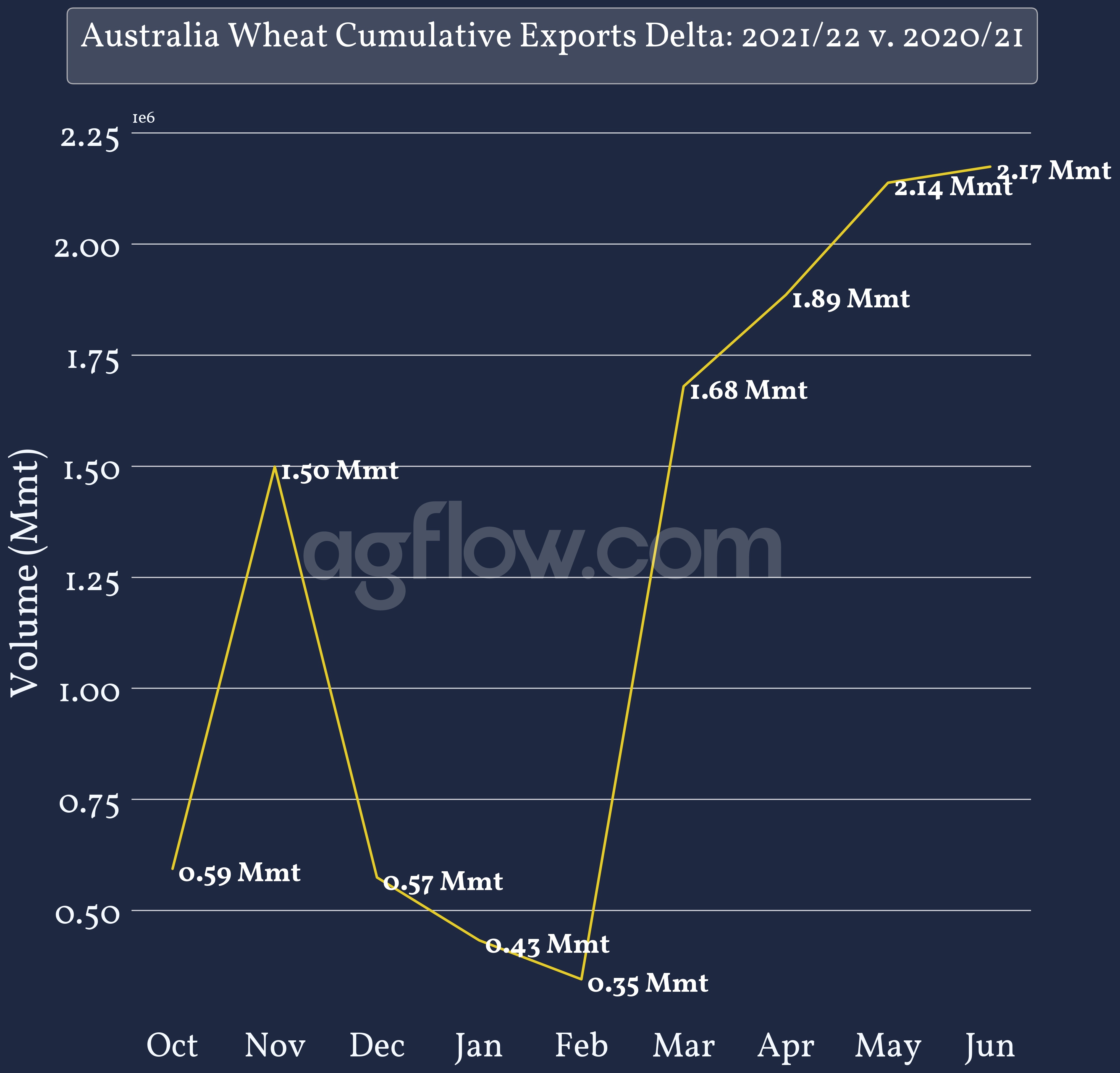

Australia had record Wheat crop production in 2021, which came timely as the global Wheat supply was tighter YoY. Australia Wheat exports, therefore, benefited from large demand globally. The pace of Wheat exports thus increased YoY, particularly with Mar exports booming 1.33 Mmt YoY. Nonetheless, the pace surprisingly slowed down between Dec 21 & Feb 22, with exports decreasing 925 kmt in Dec YoY. Overall, the export pace is way ahead of the 20/21 one, totaling 21.4 Mmt of Wheat exported in 21/22 so far, heading towards a record season. Yet, Russia’s expected bumper crop could potentially put a brake on Australia’s Wheat exports pace.

Australia Cumulative Wheat Exports Delta: 2021/22 v. 2020/21

Track Wheat Cargos From Australia to Indonesia & Up to 11 Other Origins

Free & Unlimited Access In Time

Droughts in France Put Crops At Risk

France (and the EU in general) suffers from droughts throughout the land, and staple crops’ quality is already dropping fast. In early winter, the wet conditions led to extra moisture in France soils, reaching around 53.8% average moisture on Jan 10th, 22. The situation rapidly degraded one month later, and this value only increased by 1.1 points to 54.98% against 55.6% on average. Up until now, soil moisture conditions were mixed. But as precipitation events decrease as Summer arrives, these conditions are currently degrading faster despite small showers. With droughts also settling in the Black Sea area, global Wheat production outlook could be worse than expected in 22/23.

France Average Soil Moisture Delta Between 2022 & 5-Year Average

Analyze French Soil Moisture Conditions From 2022 to 2014

Free & Unlimited Access In Time

Read also: Can The French Wheat Meet its Market in 2022?

Read also: Are Algeria Wheat Imports Going to Decrease in 2022/23?

Ukraine Ports Exports Reflect Russian Advance

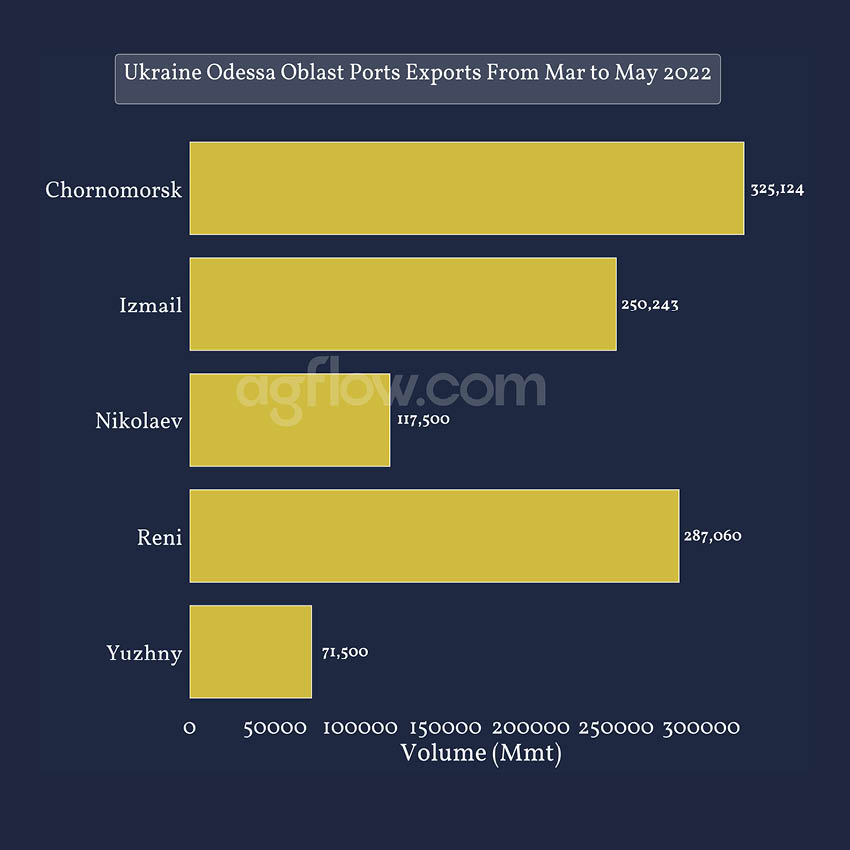

After +100 days of conflict in Ukraine, exports have stopped and started again slightly in Ukraine ports, particularly in the Odesa Oblast. Russia’s strategy to redirect its effort on territories bordering the Black Sea is reflected in Ukraine’s operational ports’ dynamics. Nikolaev (Миколаїв) is currently facing pressure from Russia’s advance, and exports declined 4.93 Mmt YoY between Mar & May 2022. Similarly, Chornomorsk (Чорномо́рськ) & Yuzhny (Южне) exports declined by 3.86 & 2.44 Mmt YoY due to the pressure of bombings and the Russian fleet blockade. However, export from the Westernmost ports of Izmail (Ізмаїл) & Reni (Рені) grew by 200 & 222 kmt, respectively, as they are more protected by their proximity to Romania.

Odesa Oblast’s Ports Exports Between Mar & May 2022

Track Cargos From Odesa Oblast to Up to 15 Destinations

Free & Unlimited Access In Time

Read also: Lachstock | Daily Report on Grains

Read also: Agricultural Market Coverage – Week 21