Soybean Oil vs. Palm Oil prices

Reading time: 9 minutes

Soybean Oil to Supersede Palm Oil in 2021?

Palm Oil is usually cheaper when compared to Soybean Oil prices. Comparing both commodities is a standard business practice as they are fungible, meaning that one can replace the other in food consumption products or other usages.

In the third quarter of 2020, predictions saw the cash prices of South-Eastern Asia Palm Oil drop under the effect of high yields resulting from the La Nina event. In reality, however, cash prices increased drastically due to high demand and a bull market. Moreover, the food industry and mass consumption goods face an ever more present pressure from the long-running ethical debate around Palm Oil production, becoming more and more relevant with the price increase.

Thus, other Vegoil commodities, such as Soybean Oil, Rapeseed Oil, or Sunseed Oil, can become more attractive as a substitute for Palm Oil products’ various usages. Soybean Oil cash prices are currently lower than Palm Oil cash prices for the first time in years. It is crucial to determine the reasons behind that shift and the consequences it has, and will have, on the global market.

Soybean Oil vs. Palm Oil prices: what happened since February 2020?

The change in the relationship between Soybean Oil prices and Palm Oil prices started in late Q4 2020. However, as both commodities are possibly interchangeable, looking as far back as February 2020 is necessary to gain a holistic view of the changing dynamics.

Figure 1: Indonesia Palm Oil and Argentina Soybean Oil Spot Cash Prices

Between Feb 2020 and Feb 2021

The time-series for Soybean Oil and Palm Oil in Figure 1 show the relationship between both parities. The prices displayed are aggregations from daily quotes on the AgFlow database, reducing the figure’s volatility.

The evolution of prices throughout the year 2020 shows that the usual price relationship lasted until December 2020. Palm Oil prices reached their lowest price in May 2020, when AgFlow recorded cash quotes as low as $500/mt However, the demand then led to a price increase and high market volatility, which accelerated in October 2020 under bull market conditions.

This acceleration closed the gap between both commodities despite the high yields due to La Nina. On the other hand, la Nina had a drought effect in South America, which perhaps also contributed to the price rise for Soybean Oil. In January 2021, however, prices decreased, especially for Soybean Oil, leading to a more significant price gap with soaring Palm Oil prices.

Looking at forward curves will indicate how Palm Oil and Soybean Oil prices evolve in the near future.

Figure 2: Indonesia Palm Oil and Argentina Soybean Oil Forward Cash Prices

The forward curves continue to show price increases in Palm Oil quotes, coming from one and two-month shipments. These shipment periods show that Indonesian Palm Oil works on a short term, almost just-in-time delivery, as well as the high demand for this product.

The curves also show that in the coming months, Soybean Oil prices decrease. Consequently, Soybean Oil prices look like they can keep their competitive advantage with Palm Oil, which must influence the demand. Shipments will show how the market then followed this change.

Soybean Oil vs. Palm Oil: How has demand changed since February 2020?

Considering the relationship between Palm Oil and Soybean Oil changed, these products’ demand must also have changed in the past year. Looking at the shipment volumes for each commodity by destination is an excellent way to visualize this.

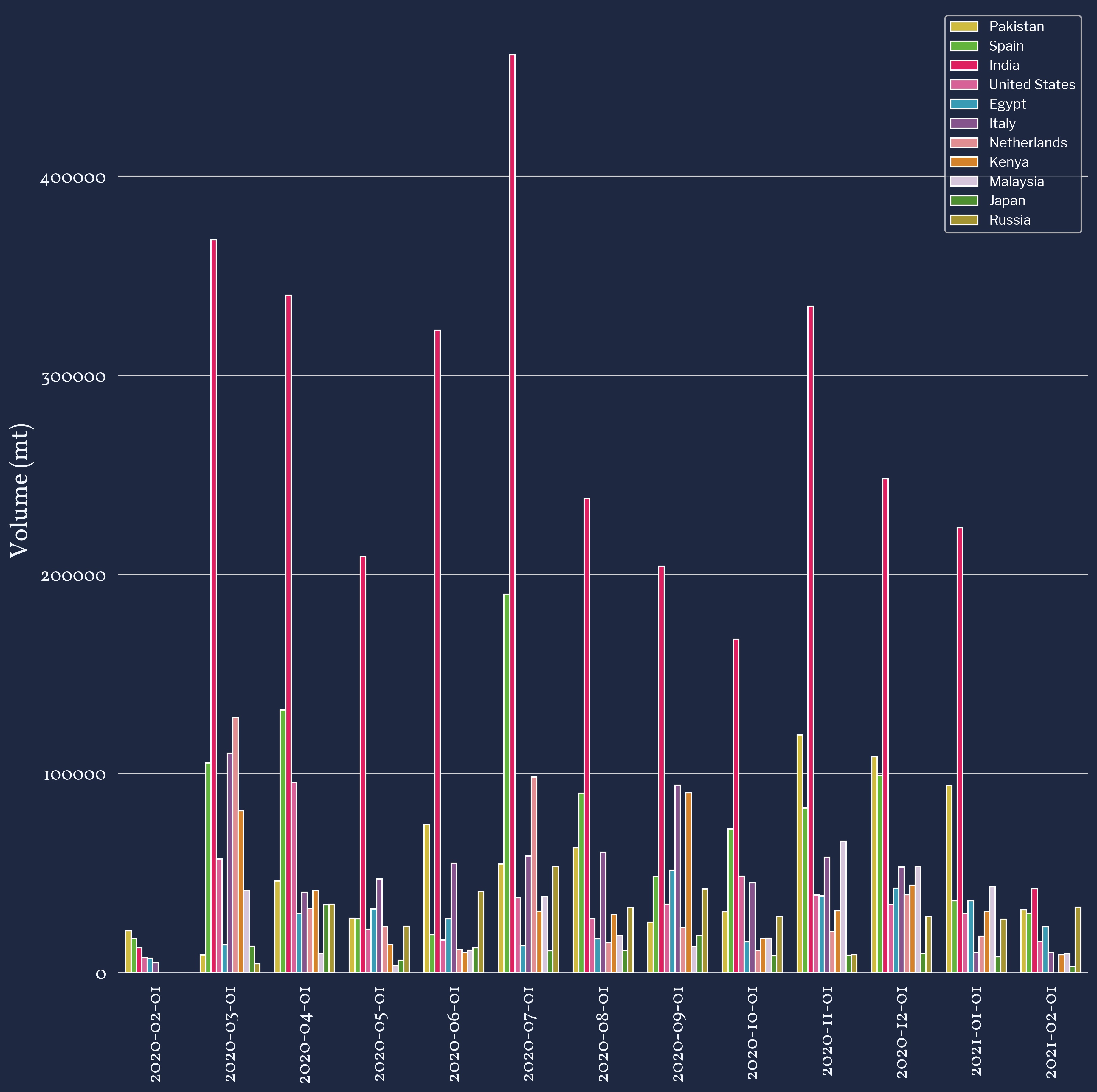

Figure 3: Monthly Trade Flows Volumes By Import Country

Per Month Between Feb 2020 to Feb 2021

Indonesia Palm Oil Shipments

Indonesia Palm Oil Shipments

Argentina Soybean Oil Shipments

Argentina Soybean Oil Shipments

Figure 3 displays the shipment volumes in metric tonnes for Indonesia Palm Oil and Argentina Soybean Oil*.

That being said, Palm Oil shipments reveal that there is indeed a high demand from India, but also Spain, which are among the most important importers. Imports reached an annual peak in July 2020, which then decreased until October 2020. Shipments then increased anew in November 2020 – most probably in the wake of the bull market frenzy – but then continued dropping.

For Soybean Oil, India is once again the top importer—according to AgFlow’s data. The size of shipments is remarkable compared to Palm Oil. Moreover, shipment volumes increased from December 2020 to January 2021, in contrast to Palm Oil, perhaps due to Soybean Oil’s advantageous prices compared to Palm Oil. Also, while it is also the case for Palm Oil, the shipment volumes and the number of import countries increased vastly between February 2020 and February 2021 – despite lower yields for the latter.

Figure 4: Total Shipment Volumes for Palm Oil and Soybean Oil Between Feb 2020 and Feb 2021

It is also clear that while Palm Oil shipments’ volumes are usually larger than those for Soybean Oil (see fig. 4), the low Palm Oil stocks from April and May favored the buying of Soybean Oil. Nonetheless, this is not the case for February 2021, implying some changes in buyers’ behavior.

*Only the top import countries are shown for each plot, as there were 44 different import countries in AgFlow’s datasets for Palm Oil. Shipments to China are not captured to the fullest extent here, and China has a known sizable demand for Palm Oil

Is Sunseed Oil Also An Alternative to Palm Oil? Yes, But To What Extent?

Soybean Oil is an easy substitute for Palm Oil and is currently in a strong place with advantageous prices competing against it. However, other vegoils can also be used for the same purpose, like Sunseed Oil.

Figure 5: Ukraine Sunseed Oil vs. Palm Oil and Soybean Spot Cash Prices

Between Feb 2020 and Feb 2021

Now comparing, prices of Palm Oil and Soybean Oil with the addition of Sunseed Oil prices. This time, however, the price volatility is more visible. Sunseed Oil prices followed the same aggregation process as for the Palm Oil and Soybean Oil prices.

Sunseed Oil prices highlight the proximity of Palm Oil and Soybean Oil prices throughout time, as well as the significant price gap between Sunseed Oil and the other two parities.

The price difference for Sunseed Oil stems from the fact that it is not perfectly fungible with the other two commodities. Indeed, Sunseed is a suitable replacement for Soybean Oil as a cooking oil or even in transformed food products, since it is already present in various products. However, it is also a very fatty oil, and thus less preferred for products where Soybean Oil can substitute for Palm Oil.

Sunseed Oil is not only a substitute for food products but also in biodiesel production. Without the ethical concerns linked to Palm Oil, it is a strong alternative for this usage.

Nonetheless, Sunseed Oil’s price does not encourage buying as a substitute for Soybean and Palm Oil products. This is particularly true in February 2021, where prices reached the $1400/mt bar, as the price spread soared since October 2020.

Palm Oil vs. Soybean Oil Prices

How Does 2021 Look Like?

Since December 2020, the price relationship between Palm Oil and Soybean Oil changed. Historically, Palm Oil has long been the cheaper Vegoil, but Soybean Oil quotes are now lower than Palm Oil prices, with an increasing price spread in early Q1 2021.

The demand for Soybean Oil related to the price changes, and further pushed by the pressure of ethical debate and consumer demand, as Argentina’s export volumes increased from December 2020 to January 2021, and shipments in February increased 177% from 2020 to 2021.

However, the demand for Palm Oil is not majorly decreasing as well. In fact, it is the high demand from key importers like India, or Spain— and China as mentioned before, which is not displayed here—in a bull market that drove the acceleration of the Palm Oil prices. Additionally, shipments for Palm Oil were still more important than Soybean Oil for more than 60% of the year, even though they decreased since November 2020.

The possibility of substituting Palm Oil or Soybean Oil for Sunseed Oil is also less and less likely, with the increasing price spread being a strong deterrent.

All in all, there is a strong incentive to buy Soybean Oil products, as it is the cheaper of the two fungible Vegoils on the cash market at the moment. In fact, the demand has already shifted in that direction. Looking forward, it seems like the delta between Soybean Oil and Palm Oil prices is increasing even more in the coming months. But it is not certain that Soybean Oil will supersede Palm Oil products. In 2020, July was the peak of Palm Oil exports for Indonesia. Therefore, following the price spread and exports volumes in Q2 will be key to determining whether Soybean Oil can overcome the high stocks of Palm Oil. Following the price of Palm Oil will also be important, as if its acceleration is faster than that of Sunseed Oil, it is possible to see higher demand for Sunseed Oil, especially for Biodiesel.

Read also: The Growth and Relevance of Biodiesel in Brazilian Market – by Aboissa Commodity Brokers

Read also: Can Price Variations Predict Trade Flow Volumes?

Read also: The Impact Covid-19 Soybean Prices a Comparision with SARS

Read also: Do Agricultural Cash Market Updates Vary Along Forward Curves?

Read also: Infrastructure Developments in the Americas and Their Impact on Corn & Soybean Trade Flows